Compare Kranti Industrie with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -0.36% CAGR growth in Net Sales over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.21 times

- The company has been able to generate a Return on Equity (avg) of 8.50% signifying low profitability per unit of shareholders funds

Below par performance in long term as well as near term

Stock DNA

Auto Components & Equipments

INR 79 Cr (Micro Cap)

33.00

35

0.00%

1.05

2.05%

1.71

Total Returns (Price + Dividend)

Kranti Industrie for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

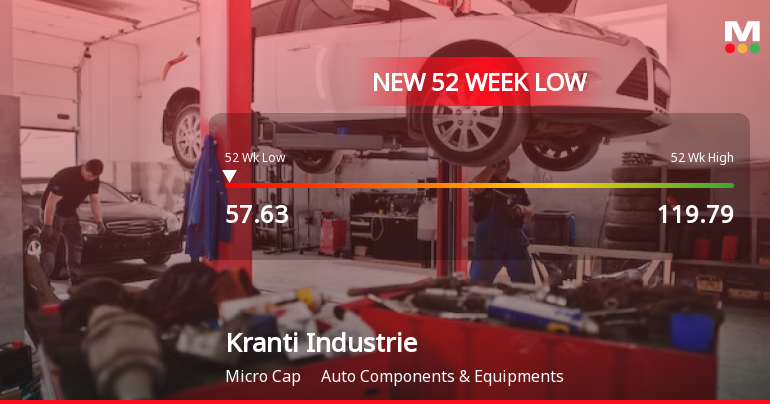

Kranti Industries Ltd Stock Falls to 52-Week Low of Rs.57.71

Kranti Industries Ltd, a player in the Auto Components & Equipments sector, has touched a new 52-week low of Rs.57.71 today, marking a significant milestone in its ongoing share price decline. The stock has been on a downward trajectory for the past seven consecutive trading sessions, culminating in a cumulative loss of 20.18% over this period.

Read full news article

Kranti Industries Ltd Stock Falls to 52-Week Low of Rs.57.71

Kranti Industries Ltd, a player in the Auto Components & Equipments sector, touched a new 52-week low of Rs.57.71 today, marking a significant milestone in its ongoing downward trajectory. The stock has been under pressure for the past week, reflecting broader concerns about its financial health and market positioning.

Read full news article

Kranti Industries Ltd is Rated Strong Sell

Kranti Industries Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 17 Feb 2026. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 04 March 2026, providing investors with the latest insights into its performance and outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

19-Feb-2026 | Source : BSEPursuant to Regulation 30 read with Schedule III and Regulation 46 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 please find enclosed the Transcript of Earnings Conference Call held with Analysts/Institutional Investors on Tuesday February 17 2026. Kindly take the same on your record.

Analyst / Investor Meet - Outcome

17-Feb-2026 | Source : BSEPursuant to Regulation 30 and Regulation 46 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 please find enclosed herewith the outcome of Q3 and Nine Months- Financial Year 2026 Earnings Conference Call held on Today i.e Tuesday February 17 2026 at 04:00 PM(IST) discussed the companys Unaudited Financial Results for the 3rd Quarter and Nine Months ended on December 31 2025. Kindly take the same on your record.

Announcement under Regulation 30 (LODR)-Investor Presentation

16-Feb-2026 | Source : BSEPursuant to Regulation 30 read with Schedule III Part A Para A and other applicable regulations of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 please find enclosed herewith the Investor Presentation to be made to Analysts/Investors for the 3rd Quarter and Nine Months ended on December 31 2025. Kindly take the same on your records.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

Kranti Industries Ltd has announced 1:5 bonus issue, ex-date: 15 Jun 21

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Vora Indubala Subhash (19.14%)

Evolution Capital Advisory Services Private Limited (9.8%)

24.53%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 7.99% vs 5.03% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -72.95% vs 96.77% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 14.63% vs -17.01% in Sep 2024

Growth in half year ended Sep 2025 is 269.72% vs -223.86% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 21.79% vs -16.23% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 202.83% vs -1,347.06% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -13.07% vs -3.16% in Mar 2024

YoY Growth in year ended Mar 2025 is -484.91% vs -89.85% in Mar 2024