Key Events This Week

Jan 27: Stock opens week at Rs.13.60, down 4.90%

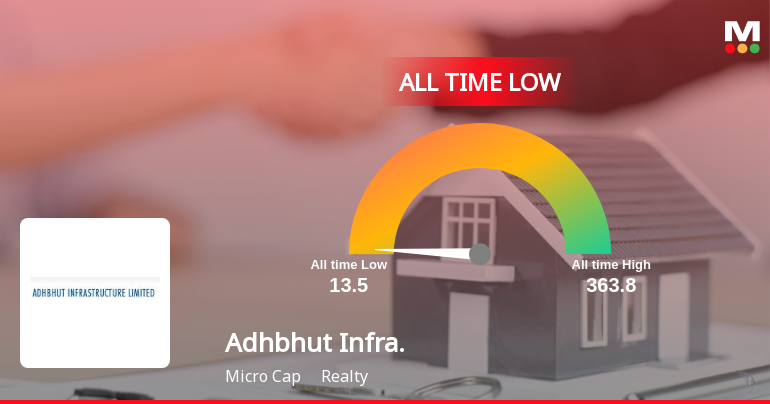

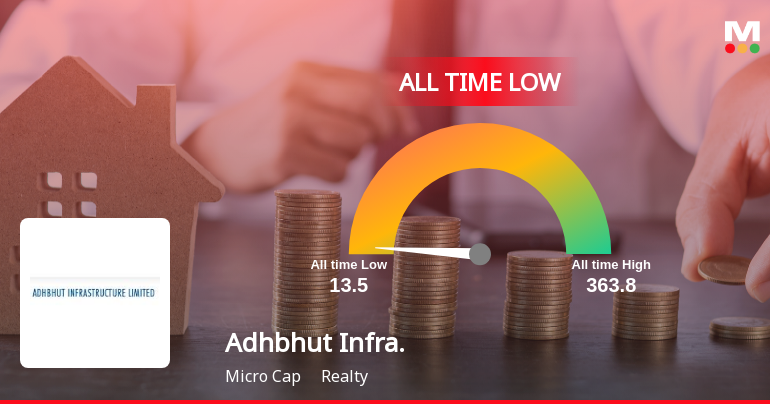

Jan 28: Hits all-time low near Rs.13.50 amid continued downtrend

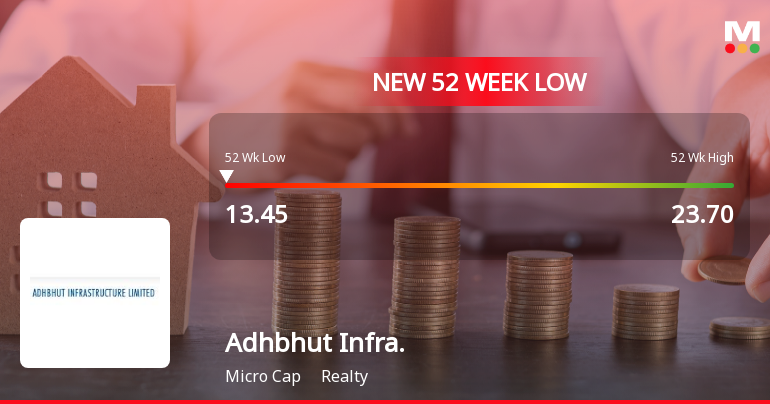

Jan 29: Falls to new 52-week low of Rs.13.45

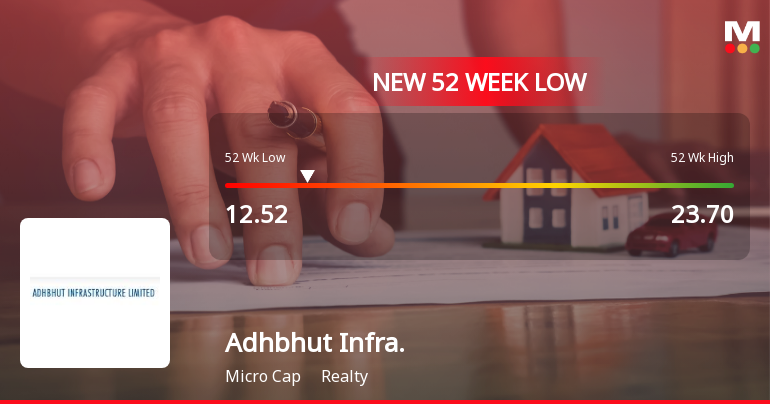

Jan 30: Drops further to Rs.12.52, marking fresh 52-week and all-time low

Adhbhut Infrastructure Ltd Falls to 52-Week Low Amidst Continued Downtrend

2026-01-30 10:58:33Adhbhut Infrastructure Ltd, a player in the Realty sector, recorded a fresh 52-week low of Rs.12.52 on 30 Jan 2026, marking a significant decline amid ongoing downward momentum. The stock has underperformed its sector and broader market indices, reflecting persistent pressures on its valuation and fundamentals.

