Intraday Volatility and Market Dynamics

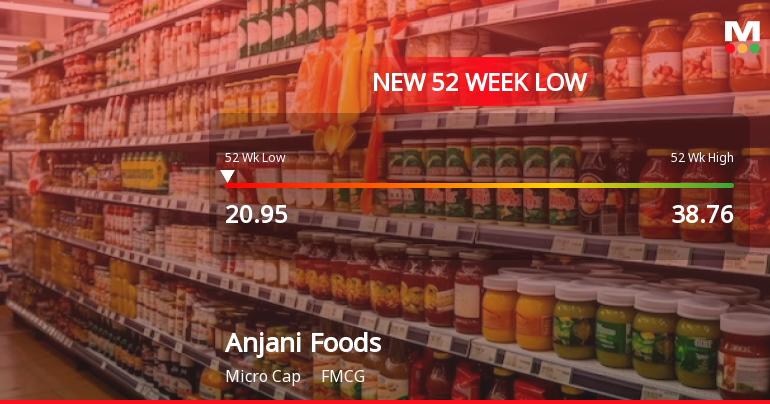

On 23 January, Anjani Foods Ltd experienced a highly volatile trading session, with the stock price swinging between an intraday low of ₹19.75 and a high of ₹22.75, representing a wide range of ₹3. The stock opened with a gap down of 3.66%, yet managed to recover strongly, outperforming its sector by 8.93% and registering gains for the second consecutive day. This recent rally has delivered a 9.88% return over the past two sessions, signalling renewed investor interest despite the stock’s longer-term struggles.

Trading volumes have also shown signs of strengthening, with delivery volumes on 22 January rising by 9.12% compared to the five-day average, indicating increased participation from investors. The weighted average price su...

Read full news article