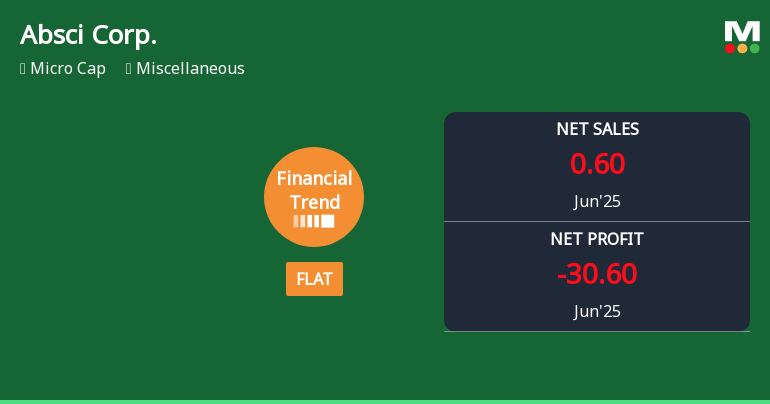

Absci Corp. Experiences Revision in Its Stock Evaluation Amid Mixed Financial Performance

2025-11-19 15:49:28Absci Corp. has reported a flat financial performance for the quarter ending June 2025, with a higher net profit of USD -56.91 million and a low debt-equity ratio. However, the company faces challenges, including a decline in net sales and a significant increase in raw material costs, impacting profitability.

Read full news articleNo announcement available

Corporate Actions

No corporate action available