Compare National Perox. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -135.58% CAGR growth in Operating Profits over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 0.14

- The company has been able to generate a Return on Equity (avg) of 1.90% signifying low profitability per unit of shareholders funds

Flat results in Sep 25

Risky - Negative Operating Profits

Below par performance in long term as well as near term

Stock DNA

Commodity Chemicals

INR 225 Cr (Micro Cap)

NA (Loss Making)

39

0.00%

-0.14

-1.92%

0.63

Total Returns (Price + Dividend)

Latest dividend: 12.5 per share ex-dividend date: Aug-20-2024

Risk Adjusted Returns v/s

Returns Beta

News

When is the next results date for National Peroxide Ltd?

The next results date for National Peroxide Ltd is scheduled for February 5, 2026....

Read full news article

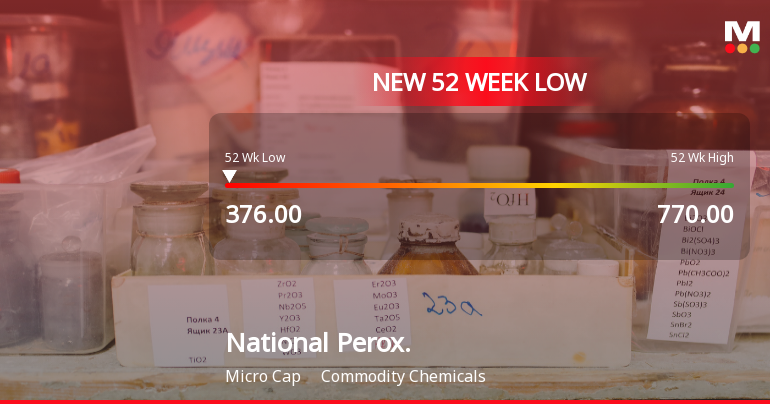

National Peroxide Ltd Falls to 52-Week Low of Rs.376 Amidst Weak Financial Metrics

National Peroxide Ltd’s stock declined sharply to a fresh 52-week low of Rs.376 on 2 Feb 2026, marking a significant downturn amid ongoing financial headwinds and underperformance relative to its sector and benchmark indices.

Read full news article

National Peroxide Ltd Stock Hits All-Time Low Amid Steep Decline

Shares of National Peroxide Ltd have fallen to an all-time low, reflecting a sustained period of underperformance relative to the broader market and its sector peers. The stock closed near its 52-week low, continuing a downward trajectory marked by significant declines in profitability and market valuation.

Read full news article Announcements

Board Meeting Intimation for Approval Of Unaudited Financial Results For The Quarter And Nine Months Ended December 31 2025.

02-Feb-2026 | Source : BSENational Peroxide Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 05/02/2026 inter alia to consider and approve the Unaudited Financial Results for the quarter and nine months ended December 31 2025.

Cancellation of Board Meeting

27-Jan-2026 | Source : BSEThe Board Meeting to be held on 28/01/2026 Stands Cancelled.

Board Meeting Intimation for Approval Of Unaudited Financial Results For The Quarter And Nine Months Ended December 31 2025.

22-Jan-2026 | Source : BSENational Peroxide Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 28/01/2026 inter alia to consider and approve unaudited financial results for the quarter and nine months ended December 31 2025.

Corporate Actions

05 Feb 2026

National Peroxide Ltd has declared 125% dividend, ex-date: 20 Aug 24

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Nowrosjee Wadia And Sons Limited (30.78%)

None

24.98%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 2.45% vs -9.55% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -56.18% vs 113.71% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -10.64% vs -6.39% in Sep 2024

Growth in half year ended Sep 2025 is -77.78% vs -35.64% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -13.85% vs -11.41% in Mar 2024

YoY Growth in year ended Mar 2025 is -113.40% vs -57.49% in Mar 2024