Recent Price Movement and Market Comparison

AKI India’s share price has been under pressure over recent weeks, with a one-week decline of 5.01%, significantly lagging behind the Sensex’s modest 0.40% drop during the same period. The stock’s monthly performance is even more concerning, having fallen 8.83%, while the Sensex remained relatively stable with a 0.30% decrease. Year-to-date, the stock has plummeted by 44.68%, in stark contrast to the Sensex’s gain of 8.69%. Over the past year, AKI India’s shares have declined by 51.32%, whereas the benchmark index has appreciated by 7.21%. This persistent underperformance highlights the challenges facing the company and investor sentiment.

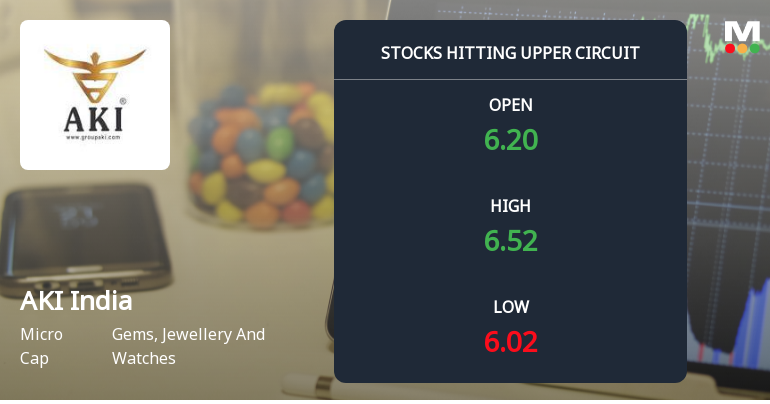

Technical Indicators and Trading Patterns

Technically, AKI Indi...

Read full news article