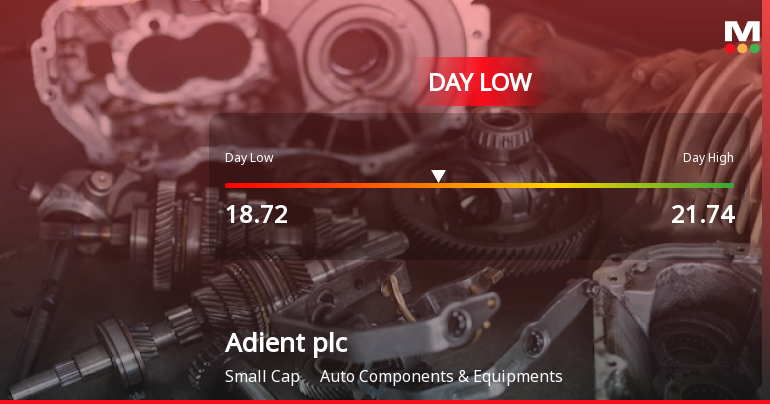

Adient plc Hits Day Low of $18.72 Amid Price Pressure

2025-11-06 16:20:58Adient plc, a small-cap company in the Auto Components & Equipment sector, faced significant stock volatility on November 5, 2025, with a notable decline. The company has struggled recently, reporting negative operating cash flow and consecutive quarterly losses, raising concerns about its long-term growth potential amidst high institutional holdings.

Read More

Adient plc Experiences Revision in Stock Evaluation Amid Mixed Market Signals

2025-10-07 20:48:36Adient plc, a small-cap auto components company, has recently revised its evaluation amid changing market conditions. The stock is priced at $25.78, with a notable 16.34% return over the past year. Despite mixed technical indicators, the company has demonstrated resilience, particularly with a strong year-to-date return of 49.62%.

Read MoreIs Adient plc technically bullish or bearish?

2025-10-07 12:23:11As of 3 October 2025, the technical trend for Adient plc has changed from mildly bullish to bullish. The weekly MACD is bullish, and the daily moving averages also indicate a bullish stance. The Bollinger Bands show a bullish trend on a monthly basis, while the KST is mildly bullish monthly but mildly bearish weekly. The RSI does not provide any signals for both weekly and monthly periods. In terms of performance, Adient has outperformed the S&P 500 over the past week and month, with returns of 6.22% and 4.88% respectively, but lags behind on a 1-year basis (16.34% vs. 17.82%) and significantly underperformed over the 3-year and 5-year periods. Overall, the current technical stance is bullish with moderate strength....

Read More

Adient plc Hits New 52-Week High at USD 26.16, Signaling Strong Recovery

2025-10-06 17:40:44Adient plc achieved a new 52-week high of USD 26.16 on October 3, 2025, despite a one-year decline of 7.11%. The company, with a market cap of approximately USD 1,993 million, has a P/E ratio of 7.00 and a return on equity of 13.28%, but does not offer dividends.

Read MoreIs Adient plc technically bullish or bearish?

2025-10-06 12:13:21As of 3 October 2025, the technical trend for Adient plc has changed from mildly bullish to bullish. The weekly MACD is bullish, and both the weekly and monthly Bollinger Bands indicate a bullish stance. Daily moving averages also support this bullish outlook. However, the KST shows a mildly bearish signal on the weekly timeframe, while the Dow Theory remains mildly bullish across both weekly and monthly periods. In terms of performance, Adient has outperformed the S&P 500 over the past week and month, with returns of 4.99% and 6.64% compared to 1.09% and 4.15% respectively. Year-to-date, Adient has returned 50.15%, significantly higher than the S&P 500's 14.18%. Overall, the current technical stance is bullish, with moderate strength indicated by the mixed signals from KST and Dow Theory....

Read MoreIs Adient plc technically bullish or bearish?

2025-10-05 11:58:32As of 3 October 2025, the technical trend for Adient plc has changed from mildly bullish to bullish. The weekly MACD is bullish, and both the weekly and monthly Bollinger Bands are bullish, supporting the positive stance. Daily moving averages also indicate a bullish trend. However, the KST shows a mildly bearish signal on the weekly timeframe, and the OBV is mildly bearish on the weekly as well, suggesting some caution. In terms of performance, Adient has outperformed the S&P 500 over the past week and month, with returns of 4.99% and 6.64% compared to 1.09% and 4.15% for the index, respectively. Year-to-date, Adient is up 50.15%, significantly exceeding the S&P 500's 14.18%. Overall, the current technical stance is bullish, with strong indicators supporting this view....

Read More