Key Events This Week

Jan 27: Stock opens week at Rs.24.31, up 0.62%

Jan 28: Q3 FY26 results reveal deepening profitability crisis; stock surges 3.41%

Jan 29: Flat quarterly performance reported amid long-term challenges; stock retreats 2.94%

Jan 30: Week closes at Rs.24.38, marginal decline of 0.08% on the day

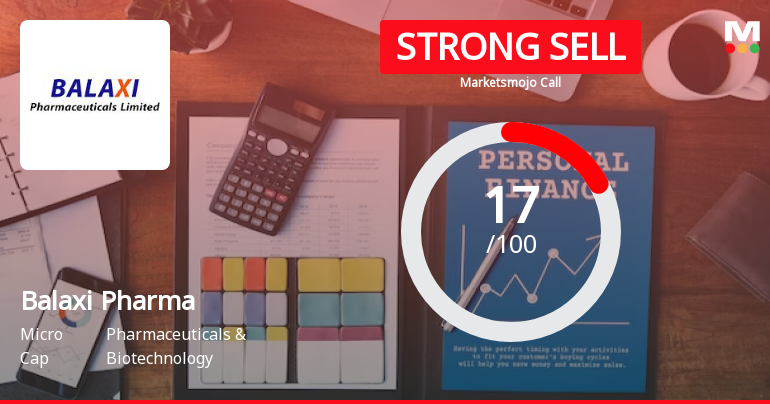

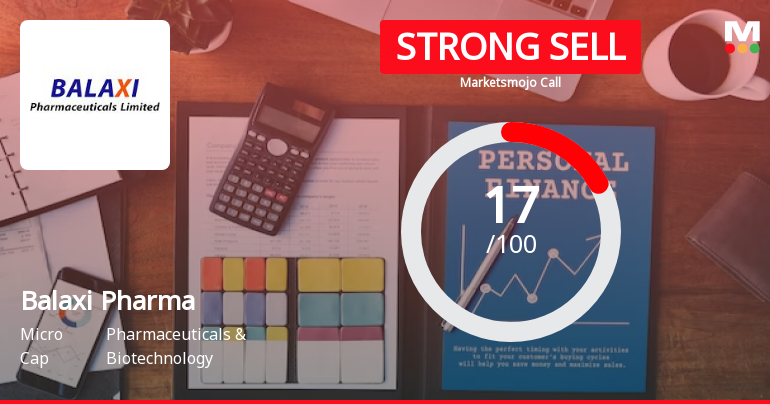

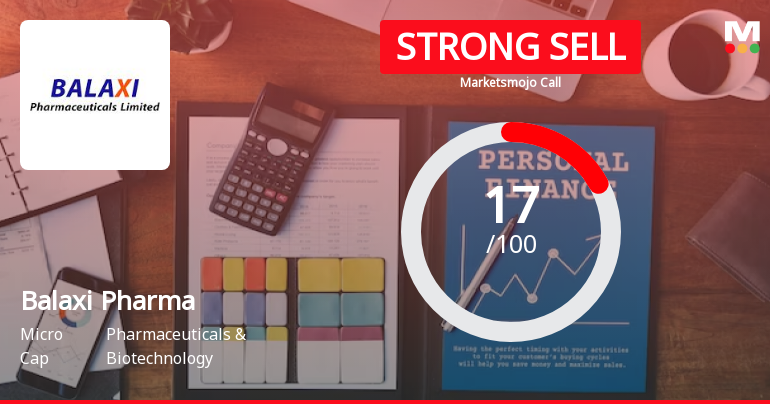

Balaxi Pharmaceuticals Ltd is Rated Strong Sell

2026-01-29 10:11:07Balaxi Pharmaceuticals Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 12 Nov 2025, reflecting a reassessment of the stock’s outlook. However, the analysis and financial metrics discussed below represent the company’s current position as of 29 January 2026, providing investors with the latest data to inform their decisions.

Read full news article

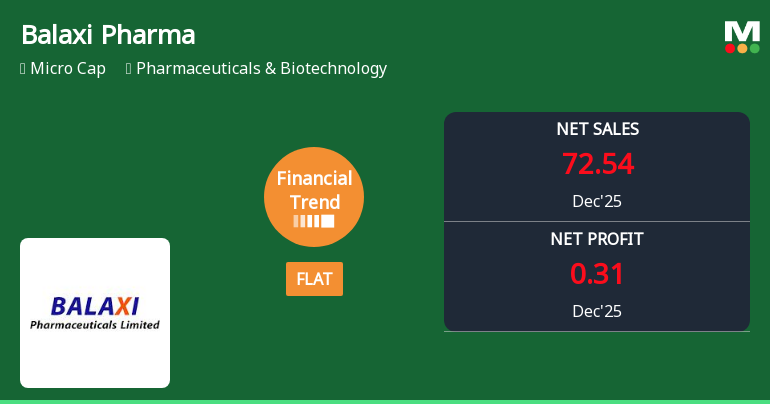

Balaxi Pharmaceuticals Reports Flat Quarterly Performance Amid Long-Term Challenges

2026-01-29 08:00:23Balaxi Pharmaceuticals Ltd has reported a flat financial performance for the quarter ended December 2025, marking a notable shift from its previous negative trend. Despite the absence of key negative triggers, the company continues to face significant headwinds, reflected in its long-term stock underperformance relative to the broader market.

