Compare Krypton Industri with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -0.05% CAGR growth in Net Sales over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.56

- The company has been able to generate a Return on Equity (avg) of 6.08% signifying low profitability per unit of shareholders funds

Underperformed the market in the last 1 year

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Sep-12-2025

Risk Adjusted Returns v/s

Returns Beta

News

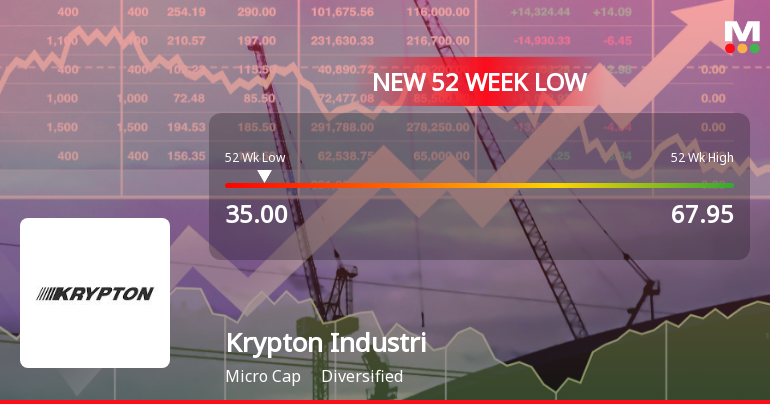

Krypton Industries Ltd Falls to 52-Week Low of Rs.35 Amidst Continued Underperformance

Krypton Industries Ltd has touched a new 52-week low of Rs.35 today, marking a significant decline in its share price amid broader market fluctuations and company-specific performance concerns. This level represents a sharp drop from its 52-week high of Rs.67.95, reflecting a year-long downward trajectory that has seen the stock underperform the broader market substantially.

Read full news article

Krypton Industries Ltd is Rated Strong Sell

Krypton Industries Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 24 December 2025, reflecting a reassessment of the company’s outlook. However, all fundamentals, returns, and financial metrics discussed here are based on the stock’s current position as of 03 February 2026, providing investors with the most up-to-date analysis.

Read full news article

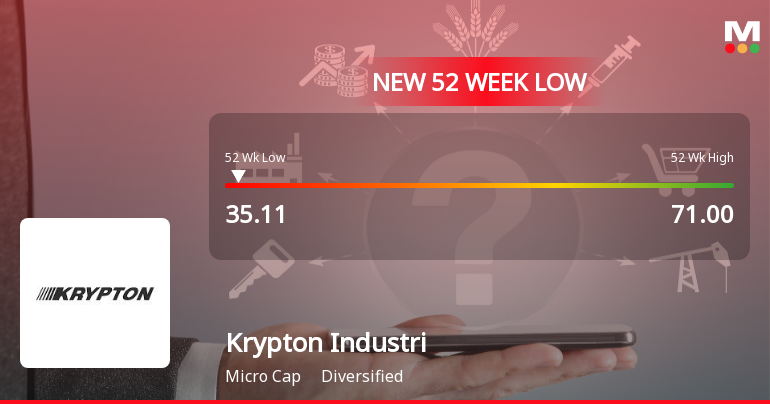

Krypton Industries Ltd Stock Falls to 52-Week Low of Rs.35.11

Krypton Industries Ltd, a player in the diversified sector, has touched a new 52-week low of Rs.35.11 today, marking a significant milestone in its ongoing price decline. The stock has experienced a notable downtrend over recent sessions, reflecting persistent pressures amid broader market movements.

Read full news article Announcements

Board Meeting Intimation for Intimation Of Board Meeting Pursuant To Regulation 30 Of SEBI LODR Regulations 2015.

02-Feb-2026 | Source : BSEKrypton Industries Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 10/02/2026 inter alia to consider and approve 1. Unaudited Financial Results (Standalone and Consolidate) for the quarter and nine months ended 31st December 2025. 2. Any other matter with the Permission of Chairperson.

Announcement under Regulation 30 (LODR)-Change in Directorate

29-Jan-2026 | Source : BSERe Appointment of Mr. Jay Singh Bardia as the Managing Director of the Company voting through Postal Ballot under Regulation 44 of SEBI LODR Regulations 2015.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

29-Jan-2026 | Source : BSERe-Appointment of Mr. Jay Singh Bardia as the Managing Director of the Company through Postal Ballot.

Corporate Actions

10 Feb 2026

Krypton Industries Ltd has declared 10% dividend, ex-date: 12 Sep 25

No Splits history available

No Bonus history available

Krypton Industries Ltd has announced 17:10 rights issue, ex-date: 10 Mar 11

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

1.5628

Held by 2 Schemes (0.02%)

Held by 0 FIIs

Jay Singh Bardia (15.45%)

Sangeetha S (4.59%)

57.3%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 10.58% vs -16.90% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 9.09% vs 165.48% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 0.18% vs 34.89% in Sep 2024

Growth in half year ended Sep 2025 is 32.18% vs 97.73% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 16.62% vs 24.74% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 18.89% vs 18.42% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 9.59% vs 28.43% in Mar 2024

YoY Growth in year ended Mar 2025 is -66.95% vs 15.69% in Mar 2024