Key Events This Week

16 Feb: Quality grade upgraded from below average to average

17 Feb: Mojo Grade upgraded from Strong Sell to Sell amid strong Q3 FY26 results

17 Feb: Stock price rebounds sharply by 7.25% after two days of decline

20 Feb: Week closes at Rs.79.00, down 0.42% for the week

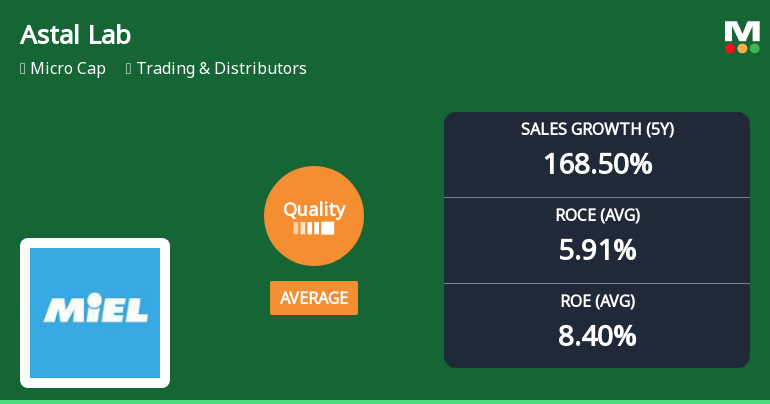

Astal Laboratories Ltd is Rated Sell

2026-02-28 10:10:03Astal Laboratories Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 16 February 2026. However, the analysis and financial metrics presented here reflect the stock's current position as of 28 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Astal Laboratories Q3 FY26: Growth Momentum Masks Alarming Margin Erosion

2026-02-17 11:32:12Astal Laboratories Ltd., a micro-cap pharmaceutical intermediates and bulk drugs manufacturer, reported net profit of ₹2.36 crores for Q3 FY26 (October-December 2025), reflecting an 8.53% decline quarter-on-quarter but a modest 5.22% decline year-on-year. Despite impressive top-line expansion, the company's profitability metrics reveal a concerning deterioration in operational efficiency that has sent the stock into bearish territory, trading at ₹77.60 as of February 17, 2026—down 24.81% from its 52-week high of ₹103.20.

Read full news article

Astal Laboratories Ltd Upgraded to Sell on Improved Quality and Financial Trends

2026-02-17 08:13:06Astal Laboratories Ltd has seen its investment rating upgraded from Strong Sell to Sell, reflecting notable improvements in its quality metrics and financial trends despite valuation concerns and recent price weakness. The revised assessment follows a comprehensive review of four key parameters: Quality, Valuation, Financial Trend, and Technicals.

Read full news article

Astal Laboratories Ltd Quality Grade Upgrade: A Detailed Analysis of Business Fundamentals

2026-02-17 08:00:17Astal Laboratories Ltd has seen its quality grade improve from below average to average, reflecting a nuanced shift in its business fundamentals. While key metrics such as return on equity (ROE) and return on capital employed (ROCE) remain modest, improvements in sales and earnings growth alongside low debt levels have contributed to this upgrade. However, investors should weigh these positives against the company’s middling profitability ratios and recent share price underperformance relative to the Sensex.

Read full news articleAre Astal Laboratories Ltd latest results good or bad?

2026-02-14 19:38:09Astal Laboratories Ltd has reported significant operational changes in its latest financial results for Q2 FY26. The company achieved net sales of ₹37.52 crores, reflecting a remarkable year-on-year growth of 185.11%, indicating a strong recovery and expansion from its previous operational dormancy. This growth trajectory is notable, especially considering the company’s revenue was only ₹13.16 crores in the same quarter last year. However, while revenue growth is impressive, it is accompanied by a concerning trend in profitability. The net profit for the quarter stood at ₹2.58 crores, marking a 29.00% increase year-on-year. Despite this positive figure, the profit margins have faced compression, with the PAT margin declining to 6.88% from 8.25% in the previous quarter. This suggests that the aggressive pursuit of revenue growth may be impacting operational efficiency and pricing power. The operating profi...

Read full news articleWhen is the next results date for Astal Laboratories Ltd?

2026-02-11 23:16:28The next results date for Astal Laboratories Ltd is scheduled for 14 February 2026....

Read full news article

Astal Laboratories Ltd is Rated Strong Sell

2026-02-10 10:10:07Astal Laboratories Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 21 January 2026. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 10 February 2026, providing investors with the most up-to-date view of the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article