Read full news articleAre Balaxi Pharmaceuticals Ltd latest results good or bad?

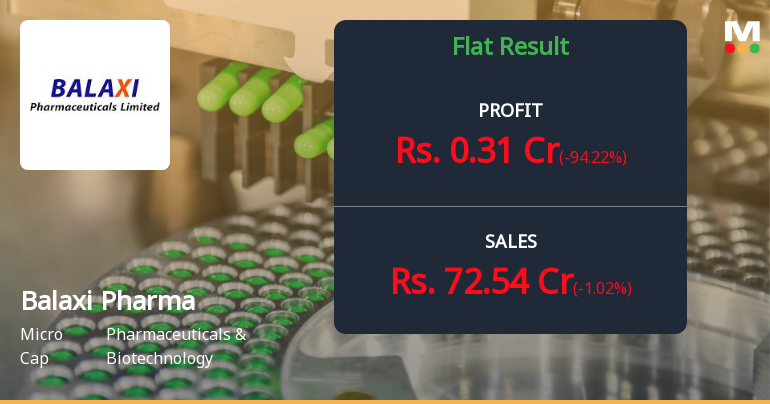

2026-01-28 19:17:21Balaxi Pharmaceuticals Ltd's latest financial results for Q3 FY26 present a complex picture of operational challenges and profitability issues. The company reported net sales of ₹72.54 crores, reflecting a slight decline of 1.02% year-on-year from ₹73.29 crores. This indicates a degree of revenue stability in a competitive environment; however, the net profit plummeted by 94.22% to just ₹0.31 crores, highlighting severe profitability erosion. The company's profitability metrics have also shown significant compression. The profit after tax (PAT) margin fell to 0.43%, down from 7.31% in the same quarter last year, while the operating margin decreased to 4.26% from 5.44%. These figures suggest that Balaxi Pharmaceuticals is facing substantial operational inefficiencies and cost pressures, despite a sequential recovery in revenue and net profit compared to the previous quarter. Notably, the extraordinary tax ...

Read full news article

Balaxi Pharmaceuticals Q3 FY26: Profitability Crisis Deepens Amid Margin Collapse

2026-01-28 18:17:24Balaxi Pharmaceuticals Ltd. reported a devastating 94.22% year-on-year decline in net profit for Q3 FY26, with earnings collapsing to just ₹0.31 crores from ₹5.36 crores in the same quarter last year. The micro-cap pharmaceutical company, with a market capitalisation of ₹137.00 crores, saw its profit margins evaporate to a mere 0.43%, down from 7.31% in Q3 FY25, as an extraordinary tax burden and operational inefficiencies ravaged the bottom line. The stock, trading at ₹25.14, has plunged 62.72% over the past year, underperforming the pharmaceutical sector by a staggering 86.83 percentage points.

Read full news article

Balaxi Pharmaceuticals Ltd is Rated Strong Sell

2026-01-05 10:13:31Balaxi Pharmaceuticals Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 12 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 05 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market trends.

Read full news article

Balaxi Pharmaceuticals Ltd is Rated Strong Sell

2025-12-25 12:58:03Balaxi Pharmaceuticals Ltd is rated 'Strong Sell' by MarketsMOJO, with this rating last updated on 12 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 December 2025, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news articleWhy is Balaxi Pharma falling/rising?

2025-12-13 01:11:39

Persistent Underperformance Against Benchmarks

Balaxi Pharma’s recent price movement reflects a sustained period of weakness. Over the past week, the stock has declined by 11.85%, a stark contrast to the Sensex’s marginal fall of 0.53% during the same period. The divergence becomes even more pronounced over longer time horizons. In the last month, Balaxi Pharma’s shares have dropped by 20.71%, while the Sensex gained 0.66%. Year-to-date, the stock has plummeted 58.43%, whereas the Sensex has risen by 10.16%. Over one, three, and five years, the stock’s performance remains deeply negative, with losses exceeding 60%, 70%, and 75% respectively, while the Sensex has delivered positive returns ranging from 6.10% to an impressive 92.74% over five years.

This stark underperfo...

Read full news article

Balaxi Pharma’s Evaluation Metrics Revised Amid Challenging Market Conditions

2025-12-04 11:08:33Balaxi Pharma has experienced a revision in its evaluation metrics, reflecting a more cautious market assessment. This shift is driven by changes across key analytical parameters including quality, valuation, financial trends, and technical outlook, signalling a complex environment for this pharmaceuticals and biotechnology microcap.

Read full news article