Compare Likhitha Infra with Similar Stocks

Dashboard

Poor long term growth as Operating profit has grown by an annual rate 6.46% of over the last 5 years

With a fall in Net Sales of -8.16%, the company declared Very Negative results in Dec 25

Despite the size of the company, domestic mutual funds hold only 0% of the company

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 1.5 per share ex-dividend date: Sep-20-2023

Risk Adjusted Returns v/s

Returns Beta

News

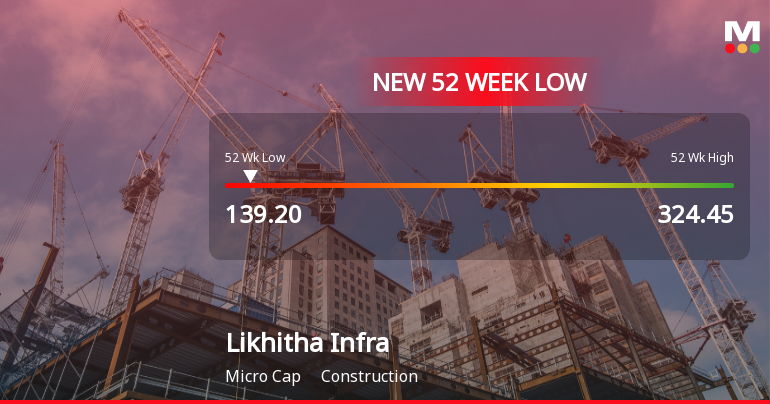

Likhitha Infrastructure Ltd Falls to 52-Week Low of Rs.139.2 Amidst Continued Underperformance

Likhitha Infrastructure Ltd’s shares touched a new 52-week low of Rs.139.2 today, marking a significant decline amid a challenging market environment and subdued financial performance. The stock’s fall to this level reflects ongoing pressures within the construction sector and the company’s recent results.

Read full news article

Likhitha Infrastructure Ltd Falls to 52-Week Low of Rs.139.2 Amidst Continued Downtrend

Likhitha Infrastructure Ltd’s shares touched a new 52-week low of Rs.139.2 today, marking a significant decline amid a challenging market environment. The stock’s performance over the past year has been notably weak, reflecting a combination of subdued financial results and sectoral pressures.

Read full news article

Likhitha Infrastructure Ltd Stock Falls to 52-Week Low of Rs.145

Likhitha Infrastructure Ltd’s shares declined to a fresh 52-week low of Rs.145 today, marking a significant milestone in the stock’s ongoing downward trajectory. The stock has underperformed its sector and benchmark indices, reflecting persistent pressures on the company’s financial performance and market sentiment.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

Likhitha Infrastructure Ltd has declared 30% dividend, ex-date: 20 Sep 23

Likhitha Infrastructure Ltd has announced 5:10 stock split, ex-date: 02 Dec 22

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 8 FIIs (0.22%)

Srinivasa Rao Gaddipati (68.38%)

None

25.54%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 8.96% vs -16.48% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -19.62% vs -16.76% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -13.03% vs 29.93% in Sep 2024

Growth in half year ended Sep 2025 is -26.41% vs 9.40% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -12.34% vs 28.04% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -32.82% vs 8.37% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 23.34% vs 15.54% in Mar 2024

YoY Growth in year ended Mar 2025 is 5.99% vs 8.47% in Mar 2024