Compare Kerala Ayurveda with Similar Stocks

Dashboard

With HIgh Debt (Debt-Equity Ratio at 14.59 times)- the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Operating profit has grown by an annual rate 0% of over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

- The company has been able to generate a Return on Capital Employed (avg) of 6.09% signifying low profitability per unit of total capital (equity and debt)

The company has declared Negative results for the last 3 consecutive quarters

Risky - Negative EBITDA

Underperformed the market in the last 1 year

Stock DNA

Pharmaceuticals & Biotechnology

INR 297 Cr (Micro Cap)

NA (Loss Making)

32

0.00%

14.59

-417.22%

50.38

Total Returns (Price + Dividend)

Kerala Ayurveda for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

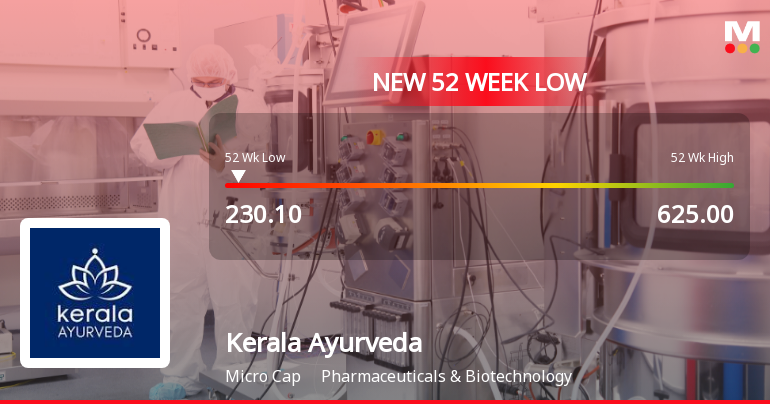

Kerala Ayurveda Ltd Stock Hits 52-Week Low Amidst Continued Downtrend

Kerala Ayurveda Ltd, a player in the Pharmaceuticals & Biotechnology sector, has touched a new 52-week low of Rs.230.1 today, marking a significant decline amid a sustained downward trend. The stock’s performance continues to lag behind sector peers and broader market indices, reflecting ongoing pressures on the company’s financial metrics and market sentiment.

Read full news article

Kerala Ayurveda Ltd Stock Falls to 52-Week Low of Rs.240.1

Kerala Ayurveda Ltd’s shares declined sharply to a fresh 52-week low of Rs.240.1 today, marking a significant milestone in the stock’s ongoing downward trajectory. The pharmaceutical and biotechnology company’s stock has underperformed its sector and broader market indices, reflecting persistent financial headwinds and subdued operational metrics.

Read full news article

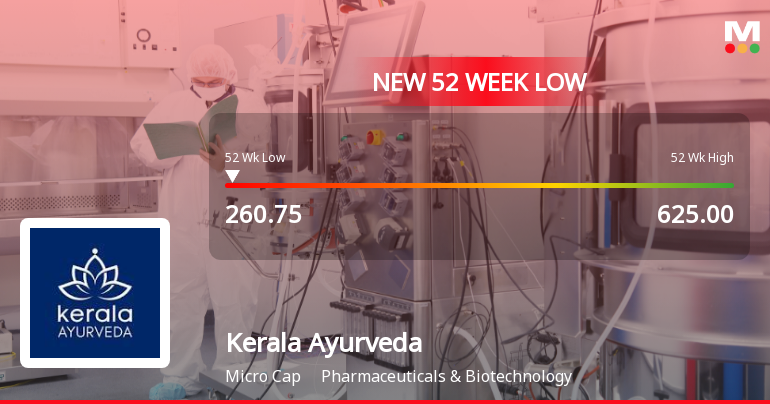

Kerala Ayurveda Ltd Stock Falls to 52-Week Low of Rs.260.75

Kerala Ayurveda Ltd’s shares declined to a fresh 52-week low of Rs.260.75 on 27 Jan 2026, marking a significant downturn for the pharmaceutical and biotechnology company. The stock has underperformed its sector and broader market indices, reflecting ongoing financial pressures and subdued operational performance.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Resignation of Company Secretary / Compliance Officer

30-Jan-2026 | Source : BSEAnnouncement under regulation 30 (LODR) Resignation of Company Secretary

Shareholder Meeting / Postal Ballot-Scrutinizers Report

20-Jan-2026 | Source : BSEPlease find attached the voting results and scrutinizers report for the Postal ballot notice issued on December 19 2025. This is to further inform you that all the resolutions contained in the notice has been duly passed by the Members.

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

20-Jan-2026 | Source : BSEPostal Ballot Voting results

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

23.5592

Held by 1 Schemes (0.02%)

Held by 1 FIIs (0.22%)

Katra Holdings Ltd (33.14%)

Porinju Veliyath (4.03%)

44.42%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 21.78% vs -8.65% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -418.59% vs 112.81% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 9.60% vs 18.38% in Sep 2024

Growth in half year ended Sep 2025 is -216.31% vs 863.27% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 18.35% vs 11.64% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 157.05% vs -55.21% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 16.66% vs 15.59% in Mar 2024

YoY Growth in year ended Mar 2025 is -1,104.92% vs -359.57% in Mar 2024