Compare Mittal Life Styl with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -41.82% CAGR growth in Operating Profits over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.22

- The company has been able to generate a Return on Equity (avg) of 2.63% signifying low profitability per unit of shareholders funds

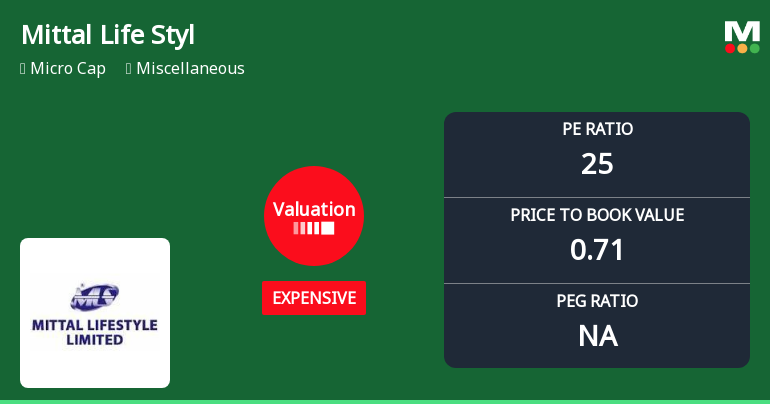

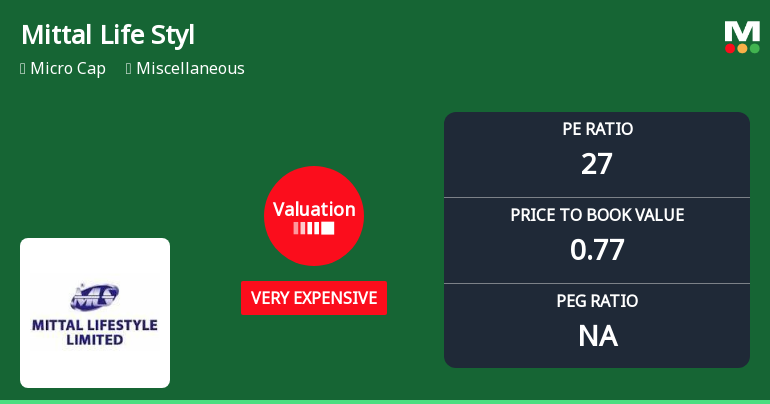

With ROE of 2.8, it has a Expensive valuation with a 0.7 Price to Book Value

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Dec-10-2018

Risk Adjusted Returns v/s

Returns Beta

News

Mittal Life Style Ltd is Rated Strong Sell

Mittal Life Style Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 11 Aug 2025, reflecting a shift from the previous 'Sell' grade. However, the analysis and financial metrics discussed here represent the stock's current position as of 05 March 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Mittal Life Style Ltd Valuation Shifts Signal Heightened Price Risk Amid Sector Challenges

Mittal Life Style Ltd has experienced a notable shift in its valuation parameters, moving from a 'very expensive' to an 'expensive' rating, reflecting a subtle recalibration in market perception. Despite this, the stock continues to underperform against key benchmarks, raising questions about its price attractiveness relative to peers and historical averages.

Read full news article

Mittal Life Style Ltd Valuation Shifts Signal Heightened Price Risk

Mittal Life Style Ltd has seen a marked shift in its valuation parameters, moving from an expensive to a very expensive rating, raising concerns about its price attractiveness amid subdued financial performance and challenging market conditions.

Read full news article Announcements

Mittal Life Style Limited - Outcome of Board Meeting

13-Nov-2019 | Source : NSEMittal Life Style Limited has informed the Exchange regarding Board meeting held on November 11, 2019.

Mittal Life Style Limited - Other General Purpose

23-Oct-2019 | Source : NSEMittal Life Style Limited has informed the Exchange Declaration regarding non-applicability of Regulation 23 Sub regulation 9 of SEBI (LODR) Regulations, 2015.

Mittal Life Style Limited - Updates

16-Oct-2019 | Source : NSEMittal Life Style Limited has informed the Exchange regarding 'Declaration with respect to Non - Applicability of Corporate Governance under Regulation 27(2).'.

Corporate Actions

No Upcoming Board Meetings

Mittal Life Style Ltd has declared 5% dividend, ex-date: 10 Dec 18

Mittal Life Style Ltd has announced 1:10 stock split, ex-date: 01 Nov 23

Mittal Life Style Ltd has announced 1:10 bonus issue, ex-date: 31 Aug 21

Mittal Life Style Ltd has announced 1:2 rights issue, ex-date: 03 Oct 24

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Brijeshkumar Jagdishkumar Mittal Huf (11.37%)

Govind Ram Patodia (3.42%)

60.03%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 4.17% vs 31.26% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -8.82% vs 0.00% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 36.70% vs -11.12% in Sep 2024

Growth in half year ended Sep 2025 is -34.21% vs 159.09% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 25.18% vs 0.36% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -28.38% vs 89.74% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 6.89% vs 5.99% in Mar 2024

YoY Growth in year ended Mar 2025 is -10.34% vs 392.45% in Mar 2024