Compare Mini Diamonds(I) with Similar Stocks

Dashboard

Poor Management Efficiency with a low ROE of 6.41%

- The company has been able to generate a Return on Equity (avg) of 6.41% signifying low profitability per unit of shareholders funds

Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.26 times

Underperformed the market in the last 1 year

Stock DNA

Gems, Jewellery And Watches

INR 222 Cr (Micro Cap)

41.00

51

0.00%

0.01

7.91%

3.28

Total Returns (Price + Dividend)

Mini Diamonds(I) for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

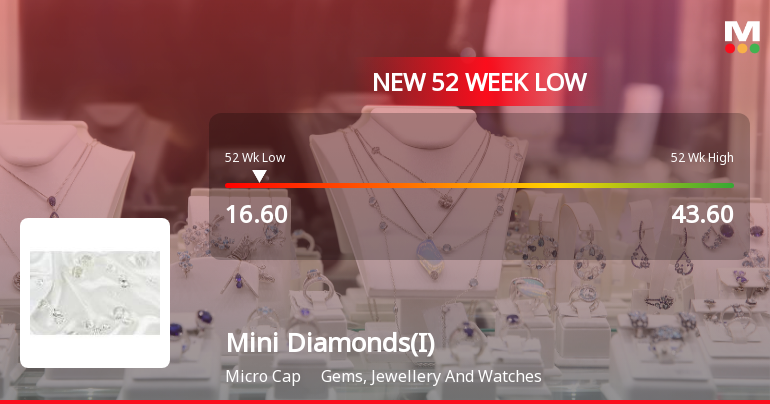

Mini Diamonds (India) Ltd Falls to 52-Week Low Amidst Continued Downtrend

Mini Diamonds (India) Ltd touched a new 52-week low of Rs.16.6 today, marking a significant decline in its stock price amid broader market fluctuations and sectoral pressures. The stock has underperformed both its sector and the broader market over the past year, reflecting a combination of financial metrics and market dynamics.

Read full news article

Mini Diamonds (India) Ltd Falls to 52-Week Low of Rs.16.6 Amid Market Pressure

Mini Diamonds (India) Ltd’s shares declined to a fresh 52-week low of Rs.16.6 on 4 March 2026, marking a significant downturn amid broader sectoral and market movements. The stock has underperformed both its sector and the broader market over the past year, reflecting a combination of financial metrics and market sentiment.

Read full news article

Mini Diamonds (India) Ltd Valuation Shifts Signal Changing Market Sentiment

Mini Diamonds (India) Ltd has experienced a notable shift in its valuation parameters, moving from an expensive to a fair valuation grade. This change reflects evolving market perceptions amid a challenging environment for the gems, jewellery and watches sector. Despite a sharp decline in share price and a downgrade in its Mojo Grade to Sell, the company’s valuation metrics relative to peers and historical averages offer a nuanced perspective on its price attractiveness and investment appeal.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

23-Feb-2026 | Source : BSEReceipt of Donestic Order for Lab Grown Polished Diamonds Amounting to Rs. 12 Crores

Announcement under Regulation 30 (LODR)-Newspaper Publication

14-Feb-2026 | Source : BSECopy of Newspaper Advertisement of the Un-Audited Financial Results (Standalone and Consolidated) for the quarter and nine months ended December 31 2025.

Board Meeting Outcome for Outcome Of The Board Of Directors Meeting Held Today I.E. Friday February 13 2026 Pursuant To Regulations 30 And 33 Of Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015.

13-Feb-2026 | Source : BSEPursuant to Regulation 30 (read with Part A of Schedule III) and 33 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 (SEBI Listing Regulations) we wish to inform you that the Board of Directors of the Company at its meeting held today i.e. on Friday February 13 2026 inter-alia considered and approved the Un-Audited Financial Results (Standalone and Consolidated) of the Company for the quarter and nine months ended December 31 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Mini Diamonds (India) Ltd has announced 2:10 stock split, ex-date: 02 Dec 25

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Late Meena Upendra Shah (1.11%)

Shashank Pravinchandra Doshi (8.91%)

57.5%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 11.51% vs 48.76% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 17.27% vs 52.75% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 29.40% vs 117.99% in Sep 2024

Growth in half year ended Sep 2025 is 18.25% vs 1,026.19% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 34.90% vs 91.93% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 28.01% vs 667.50% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 65.15% vs 44.87% in Mar 2024

YoY Growth in year ended Mar 2025 is 60.00% vs 283.93% in Mar 2024