Key Events This Week

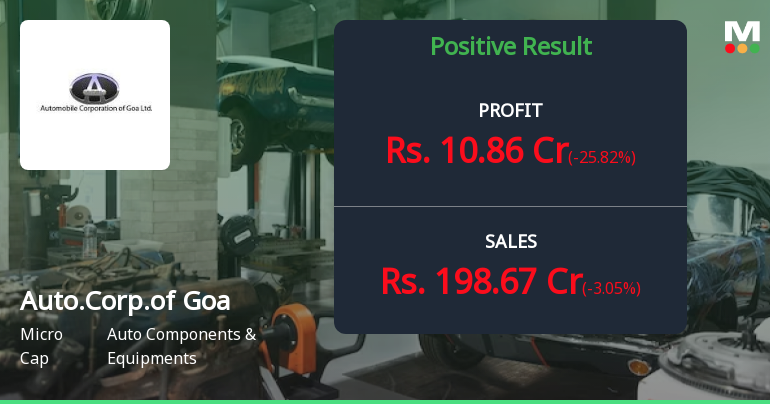

Jan 19: Profit surge reported amid margin pressures

Jan 19: Technical momentum shifts to mildly bearish

Jan 22: Downgrade to Sell rating amid technical weakness

Jan 22: Bearish momentum confirmed with price decline

Jan 23: Week closes at Rs.1,674.85 (-7.61%)