Compare KJMC Financial with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 24 Cr (Micro Cap)

20.00

23

0.00%

0.09

0.83%

0.16

Total Returns (Price + Dividend)

KJMC Financial for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

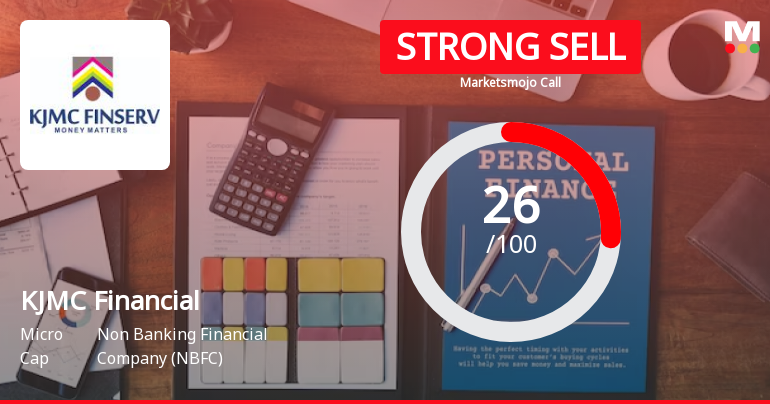

KJMC Financial Services Ltd is Rated Strong Sell

KJMC Financial Services Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 03 June 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 12 February 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

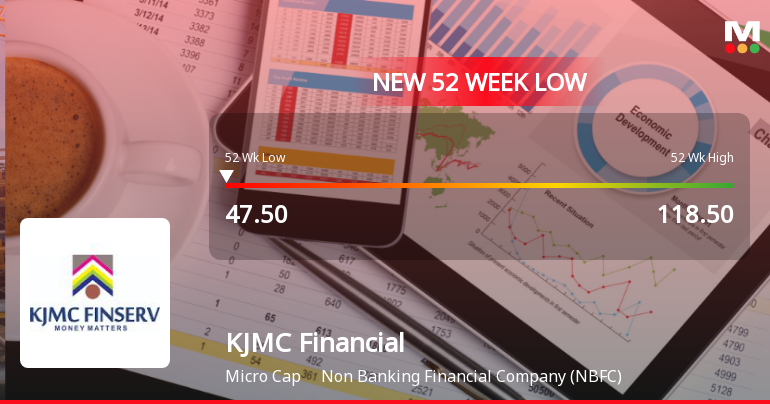

KJMC Financial Services Ltd Hits 52-Week Low Amidst Continued Underperformance

KJMC Financial Services Ltd has touched a new 52-week low of Rs.47.5 today, marking a significant decline in its share price amid ongoing challenges in its financial performance and market positioning. The stock’s fall comes despite a broadly positive market environment, underscoring persistent concerns surrounding the company’s fundamentals and valuation metrics.

Read full news article

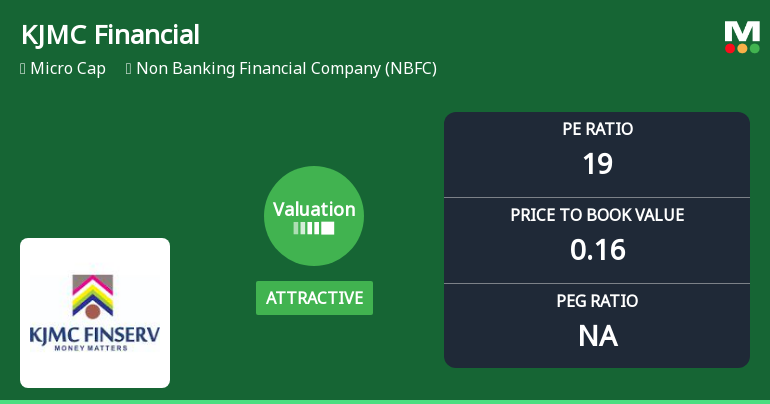

KJMC Financial Services Ltd: Valuation Shifts Signal Renewed Price Attractiveness Amid Mixed Returns

KJMC Financial Services Ltd has witnessed a notable shift in its valuation parameters, moving from a very attractive to an attractive rating, driven primarily by its current price-to-earnings (P/E) and price-to-book value (P/BV) ratios. Despite a challenging recent performance relative to the Sensex, the stock’s valuation metrics suggest a potential opportunity for investors seeking value in the NBFC sector.

Read full news article Announcements

Board Meeting Intimation for Board Meeting Intimation For Notice Of The Board Meeting Scheduled To Be Held On Friday February 13 2026.

06-Feb-2026 | Source : BSEKJMC Financial Services Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/02/2026 inter alia to consider and approve KJMC Financial Services Limited has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/02/2026 inter alia to consider and approve the Un-Audited Standalone & Consolidated Financial Results of the Company alongwith Limited Review Report from the Statutory Auditors for the quarter ended December 31 2025.

Intimation Of Merger Of Statutory Auditors

05-Feb-2026 | Source : BSEIntimation of merger of Statutory Auditors

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

14-Jan-2026 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended December 31 2025.

Corporate Actions

13 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Chanddevi Jain (43.53%)

Tck Finance & Leasing Private Limited (1.57%)

15.71%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -26.64% vs 4,180.00% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -38.89% vs 325.00% in Jun 2025

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 6.26% vs 60.21% in Mar 2024

YoY Growth in year ended Mar 2025 is -1.16% vs 193.48% in Mar 2024