Compare Kapston Services with Similar Stocks

Dashboard

High Debt company with Weak Long Term Fundamental Strength

- Poor long term growth as Operating profit has grown by an annual rate 19.70% of over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 1.61 times

With a growth in Net Profit of 64.02%, the company declared Outstanding results in Dec 25

With ROCE of 12.1, it has a Expensive valuation with a 3.7 Enterprise value to Capital Employed

Despite the size of the company, domestic mutual funds hold only 0% of the company

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Nov-17-2020

Risk Adjusted Returns v/s

Returns Beta

News

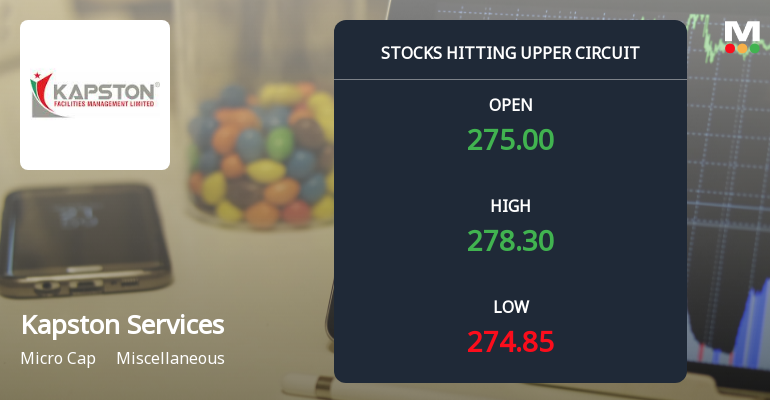

Kapston Services Ltd Surges to Upper Circuit Amid Strong Buying Pressure

Kapston Services Ltd surged to its upper circuit price limit on 6 Mar 2026, reflecting intense buying interest and a maximum daily gain of 6.05%. The stock closed at ₹278.30, just 2.81% shy of its 52-week high of ₹286.11, signalling renewed investor confidence in this miscellaneous sector micro-cap.

Read full news article

Kapston Services Ltd is Rated Hold

Kapston Services Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 22 September 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 26 February 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

Kapston Services Ltd Technical Momentum Shifts Amid Mixed Indicator Signals

Kapston Services Ltd has experienced a nuanced shift in its technical momentum, moving from a bullish to a mildly bullish trend as of late February 2026. While key indicators such as the MACD and moving averages maintain positive signals, others like the RSI and KST present a more cautious outlook, reflecting a complex technical landscape for investors to consider.

Read full news article Announcements

Kapston Facilities Management Limited - Address Change

28-Nov-2019 | Source : NSEKapston Facilities Management Limited has informed the Exchange regarding change in Corporate Office of the company.

Kapston Facilities Management Limited - Outcome of Board Meeting

13-Nov-2019 | Source : NSEKapston Facilities Management Limited has informed the Exchange regarding Board meeting held on November 11, 2019.

Corporate Actions

No Upcoming Board Meetings

Kapston Services Ltd has declared 10% dividend, ex-date: 17 Nov 20

Kapston Services Ltd has announced 5:10 stock split, ex-date: 09 Aug 24

Kapston Services Ltd has announced 1:6 bonus issue, ex-date: 27 Jan 20

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 1 FIIs (0.0%)

Srikanth Kodali (71.01%)

Chereddi Ramachandra Naidu (6.32%)

15.63%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 16.49% vs 33.19% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 64.02% vs 68.40% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 24.79% vs 33.15% in Sep 2024

Growth in half year ended Sep 2025 is 81.54% vs 1.97% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 21.79% vs 33.17% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 74.81% vs 20.18% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 32.42% vs 30.36% in Mar 2024

YoY Growth in year ended Mar 2025 is 41.85% vs 147.93% in Mar 2024