Compare JK Paper with Similar Stocks

Stock DNA

Paper, Forest & Jute Products

INR 5,383 Cr (Small Cap)

20.00

16

1.53%

0.27

5.44%

1.01

Total Returns (Price + Dividend)

Latest dividend: 5 per share ex-dividend date: Aug-18-2025

Risk Adjusted Returns v/s

Returns Beta

News

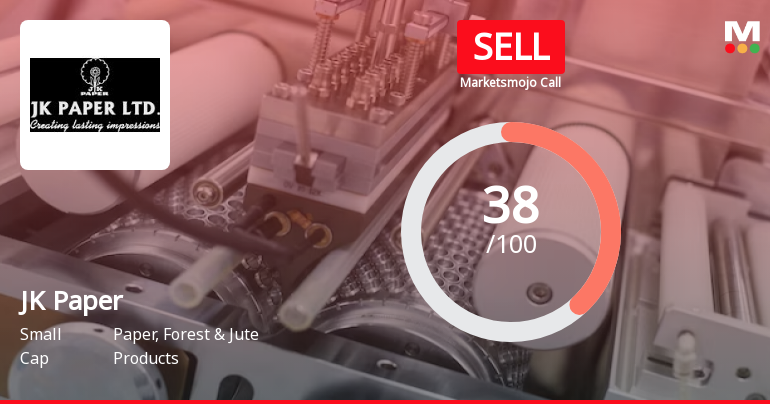

JK Paper Ltd is Rated Sell by MarketsMOJO

JK Paper Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 08 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 07 February 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news articleAre JK Paper Ltd latest results good or bad?

JK Paper Ltd's latest financial results reveal a complex operational landscape characterized by contrasting trends in revenue and profitability. For the quarter ending Q3 FY26, the company reported net sales of ₹1,748.53 crores, reflecting a year-on-year growth of 3.90%. This indicates a degree of resilience in top-line performance despite the challenging market conditions. However, the net profit for the same period was ₹74.75 crores, which represents a significant year-on-year decline of 41.83%. This stark divergence between revenue growth and profit contraction highlights the ongoing margin pressures faced by the company, primarily due to rising input costs and competitive dynamics within the paper industry. The operating margin, excluding other income, was recorded at 12.81%, which is 282 basis points lower than the previous year, indicating a notable compression in profitability. Similarly, the profit...

Read full news article

JK Paper Q3 FY26: Margin Pressure Persists Amid Volume Growth

JK Paper Ltd., India's leading integrated paper manufacturer, reported consolidated net profit of ₹74.75 crores for Q3 FY26 (October-December 2025), marking a decline of 7.98% quarter-on-quarter and a sharper 41.83% year-on-year contraction. The results underscore persistent margin compression despite modest revenue growth, raising concerns about the company's ability to navigate challenging industry dynamics. Trading at ₹326.90, the stock has declined 2.88% following the results announcement, extending a broader downtrend that has seen shares fall 15.40% over the past three months.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Press Release / Media Release

05-Feb-2026 | Source : BSEPress Release

Unaudited Financial Results For The Quarter And Nine Months Ended 31St December 2025

05-Feb-2026 | Source : BSEUnaudited Financial Results for the quarter and nine months ended 31st December 2025

Board Meeting Outcome for Outcome Of Board Meeting Held On 5Th February 2026

05-Feb-2026 | Source : BSEOutcome of Board Meeting held on 5th February 2026

Corporate Actions

No Upcoming Board Meetings

JK Paper Ltd has declared 50% dividend, ex-date: 18 Aug 25

No Splits history available

No Bonus history available

JK Paper Ltd has announced 3:4 rights issue, ex-date: 26 Jul 11

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 10 Schemes (5.09%)

Held by 133 FIIs (12.07%)

Bengal & Assam Company Ltd (47.0%)

Pradip Kumar Khaitan Jointly With Shreekant Somany (trustees, Jk Paper Employees' Welfare Trust) (4.97%)

18.27%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 8.03% vs -4.35% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -58.10% vs -72.19% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 0.77% vs 5.01% in Sep 2024

Growth in half year ended Sep 2025 is -41.85% vs -56.10% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 3.12% vs 1.78% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -45.03% vs -60.57% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 0.88% vs 3.46% in Mar 2024

YoY Growth in year ended Mar 2025 is -63.47% vs -6.19% in Mar 2024