Alok Industries Ltd Opens with Strong Gap Up, Reflecting Positive Market Sentiment

2026-02-03 09:37:27Alok Industries Ltd witnessed a significant gap up at the opening bell on 3 Feb 2026, surging 11.81% above its previous close. This strong start underscores a positive market sentiment despite the stock’s broader technical challenges and sector dynamics.

Read full news article

Alok Industries Ltd Hits Intraday High with 7.9% Surge on 3 Feb 2026

2026-02-03 09:35:47Alok Industries Ltd recorded a robust intraday performance on 3 Feb 2026, surging to a day’s high of Rs 17, marking a 12.81% increase from its previous close. The stock demonstrated strong momentum throughout the trading session, closing with a notable gain of 7.9%, outperforming the broader Sensex index which rose 2.76% on the day.

Read full news article

Alok Industries Ltd is Rated Strong Sell

2026-02-01 10:10:22Alok Industries Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 02 September 2024. However, the analysis and financial metrics discussed here reflect the stock's current position as of 01 February 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market standing.

Read full news article

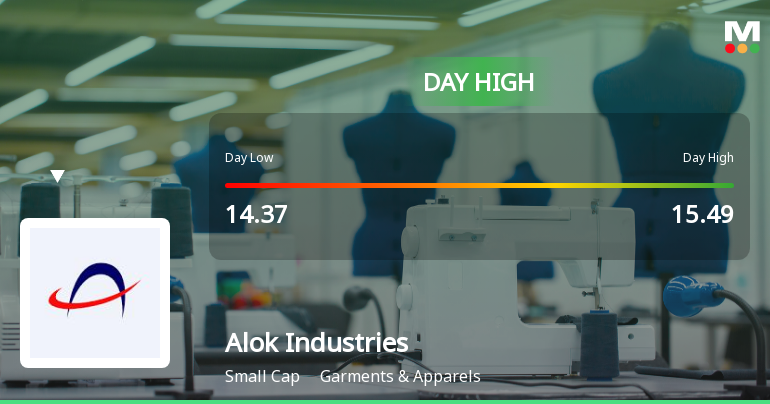

Alok Industries Ltd Hits Day High with 7.04% Intraday Surge

2026-01-22 09:31:07Alok Industries Ltd recorded a robust intraday rally on 22 Jan 2026, surging 7.04% to hit its day high, significantly outperforming its sector and the broader market indices amid positive trading momentum.

Read full news article

Alok Industries Ltd is Rated Strong Sell

2026-01-21 10:10:20Alok Industries Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 02 September 2024. However, the analysis and financial metrics discussed here reflect the company’s current position as of 21 January 2026, providing investors with an up-to-date perspective on the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Alok Industries Ltd is Rated Strong Sell

2026-01-10 10:10:20Alok Industries Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 02 September 2024. However, the analysis and financial metrics discussed here reflect the company’s current position as of 10 January 2026, providing investors with an up-to-date view of its fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Alok Industries Ltd Sees Exceptional Volume Surge Amid Strong Sell Rating

2026-01-08 11:00:10Alok Industries Ltd (ALOKINDS) emerged as one of the most actively traded stocks on 8 January 2026, registering a remarkable volume surge that outpaced sector and benchmark indices. Despite a strong intraday rally and rising investor participation, the company’s technical and fundamental indicators present a complex picture, with a recent downgrade to a Strong Sell rating by MarketsMOJO underscoring caution for investors.

Read full news article

Alok Industries Ltd is Rated Strong Sell

2025-12-29 10:10:04Alok Industries Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 02 September 2024. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 29 December 2025, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

Alok Industries Sees Exceptional Trading Volume Amidst Market Volatility

2025-12-23 10:00:13Alok Industries, a key player in the Garments & Apparels sector, has emerged as one of the most actively traded stocks by volume on 23 December 2025, registering a significant surge in market participation. The stock’s trading activity reflects heightened investor interest, with volumes surpassing 1.08 crore shares and a notable price movement that outpaced its sector and benchmark indices.

Read full news articleAlok Industries Limited - Committee Meeting Updates

21-Nov-2019 | Source : NSEAlok Industries Limited has informed the Exchange regarding Committee Meeting to be held on November 22, 2019.

Alok Industries Limited - Updates

18-Nov-2019 | Source : NSEAlok Industries Limited has informed the Exchange regarding 'Letter of Debenture Trustee pursuant to regulations 52 (5) of the SEBI (Listing Obligations and Disclosure Requirements) 2015'.

Alok Industries Limited - Updates

13-Nov-2019 | Source : NSEAlok Industries Limited has informed the Exchange regarding 'News paper advertisement regarding notice of Monitoring Committee for declaration of un-audited financial results for the quarter ended September 30, 2019.'.

Corporate Actions

No Upcoming Board Meetings

Alok Industries Ltd has declared 3% dividend, ex-date: 18 Dec 13

No Splits history available

No Bonus history available

Alok Industries Ltd has announced 2:3 rights issue, ex-date: 15 Feb 13