Read full news article

Adhbhut Infrastructure Ltd Hits All-Time Low Amid Prolonged Downtrend

2026-01-30 09:34:20Adhbhut Infrastructure Ltd, a player in the realty sector, has recorded a new all-time low price of Rs.12.52, marking a significant decline amid sustained negative returns and underperformance relative to key market indices and its sector peers.

Read full news article

Adhbhut Infrastructure Ltd Falls to 52-Week Low of Rs.13.45

2026-01-29 15:40:00Adhbhut Infrastructure Ltd, a player in the Realty sector, has touched a new 52-week and all-time low of Rs.13.45 today, marking a significant decline in its stock price amid ongoing challenges reflected in its financial and market performance.

Read full news article

Adhbhut Infrastructure Ltd Stock Hits All-Time Low Amid Prolonged Downtrend

2026-01-29 14:52:14Shares of Adhbhut Infrastructure Ltd have declined to an all-time low, reflecting a sustained period of underperformance within the realty sector. The stock’s recent fall underscores significant pressures on the company’s financial health and market valuation.

Read full news article

Adhbhut Infrastructure Ltd Stock Hits All-Time Low Amid Prolonged Downtrend

2026-01-28 10:12:36Shares of Adhbhut Infrastructure Ltd have declined to an all-time low, reflecting a sustained period of underperformance within the Realty sector. The stock’s recent price movements underscore significant challenges faced by the company, as it continues to lag behind key market benchmarks and sector peers.

Read full news articleAdhbhut Infrastructure Ltd Drops 11.12%: 4 Key Factors Behind the Steep Decline

2026-01-24 17:04:15

Key Events This Week

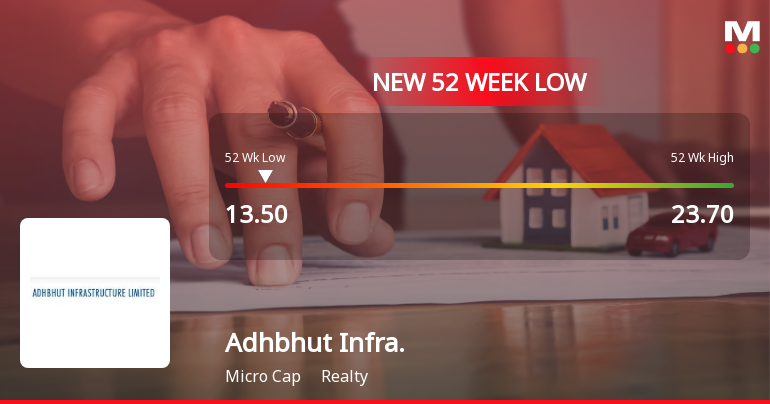

Jan 19: Stock opens at Rs.14.61, down 9.20% on heavy volume

Jan 20: Modest recovery to Rs.14.76 despite Sensex decline

Jan 22: New 52-week and all-time low hit at Rs.13.5

Jan 23: Week closes steady at Rs.14.30, down 0.31% on the day

Adhbhut Infrastructure Ltd Falls to 52-Week Low Amidst Continued Downtrend

2026-01-22 10:51:22Adhbhut Infrastructure Ltd, a player in the Realty sector, has touched a new 52-week low of Rs.13.5 today, marking a significant decline in its stock price amid ongoing market pressures and company-specific concerns. This fresh low underscores the challenges faced by the company as it continues to underperform relative to its sector and broader market indices.

Read full news articleBoard Meeting Intimation for Un-Audited Financial Results Of The Company Along With The Limited Review Report For Quarter Ended 31St December 2025.

04-Feb-2026 | Source : BSEAdhbhut Infrastructure Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 10/02/2026 inter alia to consider and approve Un-audited Financial Results of the Company along with the Limited Review Report for Quarter ended 31st December 2025.

Announcement under Regulation 30 (LODR)-Newspaper Publication

10-Jan-2026 | Source : BSENewspaper Clippings of Notice of Postal Ballot.

Board Meeting Outcome for For Approval Of Notice Of Postal Ballot

08-Jan-2026 | Source : BSEOutcome of the Board Meeting held on today i.e. Thursday 08th January 2026 to consider and approve the Notice of Postal Ballot.

Corporate Actions

10 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available