Compare Mindspace Busine with Similar Stocks

Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.70 times

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.70 times

- The company has been able to generate a Return on Equity (avg) of 3.43% signifying low profitability per unit of shareholders funds

Healthy long term growth as Net Sales has grown by an annual rate of 33.56% and Operating profit at 34.60%

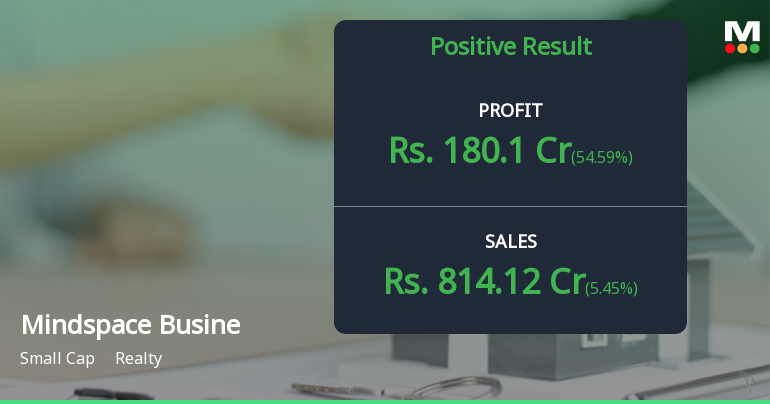

The company declared positive results in Dec'25 after flat results in Sep'25

With ROCE of 6.8, it has a Very Expensive valuation with a 1.8 Enterprise value to Capital Employed

47.58% of Promoter Shares are Pledged

Total Returns (Price + Dividend)

Latest dividend: 9.2928 per share ex-dividend date: Jan-30-2026

Risk Adjusted Returns v/s

Returns Beta

News

Mindspace Business Parks REIT is Rated Hold by MarketsMOJO

Mindspace Business Parks REIT is rated 'Hold' by MarketsMOJO, with this rating last updated on 15 Sep 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 31 January 2026, providing investors with an up-to-date perspective on its performance and outlook.

Read full news article

Mindspace Business Parks REIT Q3 FY26: Strong Operational Performance Offset by Margin Pressures

Mindspace Business Parks REIT, one of India's leading commercial real estate investment trusts with a market capitalisation of ₹31,786 crores, reported consolidated net profit of ₹116.50 crores for Q3 FY26, marking a sequential decline of 25.66% from ₹156.71 crores in Q2 FY26, though the REIT maintained robust operational momentum with revenue growth of 4.29% quarter-on-quarter. The stock responded positively to the results, trading at ₹491.67 as of January 27, 2026, reflecting a modest gain of 0.31% from the previous close, whilst maintaining its position well above all key moving averages in a bullish technical setup.

Read full news article

Mindspace Business Parks REIT is Rated Hold by MarketsMOJO

Mindspace Business Parks REIT is rated 'Hold' by MarketsMOJO, a rating that was last updated on 15 Sep 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 20 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

Mindspace Business Parks REIT has declared 2% dividend, ex-date: 30 Jan 26

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

47.5787

Held by 0 Schemes (4.93%)

Held by 0 FIIs (28.73%)

Casa Maria Properties LLP (7.9%)

None

9.1%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 5.45% vs 4.29% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 54.59% vs -25.66% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 10.33% vs 6.50% in Mar 2025

Growth in half year ended Sep 2025 is 22.86% vs -12.41% in Mar 2025

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 20.14% vs 5.26% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 16.40% vs -4.21% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 5.43% vs 7.16% in Mar 2024

YoY Growth in year ended Mar 2025 is -9.29% vs 85.13% in Mar 2024