Compare Jainam Ferro with Similar Stocks

Total Returns (Price + Dividend)

Jainam Ferro for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Jainam Ferro Alloys (I) Ltd is Rated Sell

Jainam Ferro Alloys (I) Ltd is rated Sell by MarketsMOJO, with this rating last updated on 12 January 2026. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 28 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

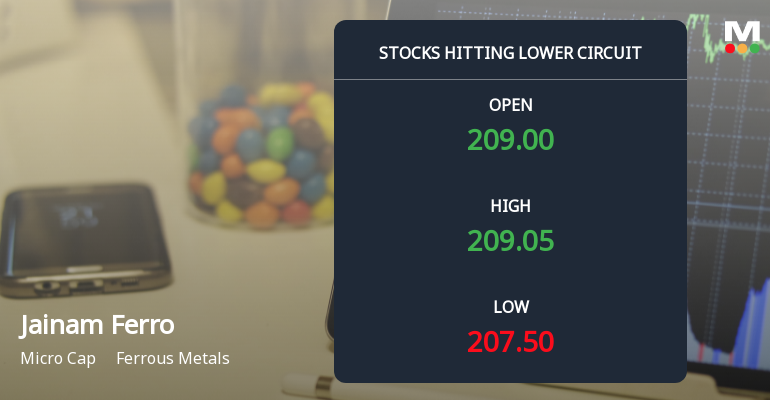

Jainam Ferro Alloys (I) Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

Shares of Jainam Ferro Alloys (I) Ltd plunged to their lower circuit limit on 24 Feb 2026, closing at ₹207.50, down 4.99% on the day. The stock faced intense selling pressure, with volumes rising despite a sharp decline, signalling panic selling and unfilled supply at lower price levels. This performance starkly underperformed both the Ferrous Metals sector and the broader Sensex, raising concerns about the company’s near-term outlook.

Read full news article

Jainam Ferro Alloys (I) Ltd is Rated Sell

Jainam Ferro Alloys (I) Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 12 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 17 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Aditya Parakh (25.06%)

Atul Garg (2.61%)

18.6%