Ajmera Realty & Infra India Ltd Falls to 52-Week Low of Rs.122.55

2026-03-06 10:17:54Ajmera Realty & Infra India Ltd’s stock has declined to a fresh 52-week low of Rs.122.55, marking a significant downturn amid broader market pressures and company-specific performance factors. The stock has now recorded a three-day consecutive fall, losing 4.25% over this period, reflecting ongoing challenges within the realty sector and the company’s financial metrics.

Read full news article

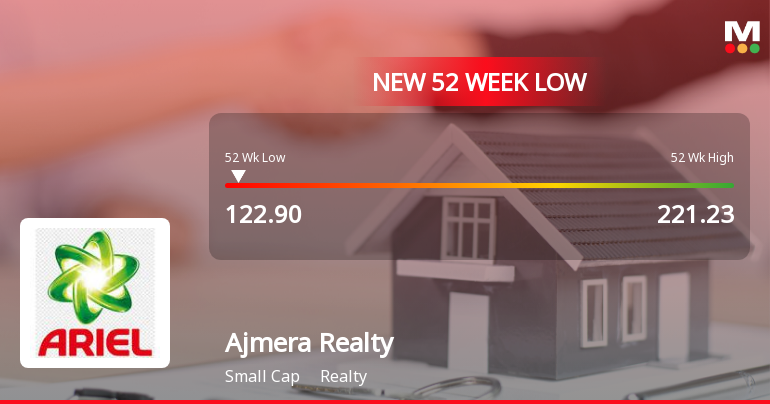

Ajmera Realty & Infra India Ltd Falls to 52-Week Low Amidst Continued Downtrend

2026-03-04 10:49:58Ajmera Realty & Infra India Ltd’s stock declined sharply to a new 52-week low of Rs.122.9 on 4 March 2026, marking a significant downturn amid broader sector weakness and company-specific financial pressures.

Read full news article

Ajmera Realty & Infra India Ltd Falls to 52-Week Low of Rs.126.4

2026-03-02 11:19:40Ajmera Realty & Infra India Ltd’s stock has declined to a fresh 52-week low of Rs.126.4, marking a significant downturn amid sustained selling pressure. The stock has now recorded losses for eight consecutive sessions, cumulatively falling by 14.11% over this period, reflecting ongoing challenges within the realty sector and company-specific performance factors.

Read full news article

Ajmera Realty & Infra India Ltd Falls to 52-Week Low of Rs.129.45

2026-02-27 11:41:36Ajmera Realty & Infra India Ltd’s stock price declined to a fresh 52-week low of Rs.129.45 today, marking a significant milestone in its ongoing downward trajectory. The stock has underperformed both its sector and the broader market over the past year, reflecting a series of financial setbacks and valuation concerns.

Read full news article

Ajmera Realty & Infra India Ltd Falls to 52-Week Low Amidst Continued Downtrend

2026-02-26 12:41:40Ajmera Realty & Infra India Ltd has declined to a new 52-week low, closing just 1.33% above its lowest price of Rs 130.1. The stock has experienced a sustained downward trajectory over the past six trading sessions, culminating in an 11.39% loss during this period, reflecting ongoing pressures within the realty sector.

Read full news article

Ajmera Realty & Infra India Ltd is Rated Sell

2026-02-25 10:10:04Ajmera Realty & Infra India Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 09 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Ajmera Realty & Infra India Ltd Falls to 52-Week Low Amidst Continued Downtrend

2026-02-24 16:01:05Ajmera Realty & Infra India Ltd has recently touched a 52-week low, closing near ₹130.1, marking a significant decline in its stock price amid a sustained downward trend over the past several sessions.

Read full news article

Ajmera Realty & Infra India Ltd Falls to 52-Week Low of Rs.130.1

2026-02-23 11:40:13Ajmera Realty & Infra India Ltd’s stock declined sharply to a fresh 52-week low of Rs.130.1 on 23 Feb 2026, marking a significant milestone in its ongoing downward trajectory. The stock has underperformed its sector and broader market indices, reflecting persistent pressures on the company’s financial performance and valuation metrics.

Read full news article

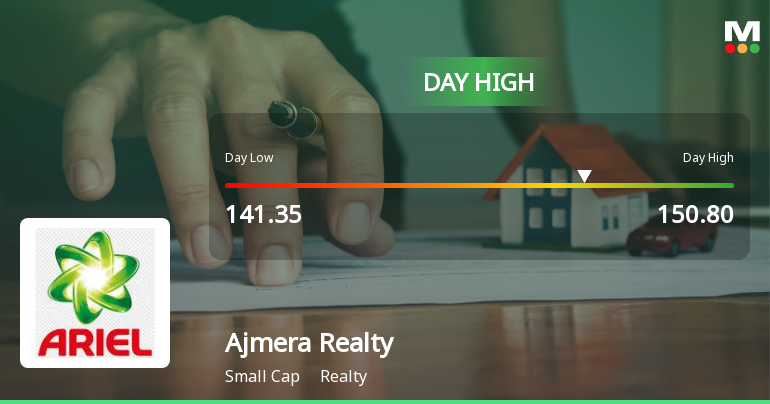

Ajmera Realty & Infra India Ltd Hits Intraday High with 7.41% Surge

2026-02-18 14:46:38Ajmera Realty & Infra India Ltd demonstrated robust intraday performance on 18 Feb 2026, surging 7.41% to touch a day’s high of Rs 148.95, significantly outperforming the Realty sector and broader market indices.

Read full news articleAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

02-Mar-2026 | Source : BSEIntimation of Schedule of Analyst/Institutional Investor Meeting under the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

26-Feb-2026 | Source : BSEIntimation of Schedule of Analyst/Institutional Investor Meeting under the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

18-Feb-2026 | Source : BSEIntimation of Schedule of Analyst/Institutional Investor Meeting under the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Corporate Actions

No Upcoming Board Meetings

Ajmera Realty & Infra India Ltd has declared 45% dividend, ex-date: 02 Sep 25

Ajmera Realty & Infra India Ltd has announced 2:10 stock split, ex-date: 14 Jan 26

No Bonus history available

No Rights history available