Compare Intuitive Machines, Inc. with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of 24.30% over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -30.12

Risky - Negative EBITDA

Stock DNA

Aerospace & Defense

USD 2,339 Million (Small Cap)

NA (Loss Making)

NA

0.00%

0.71

21.01%

-5.88

Total Returns (Price + Dividend)

Intuitive Machines, Inc. for the last several years.

Risk Adjusted Returns v/s

News

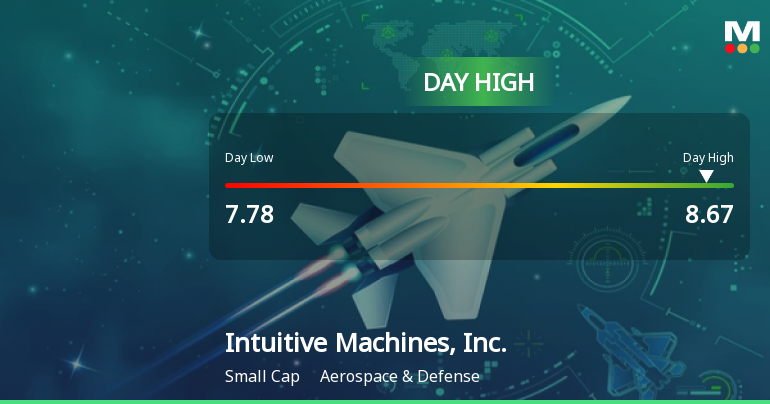

Intuitive Machines Hits Day High with Strong 7.08% Intraday Surge

Intuitive Machines, Inc. has experienced a significant stock increase today, reaching an intraday high. However, its longer-term performance shows a decline over the past year and year-to-date. The company faces financial challenges, including a negative book value and weak EBIT to interest ratio, amid a competitive landscape.

Read full news article

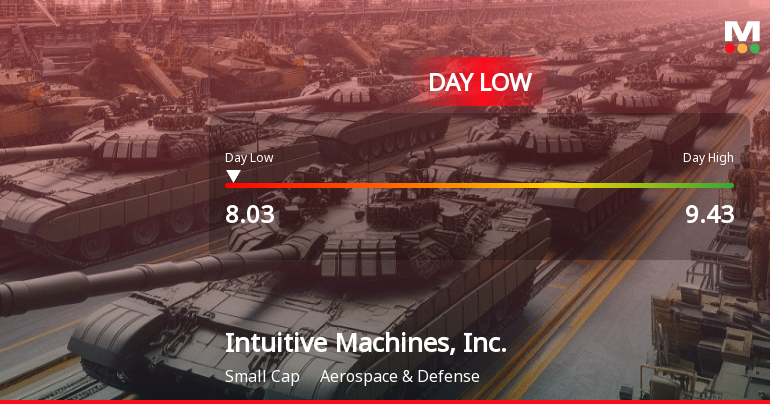

Intuitive Machines Stock Hits Day Low of $8.03 Amid Price Pressure

Intuitive Machines, Inc. has faced notable volatility, with a significant stock decline today. Over the past month, the company has experienced a substantial drop, and year-to-date losses contrast sharply with broader market gains. Financial metrics reveal challenges, including negative book value and difficulties in debt servicing.

Read full news article

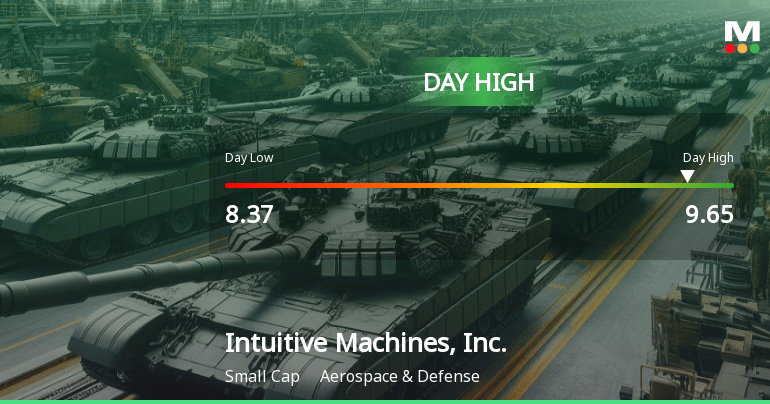

Intuitive Machines Hits Day High with 10.05% Surge in Stock Price

Intuitive Machines, Inc., a small-cap company in the Aerospace & Defense sector, saw a significant intraday gain today, contrasting with a slight decline in the S&P 500. However, the company has struggled over the longer term, facing declines in both weekly and monthly performance, alongside weak financial metrics.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 31 Schemes (21.72%)

Held by 70 Foreign Institutions (10.3%)

Quarterly Results Snapshot (Consolidated) - Jun'25 - YoY

YoY Growth in quarter ended Jun 2025 is 21.50% vs 130.00% in Jun 2024

YoY Growth in quarter ended Jun 2025 is -338.75% vs -14.89% in Jun 2024

Annual Results Snapshot (Consolidated) - Dec'24

YoY Growth in year ended Dec 2024 is 186.43% vs -7.33% in Dec 2023

YoY Growth in year ended Dec 2024 is -2,189.76% vs 0.00% in Dec 2023