Recent Price Movement and Market Comparison

Aditya Birla Money Ltd has been under significant pressure over the past year, with its stock price falling by 37.14%, a stark contrast to the Sensex’s 9.00% gain during the same period. This underperformance extends to shorter time frames as well, with the stock declining 5.59% in the last week and 8.99% over the past month, both considerably worse than the Sensex’s respective returns of -1.86% and -2.21%. Year-to-date, the stock has dropped 5.12%, again underperforming the benchmark’s 2.16% decline.

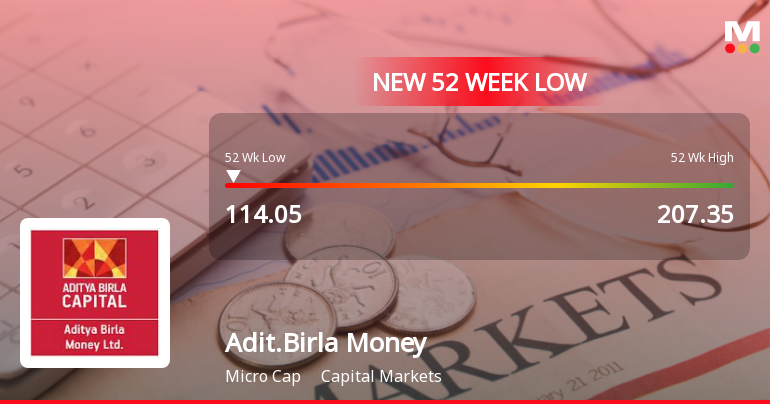

On 14-Jan, the stock traded close to its 52-week low, just 3.14% above the bottom price of ₹130.9. The intraday low touched ₹134, marking a 2.65% drop from the previous close. Notably, the stock has been falling for four consecu...

Read full news article