Compare Mahindra EPC with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -7.45% CAGR growth in Operating Profits over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -0.01

- The company has been able to generate a Return on Equity (avg) of 2.54% signifying low profitability per unit of shareholders funds

Below par performance in long term as well as near term

Stock DNA

Industrial Manufacturing

INR 335 Cr (Micro Cap)

22.00

37

0.00%

0.20

8.06%

1.85

Total Returns (Price + Dividend)

Latest dividend: 1.2 per share ex-dividend date: Jul-14-2021

Risk Adjusted Returns v/s

Returns Beta

News

Mahindra EPC Irrigation Ltd is Rated Sell

Mahindra EPC Irrigation Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 16 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 29 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

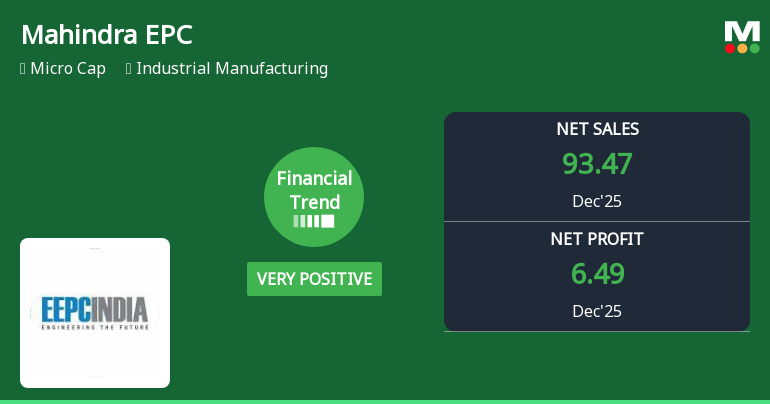

Mahindra EPC Irrigation Ltd Reports Strong Quarterly Upswing Amid Financial Trend Shift

Mahindra EPC Irrigation Ltd has demonstrated a marked turnaround in its financial performance for the quarter ended December 2025, posting robust revenue growth and margin expansion that contrast with its previously flat trend. Despite a modest share price movement, the company’s operational metrics reveal significant improvement, signalling a potential shift in investor sentiment within the industrial manufacturing sector.

Read full news article

Mahindra EPC Irrigation Ltd is Rated Strong Sell

Mahindra EPC Irrigation Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 02 December 2025, reflecting a change from the previous 'Sell' grade. However, the analysis and financial metrics discussed below represent the stock's current position as of 07 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

17-Jan-2026 | Source : BSEPursuant to Regulation 47 of SEBI (LODR) Regulations 2015 please find enclosed herewith the copies of Newspaper Advertisement regarding extract of the Un-audited Standalone and Consolidated Financial Results for the quarter and nine months ended 31st December 2025 published in the Business Standard Navshakti and Free Press Journal

Board Meeting Outcome for Of The Board Meeting Held Today I.E. January 16 2026.

16-Jan-2026 | Source : BSEPlease find enclosed the outcome of the Board Meeting held today i.e. January 16 2026.

For The Quarter And Nine Months Ended December 31 2025.

16-Jan-2026 | Source : BSEPlease find enclosed the financial results for the quarter and nine months ended December 31 2025.

Corporate Actions

No Upcoming Board Meetings

Mahindra EPC Irrigation Ltd has declared 12% dividend, ex-date: 14 Jul 21

No Splits history available

No Bonus history available

Mahindra EPC Irrigation Ltd has announced 3:5 rights issue, ex-date: 02 May 12

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 2 FIIs (0.01%)

Mahindra & Mahindra Limited (54.2%)

Rajen Anil Shah (2.05%)

39.48%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 88.52% vs -20.08% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 1,409.30% vs -56.12% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 17.09% vs -14.11% in Sep 2024

Growth in half year ended Sep 2025 is 126.16% vs -261.74% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 16.01% vs -7.58% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 722.92% vs 433.33% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 3.89% vs 24.76% in Mar 2024

YoY Growth in year ended Mar 2025 is 331.74% vs 113.57% in Mar 2024