Is Arista Networks, Inc. overvalued or undervalued?

2025-10-21 12:12:33As of 17 October 2025, the valuation grade for Arista Networks, Inc. has moved from expensive to fair. The company appears to be fairly valued based on its current metrics, with a P/E ratio of 40, a Price to Book Value of 12.07, and an EV to EBITDA of 35.58. In comparison, a peer like Arista Networks has a higher P/E of 54.30, indicating that while Arista is fairly valued, its peers may be overvalued. Arista Networks has shown strong performance with a year-to-date return of 29.47%, significantly outperforming the S&P 500's 13.30% during the same period. However, over the last three years, the company's return of 36.86% lags behind the S&P 500's 81.19%, suggesting some volatility in its longer-term performance. Overall, the current valuation metrics indicate that Arista Networks is fairly valued in the market....

Read MoreIs Arista Networks, Inc. overvalued or undervalued?

2025-10-20 12:29:45As of 17 October 2025, the valuation grade for Arista Networks, Inc. has moved from expensive to fair. The company appears to be fairly valued based on its current metrics, with a P/E ratio of 40, a Price to Book Value of 12.07, and an EV to EBITDA of 35.58. In comparison, a peer like Arista Networks itself has a significantly higher P/E ratio of 54.30, indicating that the market may be pricing it more aggressively than Arista Networks. With a remarkable ROCE of 159.60% and an ROE of 29.82%, Arista demonstrates strong profitability metrics. Recent stock performance shows that while Arista's 1-week return is down by 7.14%, it has outperformed the S&P 500 over the year with a return of 40.50% compared to the S&P's 14.08%. Overall, the current valuation metrics suggest that Arista Networks is fairly valued in the market....

Read MoreIs Arista Networks, Inc. overvalued or undervalued?

2025-10-19 12:07:07As of 17 October 2025, the valuation grade for Arista Networks, Inc. moved from expensive to fair, indicating a shift in its perceived value. Based on the current metrics, the company appears to be fairly valued. Key ratios include a P/E ratio of 40, an EV to EBITDA of 35.58, and a Price to Book Value of 12.07. In comparison, its peer, which has a P/E ratio of 54.30, suggests that Arista may be more attractively priced relative to its competition. Despite recent challenges, such as a 7.14% decline in the past week compared to a 1.70% gain in the S&P 500, Arista has shown strong performance year-to-date with a return of 29.47% versus the S&P 500's 13.30%. This performance, along with its robust ROCE of 159.60% and ROE of 29.82%, reinforces the notion that Arista Networks, Inc. is fairly valued in the current market landscape....

Read More

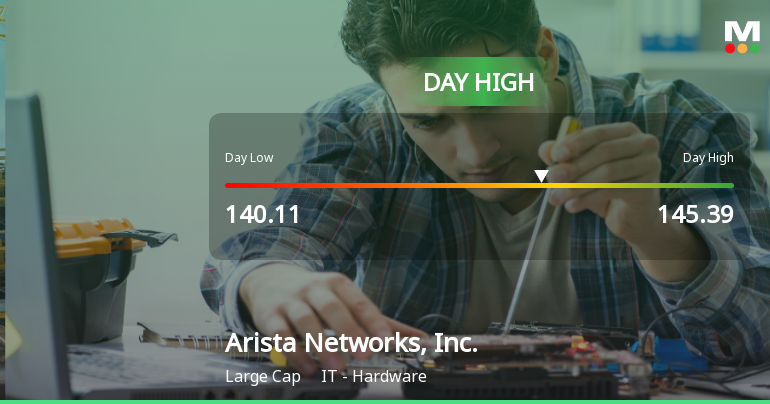

Arista Networks Hits Day High with Strong 3.31% Intraday Surge

2025-10-16 19:01:54Arista Networks, Inc. has demonstrated strong performance, achieving notable gains and an impressive annual return of 46.19%. The company boasts a robust average Return on Equity of 29.73% and significant growth in net sales and operating profit, alongside a solid market capitalization and high institutional holdings.

Read More

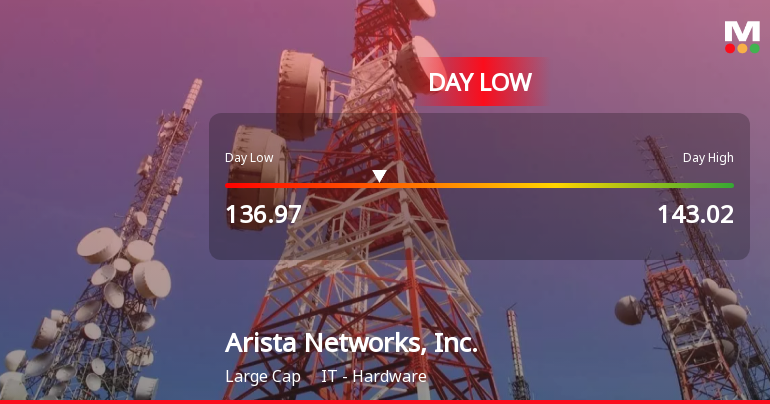

Arista Networks Stock Hits Day Low Amid Price Pressure at $136.97

2025-10-15 17:38:40Arista Networks, Inc. faced a significant stock price decline today, reaching an intraday low. Despite this, the company has shown strong long-term performance, with a notable annual stock value increase and consistent positive results over 17 quarters, highlighting its resilience and growth potential in the IT hardware sector.

