Alpa Laboratories Ltd Falls to 52-Week Low Amid Continued Downtrend

2026-03-11 16:00:11Alpa Laboratories Ltd has reached a new 52-week low, reflecting ongoing pressures in its share price as it closed at Rs 62.85, marking a significant decline from its peak of Rs 120.5 over the past year. This development underscores the challenges faced by the company within the Pharmaceuticals & Biotechnology sector amid a broader market downturn.

Read full news article

Alpa Laboratories Ltd Stock Falls to 52-Week Low of Rs.55.1

2026-03-04 10:56:55Alpa Laboratories Ltd, a player in the Pharmaceuticals & Biotechnology sector, has touched a new 52-week low of Rs.55.1 today, marking a significant decline in its stock price amid ongoing challenges reflected in its financial and market performance.

Read full news article

Alpa Laboratories Ltd Stock Falls to 52-Week Low of Rs.55.1

2026-03-04 10:56:52Alpa Laboratories Ltd, a player in the Pharmaceuticals & Biotechnology sector, has touched a new 52-week low of Rs.55.1 today, marking a significant decline in its stock price amid ongoing underperformance relative to broader market indices and sector peers.

Read full news article

Alpa Laboratories Ltd is Rated Strong Sell

2026-03-02 10:10:21Alpa Laboratories Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 17 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 02 March 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Alpa Laboratories Ltd is Rated Strong Sell

2026-02-19 10:10:26Alpa Laboratories Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 17 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 19 February 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news articleAre Alpa Laboratories Ltd latest results good or bad?

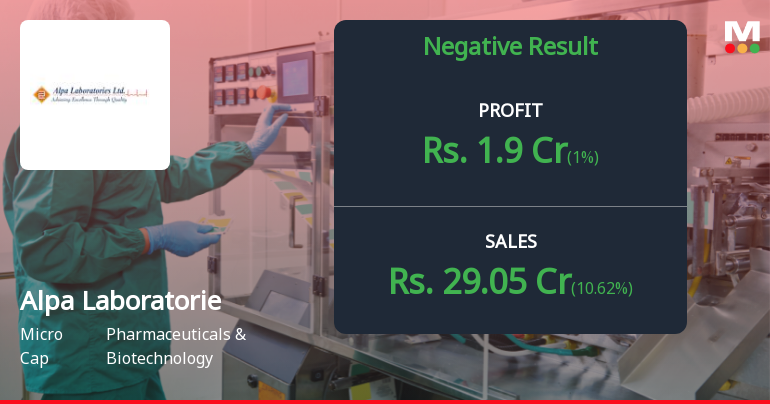

2026-02-11 19:32:32Alpa Laboratories Ltd's latest financial results for Q3 FY26 present a mixed operational picture. The company reported a revenue of ₹29.05 crores, reflecting an 11.09% year-on-year growth, which indicates some ability to maintain top-line momentum in a challenging market. Sequentially, revenue also grew by 10.62% from the previous quarter, suggesting improving demand conditions. However, the net profit for the same quarter was ₹1.90 crores, which represents a significant decline of 78.65% year-on-year. This sharp drop raises concerns about the company's profitability and overall financial health. The operating margin, excluding other income, stood at 5.23%, which is an improvement from the previous quarter's negative margin but still indicates volatility in operational performance. The reliance on other income to support profitability is notable, with a substantial portion of operating profit being derived...

Read full news article

Alpa Laboratories Q3 FY26: Profit Recovery Masks Deeper Operational Concerns

2026-02-11 15:18:03Alpa Laboratories Ltd., the Indore-based pharmaceutical formulations manufacturer, reported a sequential profit recovery in Q3 FY26 with net profit of ₹1.90 crores, marking a dramatic 1,627.27% quarter-on-quarter surge from the near-zero ₹0.11 crores in Q2 FY26. However, the year-on-year comparison reveals a concerning 78.65% decline from ₹8.90 crores in Q3 FY24, underscoring persistent operational challenges that have plagued the micro-cap pharmaceutical company throughout FY26.

Read full news article

Alpa Laboratories Ltd is Rated Strong Sell

2026-02-08 10:10:17Alpa Laboratories Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 17 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 08 February 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news articleDisclosures under Reg. 29(1) & 29(2) of SEBI (SAST) Regulations 2011

09-Mar-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 29(1) & 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Vinit Shah

Disclosures under Reg. 10(6) of SEBI (SAST) Regulations 2011

09-Mar-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 10(6) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Vinit Shah

Announcement under Regulation 30 (LODR)-Resignation of Company Secretary / Compliance Officer

25-Feb-2026 | Source : BSEMs Srashti Chopra has resigned from the post of Company Secreatary and Compliance Officer wef 25th March 2026.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available