Alacrity Securities Ltd is Rated Strong Sell

2026-02-06 10:10:27Alacrity Securities Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 03 March 2025, reflecting a significant reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed below are current as of 06 February 2026, providing investors with the latest comprehensive view of the company’s position.

Read full news article

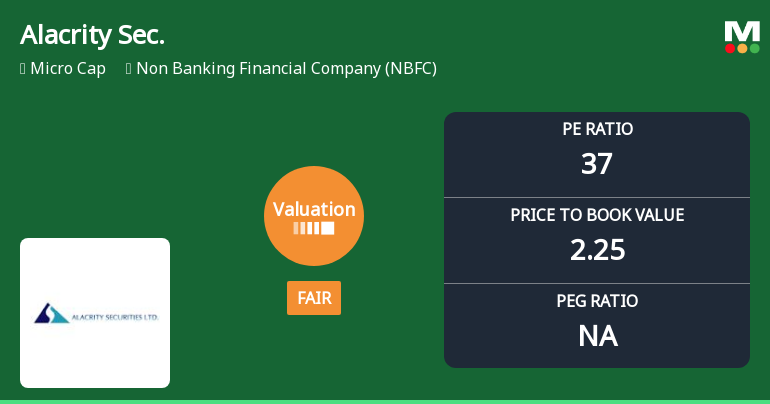

Alacrity Securities Ltd Valuation Shifts Signal Changing Market Sentiment

2026-02-01 08:05:09Alacrity Securities Ltd, a key player in the Non Banking Financial Company (NBFC) sector, has witnessed a notable shift in its valuation parameters, moving from an attractive to a fair valuation grade. This change reflects evolving market perceptions amid fluctuating financial metrics and sector dynamics, prompting investors to reassess the stock’s price attractiveness relative to its historical and peer benchmarks.

Read full news articleAre Alacrity Securities Ltd latest results good or bad?

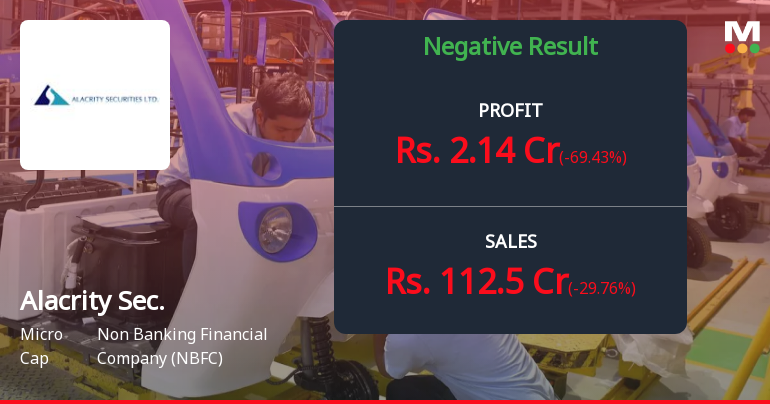

2026-01-29 19:23:08Alacrity Securities Ltd's latest financial results reflect a complex scenario characterized by significant revenue volatility and contrasting performance metrics. In Q2 FY26, the company reported net sales of ₹102.58 crores, marking a substantial sequential increase of 45.24% from the previous quarter. However, this figure represents a sharp year-on-year decline of 56.85% compared to ₹237.74 crores in Q2 FY25. The net profit for the same quarter was ₹5.79 crores, which is a 50.78% increase from Q1 FY26, yet this is juxtaposed against a backdrop of a 69.43% decrease in standalone net profit year-on-year. The operating margin for Q2 FY26 was recorded at 7.60%, showing a slight improvement from 7.50% in the previous quarter. Despite these operational gains, the overall financial picture raises concerns about the sustainability of revenue generation and the predictability of earnings. The company's PAT margin ...

Read full news article

Alacrity Securities Q2 FY26: Profit Surge Masks Troubling Revenue Volatility

2026-01-29 18:02:25Alacrity Securities Ltd., a micro-cap non-banking financial company with a market capitalisation of ₹271.00 crores, reported a net profit of ₹5.79 crores for Q2 FY26 ended September 2025, marking a 50.78% sequential increase from ₹3.84 crores in Q1 FY26. However, the seemingly positive headline figure conceals a troubling pattern of extreme revenue volatility that has become the company's defining characteristic. The stock, trading at ₹55.37 as of January 29, 2026, has plunged 60.59% over the past year, reflecting investor concerns about sustainability and business model stability despite the quarter's profit growth.

Read full news article

Alacrity Securities Ltd is Rated Strong Sell

2026-01-26 10:10:05Alacrity Securities Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 03 Mar 2025. However, the analysis and financial metrics presented here reflect the stock’s current position as of 26 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Alacrity Securities Ltd is Rated Strong Sell

2026-01-15 10:10:03Alacrity Securities Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 03 March 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 15 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Alacrity Securities Ltd is Rated Strong Sell

2026-01-04 10:10:04Alacrity Securities Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 03 March 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 04 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Alacrity Securities Ltd is Rated Strong Sell

2025-12-24 20:23:06Alacrity Securities Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 03 March 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 24 December 2025, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

Alacrity Sec. Sees Revision in Market Evaluation Amid Challenging Financial Trends

2025-12-03 11:08:14Alacrity Sec., a microcap player in the Non Banking Financial Company (NBFC) sector, has undergone a notable revision in its market evaluation, reflecting shifts in its financial and technical outlook. This adjustment comes amid a backdrop of subdued sales and profitability metrics, alongside a bearish technical stance, which collectively influence investor sentiment and market positioning.

Read full news articleAnnouncement under Regulation 30 (LODR)-Newspaper Publication

30-Jan-2026 | Source : BSENewspaper Advertisement of Un audited Financial Results for the quarter ended December 31 2025.

Board Meeting Outcome for Outcome Of Board Meeting Held On Thursday January 29 2026 At 3:00 P.M.

29-Jan-2026 | Source : BSEStandalone Un-Audited Financial Results of the Company for the quarter ended on December 31 2025 along with Limited Review Report.

Outcome Of Board Meeting Held On Thursday January 29 2026 At 3:00 P.M.

29-Jan-2026 | Source : BSEStandalone Unaudited Financial Result of the Company for the quarter ended on December 31 2025 along with Limited Review Report.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available