Compare Morarka Finance with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 26 Cr (Micro Cap)

14.00

9

1.73%

0.00

1.73%

0.24

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Sep-17-2025

Risk Adjusted Returns v/s

Returns Beta

News

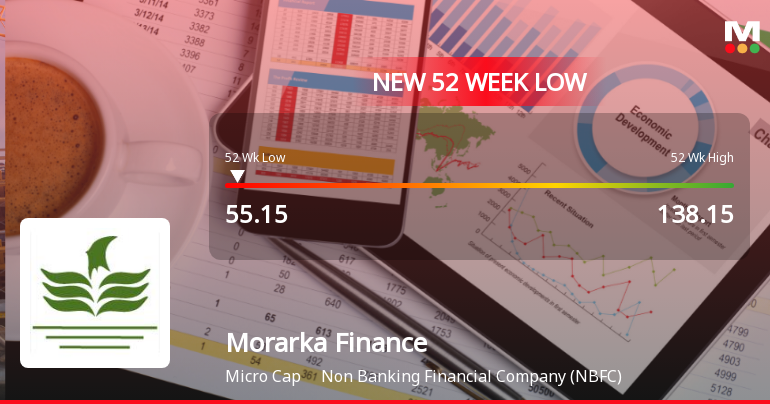

Morarka Finance Ltd Falls to 52-Week Low Amidst Continued Underperformance

Morarka Finance Ltd, a Non Banking Financial Company (NBFC), touched a fresh 52-week low of Rs.55.15 today, marking a significant decline amid persistent downward momentum. The stock’s performance continues to lag behind its sector and broader market indices, reflecting ongoing pressures on its financial metrics and valuation.

Read full news article

Morarka Finance Ltd Falls to 52-Week Low Amidst Weak Financial Metrics

Morarka Finance Ltd’s stock price touched a fresh 52-week low of Rs.57 today, marking a significant decline amid ongoing challenges in its financial performance and market positioning. This new low comes despite a broader market rally, highlighting the stock’s divergence from sector and benchmark indices.

Read full news article

Morarka Finance Ltd Stock Falls to 52-Week Low of Rs.57.05

Morarka Finance Ltd, a Non Banking Financial Company (NBFC), recorded a fresh 52-week low of Rs.57.05 today, marking a significant decline amid ongoing market pressures and subdued financial performance. The stock’s recent trajectory reflects persistent challenges in both long-term growth and near-term profitability.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

11-Feb-2026 | Source : BSEAs per Attachment

Announcement under Regulation 30 (LODR)-Newspaper Publication

22-Jan-2026 | Source : BSEAs per Attachment

Regulation 33(3)(A) - Financial Results

21-Jan-2026 | Source : BSEAttached herewith Unaudited Financial Results alongwith the Limited Review Report for the quarter and nine months ended December 31 2025.

Corporate Actions

No Upcoming Board Meetings

Morarka Finance Ltd has declared 10% dividend, ex-date: 17 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Dwarikesh Trading Company Ltd (49.08%)

Aarthi Srinivasan (3.35%)

24.87%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -84.57% vs 458.62% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -93.75% vs 700.00% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -4.50% vs -66.83% in Sep 2024

Growth in half year ended Sep 2025 is -42.20% vs -59.70% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -0.46% vs -67.99% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -41.41% vs -60.73% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -55.24% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is -55.70% vs 35.04% in Mar 2024