Compare Mini Diamonds(I) with Similar Stocks

Dashboard

Poor Management Efficiency with a low ROE of 6.41%

- The company has been able to generate a Return on Equity (avg) of 6.41% signifying low profitability per unit of shareholders funds

Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.26 times

With ROE of 6.4, it has a Expensive valuation with a 4.4 Price to Book Value

Underperformed the market in the last 1 year

Stock DNA

Gems, Jewellery And Watches

INR 281 Cr (Micro Cap)

69.00

59

0.00%

0.01

6.36%

4.41

Total Returns (Price + Dividend)

Mini Diamonds(I) for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

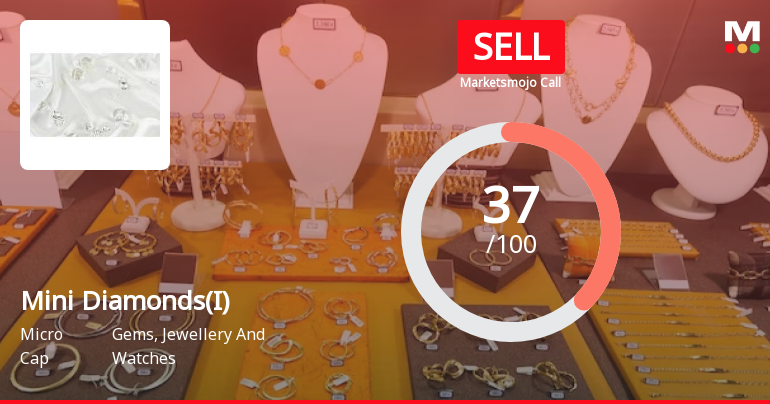

Mini Diamonds (India) Ltd is Rated Sell

Mini Diamonds (India) Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 25 August 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 05 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Mini Diamonds (India) Ltd is Rated Sell

Mini Diamonds (India) Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 25 August 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Mini Diamonds (India) Ltd is Rated Sell

Mini Diamonds (India) Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 25 August 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 14 January 2026, providing investors with an up-to-date view of its fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Board Meeting Intimation for Consideration And Approval Of Un-Audited Financial Results (Standalone And Consolidated) For The Quarter And Nine Months Ended On December 31 2025

07-Feb-2026 | Source : BSEMini Diamonds India Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/02/2026 inter alia to consider and approve the Un-Audited Financial Results (Standalone and Consolidated) of the Company for the quarter and and nine months ended on December 31 2025.

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

14-Jan-2026 | Source : BSEReceipt of domestic order for Lab Grown Polished Diamonds amounting to Rs. 14 Crores

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

05-Jan-2026 | Source : BSEReceipt of export order for Lab Grown Polished Diamonds amounting to USD 1.85 million

Corporate Actions

13 Feb 2026

No Dividend history available

Mini Diamonds (India) Ltd has announced 2:10 stock split, ex-date: 02 Dec 25

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Late Meena Upendra Shah (1.11%)

Shashank Pravinchandra Doshi (8.91%)

57.5%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 48.76% vs 3.79% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 52.75% vs 167.41% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 29.40% vs 117.99% in Sep 2024

Growth in half year ended Sep 2025 is 18.25% vs 1,026.19% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 91.93% vs 40.53% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 667.50% vs 19.40% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 65.15% vs 44.87% in Mar 2024

YoY Growth in year ended Mar 2025 is 60.00% vs 283.93% in Mar 2024