Compare Neueon Corporati with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -33.60% over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -76.08

Negative results in Sep 25

Risky - Negative EBITDA

Stock DNA

Heavy Electrical Equipment

INR 55 Cr (Micro Cap)

NA (Loss Making)

32

0.00%

0.06

-21.06%

0.07

Total Returns (Price + Dividend)

Neueon Corporati for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

When is the next results date for Neueon Corporation Ltd?

The next results date for Neueon Corporation Ltd is scheduled for 12 February 2026....

Read full news article

Neueon Corporation Ltd is Rated Sell

Neueon Corporation Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 23 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 06 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

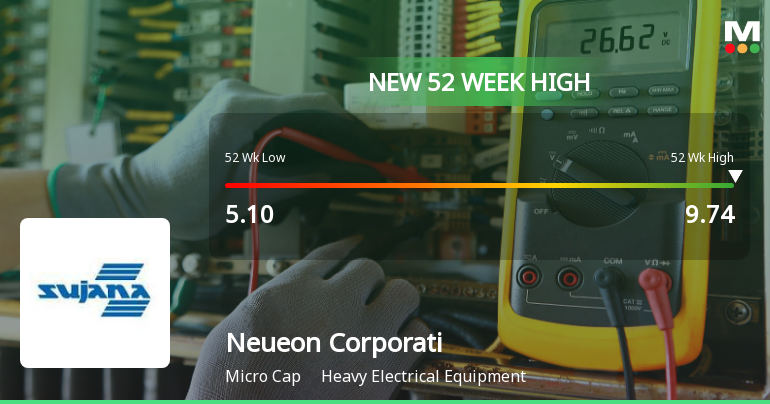

Neueon Corporation Ltd Hits New 52-Week High at Rs.9.74

Neueon Corporation Ltd, a key player in the Heavy Electrical Equipment sector, achieved a significant milestone today by reaching a new 52-week high of Rs.9.74. This marks a notable surge in the stock’s performance, reflecting strong momentum amid a mixed market backdrop.

Read full news article Announcements

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

06-Feb-2026 | Source : BSEPostal Ballot Result along with Scrutinizers Report enclosed.

Board Meeting Intimation for Meeting To Be Held On Thursday February 12 2026

05-Feb-2026 | Source : BSENeueon Corporation Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 12/02/2026 inter alia to consider and approve 1. To consider approve and take on record the Unaudited Financial Results (Standalone and Consolidated) for the quarter and nine months ended December 31 2025 2. To take note of limited review report of the Statutory Auditors of the Company for the quarter ended December 31 2025.

Clarification- Rating Assigned By CARE RATINGS

13-Jan-2026 | Source : BSEWe would like to informed that CARE Ratings Limited through its letter has independently assigned ratings to the company. However we would like to state that the same was unsolicited and not sought by the company. Letter attached.

Corporate Actions

12 Feb 2026

No Dividend history available

Neueon Corporation Ltd has announced 10:1 stock split, ex-date: 07 Aug 13

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Nov 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Preca Structures Private Limited (90.0%)

Sujana Holdings Limited (1.79%)

4.8%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -7.62% vs -16.64% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -302.67% vs 48.71% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 0.00% vs -100.00% in Sep 2024

Growth in half year ended Sep 2025 is -132.73% vs -2.10% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -66.67% vs -50.00% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -1.83% vs 1.11% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 5,900.00% vs 12.50% in Mar 2024

YoY Growth in year ended Mar 2025 is 3.16% vs -0.48% in Mar 2024