Compare Kothari Ferment. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -32.96% CAGR growth in Operating Profits over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 5.49 times

- The company has been able to generate a Return on Equity (avg) of 1.98% signifying low profitability per unit of shareholders funds

Flat results in Dec 25

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Kothari Ferment. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Kothari Fermentation & Biochem Ltd is Rated Strong Sell

Kothari Fermentation & Biochem Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 14 July 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 05 March 2026, providing investors with the most recent insights into the stock’s performance and outlook.

Read full news article

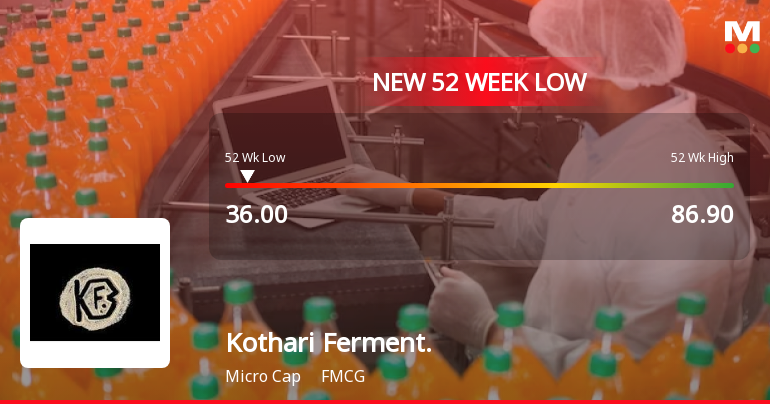

Kothari Fermentation & Biochem Ltd Stock Hits 52-Week Low Amidst Continued Downtrend

Kothari Fermentation & Biochem Ltd’s shares declined sharply to a new 52-week low of Rs.36 on 2 Mar 2026, marking a significant downturn amid a series of consecutive losses. The stock has underperformed its sector and broader market indices, reflecting ongoing concerns about the company’s financial health and long-term growth prospects.

Read full news article

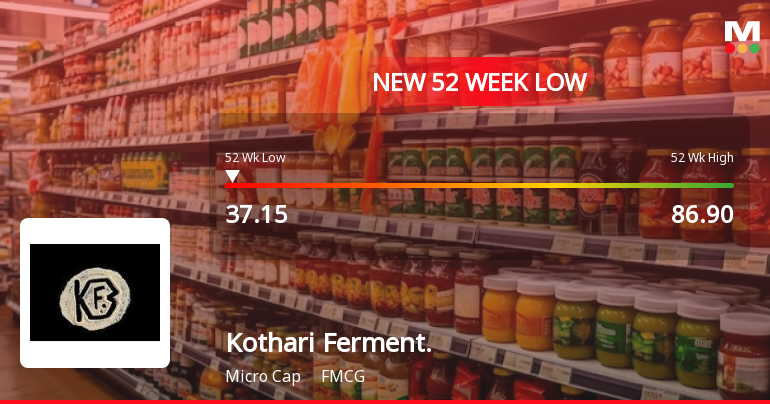

Kothari Fermentation & Biochem Ltd Falls to 52-Week Low of Rs.37.15

Kothari Fermentation & Biochem Ltd’s stock declined sharply to a fresh 52-week low of Rs.37.15 on 27 Feb 2026, marking a significant downturn amid sustained underperformance relative to its sector and benchmark indices.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

14-Feb-2026 | Source : BSENewspaper publication w.r.t Unaudited Financial Results for the quarter and nine months ended 31/12/2025.

Financial Results For The Quarter And Nine Months Ended On 31/12/2025

13-Feb-2026 | Source : BSEPlease refer to the attached annexure.

Board Meeting Outcome for Outcome Of Board Meeting Held On February 13 2026 W.R.T Approval Of Unaudited Financial Results For The Quarter And Nine Months Ended On December 31 2025

13-Feb-2026 | Source : BSEPlease refer to the attached annexure.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Siddhant Kothari (24.85%)

Dheeraj Kumar Lohia (1.36%)

27.52%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 33.35% vs 0.88% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 87.66% vs -175.00% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -7.40% vs 6.64% in Sep 2024

Growth in half year ended Sep 2025 is -546.15% vs 89.45% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -2.91% vs 6.71% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -1,808.33% vs 95.85% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 4.91% vs -1.26% in Mar 2024

YoY Growth in year ended Mar 2025 is 116.50% vs -2,684.21% in Mar 2024