Read More

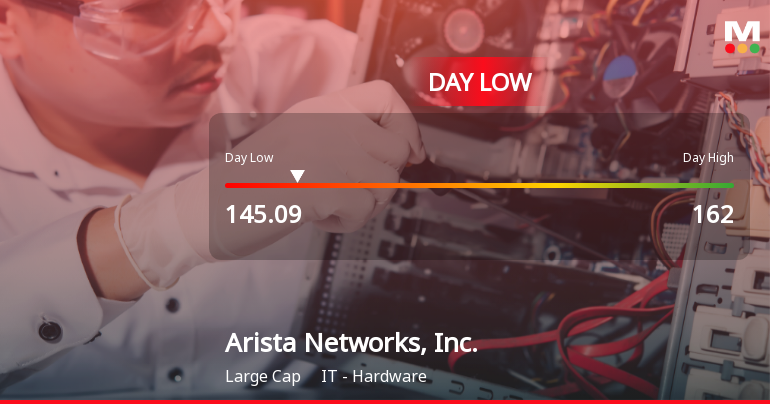

Arista Networks Stock Hits Day Low Amid Price Pressure, Closes at $145.09

2025-10-14 19:33:01Arista Networks, Inc. faced a decline in its stock price today, reaching an intraday low. However, the company has demonstrated strong long-term performance, with a year-to-date increase of 33.4% and a remarkable annual return of 41.46%. Arista has consistently reported positive results for 17 quarters, reflecting solid fundamentals.

Read MoreIs Arista Networks, Inc. technically bullish or bearish?

2025-09-20 19:43:15As of 24 July 2025, the technical trend has changed from mildly bullish to bullish. The current stance is bullish with strong indicators supporting this view. The MACD is bullish on both weekly and monthly time frames, and Bollinger Bands are also bullish in both periods. Moving averages are bullish on a daily basis, while the KST shows a mixed signal with weekly bullish and monthly mildly bearish readings. Dow Theory confirms a bullish trend on both weekly and monthly levels, and the On-Balance Volume (OBV) is bullish as well. In terms of performance, Arista Networks has outperformed the S&P 500 significantly over multiple periods, with a year-to-date return of 32.69% compared to the S&P 500's 12.22%, and a one-year return of 62.19% versus 17.14%. Overall, the technical indicators strongly support a bullish outlook....

Read MoreIs Arista Networks, Inc. overvalued or undervalued?

2025-09-20 18:18:27As of 7 July 2025, the valuation grade for Arista Networks, Inc. moved from expensive to fair. The company appears to be fairly valued based on its metrics, with a P/E ratio of 40, a Price to Book Value of 12.07, and an EV to EBITDA of 35.58. In comparison, its peer, which has a P/E of 54.30 and an EV to EBITDA of 47.92, suggests that Arista is positioned more attractively within its industry. The company's strong ROCE of 159.60% and ROE of 29.82% further support its valuation, indicating efficient use of capital and shareholder equity. Notably, Arista has outperformed the S&P 500 over multiple periods, with a 1-year return of 62.19% compared to the S&P 500's 17.14%, highlighting its robust performance relative to the broader market....

Read More

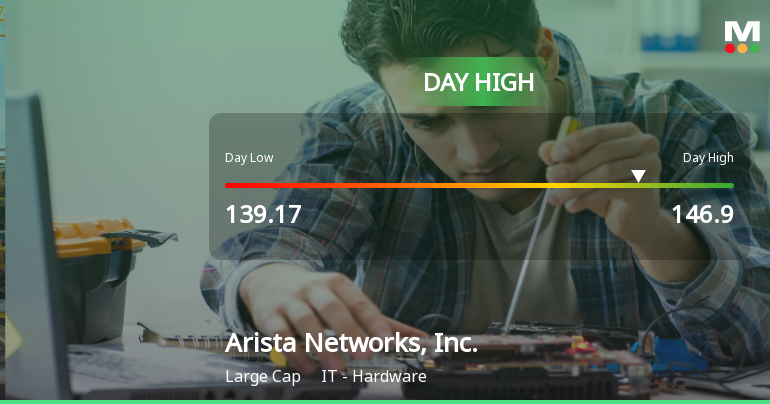

Arista Networks Hits Day High with Strong 4.33% Intraday Surge

2025-09-16 12:31:07Arista Networks, Inc. has shown impressive stock performance, gaining 4.33% on September 15, 2025, and achieving a 95.48% increase over the past year. The company boasts strong financial metrics, including a 29.73% return on equity and consistent positive results for 17 quarters, reinforcing its solid market position.

Read More