Key Events This Week

2 Feb: Stock opens week at Rs.154.62, rising 1.21% despite Sensex decline

3 Feb: Shares surge 4.00% on strong market rebound to Rs.160.81

4 Feb: Valuation shifts to very expensive amid mixed returns; stock closes at Rs.163.30 (+1.55%)

5 Feb: Q3 FY26 results reveal strong profit growth; stock gains 0.53% to Rs.164.16

6 Feb: Stock retreats 0.57% to Rs.163.22 as Sensex edges up 0.10%

Why is Aaron Industries Ltd falling/rising?

2026-02-06 00:58:20

Short-Term Price Movement and Market Context

The stock’s 0.53% rise on 05-Feb reflects a positive intraday momentum, outperforming its sector by 1.81%. Over the past week, Aaron Industries has delivered a robust 6.76% return, significantly outpacing the Sensex’s 0.88% gain during the same period. However, this short-term strength contrasts with the stock’s one-month decline of 6.37%, which is steeper than the Sensex’s 2.31% fall. Year-to-date, the stock remains down by 2.60%, slightly worse than the benchmark’s 1.86% drop.

Technical indicators reveal that the current price is above the 5-day and 20-day moving averages, signalling some recent buying interest. Yet, it remains below the 50-day, 100-day, and 200-day averages, suggesting that the broader trend is still unde...

Read full news articleAre Aaron Industries Ltd latest results good or bad?

2026-02-05 19:32:06Aaron Industries Ltd's latest financial results for the quarter ended December 2025 reflect a company that is navigating operational challenges while demonstrating some positive trends. The net sales for the quarter reached ₹23.20 crores, marking a 4.32% increase from the previous quarter and a notable 26.57% growth year-on-year. This indicates a strong demand environment or potential market share gains within the industrial manufacturing sector. The company's net profit also showed significant growth, reaching ₹2.02 crores, which represents a 45.32% increase compared to the prior quarter. This improvement in profitability is complemented by an operating margin of 20.86%, up from 18.53% in the previous quarter, suggesting enhanced operational efficiency. The return on equity stands at 20.09%, reflecting effective capital utilization. Despite these operational advancements, the market sentiment appears to ...

Read full news article

Aaron Industries Q3 FY26: Strong Profit Growth Masks Valuation Concerns

2026-02-05 14:36:46Aaron Industries Ltd., a Surat-based industrial manufacturing company, reported a robust quarter-on-quarter profit growth in Q3 FY26, yet the stock continues to languish in bearish territory, down 53.54% over the past year. With net profit rising 45.32% sequentially to ₹2.02 crores and revenue growth accelerating to 26.57% year-on-year, the operational performance appears solid. However, the company's premium valuation—trading at 49 times trailing earnings despite a micro-cap market capitalisation of ₹345.20 crores—raises critical questions about sustainability and investor expectations in a challenging market environment.

Read full news article

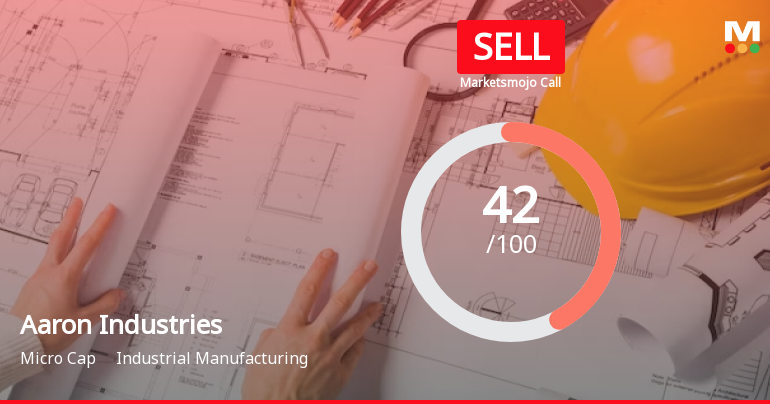

Aaron Industries Ltd is Rated Sell

2026-02-05 10:10:21Aaron Industries Ltd is rated Sell by MarketsMOJO, with this rating last updated on 01 September 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 05 February 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article

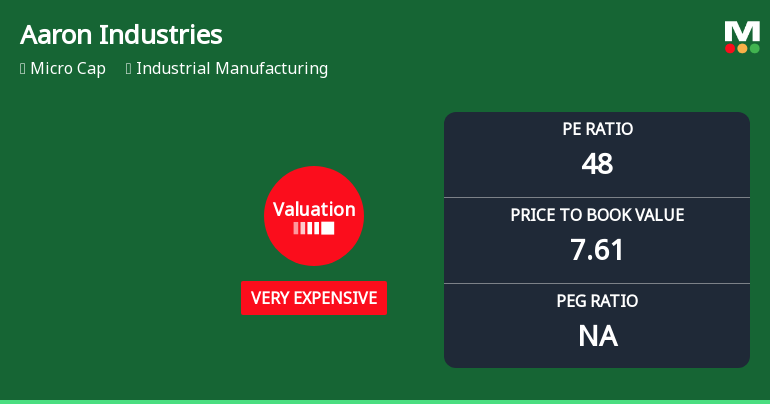

Aaron Industries Ltd Valuation Shifts to Very Expensive Amid Mixed Returns

2026-02-04 08:02:49Aaron Industries Ltd, a key player in the Industrial Manufacturing sector, has witnessed a marked deterioration in its valuation attractiveness as key price multiples have surged to historically elevated levels. The company’s price-to-earnings (P/E) and price-to-book value (P/BV) ratios now place it firmly in the “very expensive” category, prompting a downgrade in its mojo grade from Hold to Sell as of 1 September 2025. This article analyses the valuation shifts in detail, compares Aaron Industries with its peers, and assesses the implications for investors amid a challenging market backdrop.

Read full news article

Aaron Industries Ltd is Rated Sell

2026-01-25 10:10:16Aaron Industries Ltd is rated 'Sell' by MarketsMOJO. This rating was last updated on 01 September 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 25 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Aaron Industries Ltd is Rated Sell

2026-01-14 10:10:21Aaron Industries Ltd is rated 'Sell' by MarketsMOJO. This rating was last updated on 01 September 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 14 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Aaron Industries Ltd is Rated Sell

2026-01-03 10:10:34Aaron Industries Ltd is rated 'Sell' by MarketsMOJO. This rating was last updated on 01 September 2025, but the analysis below reflects the stock's current position as of 03 January 2026, incorporating the latest fundamentals, returns, and financial metrics.

Read full news article