Revenue and Profit Trends

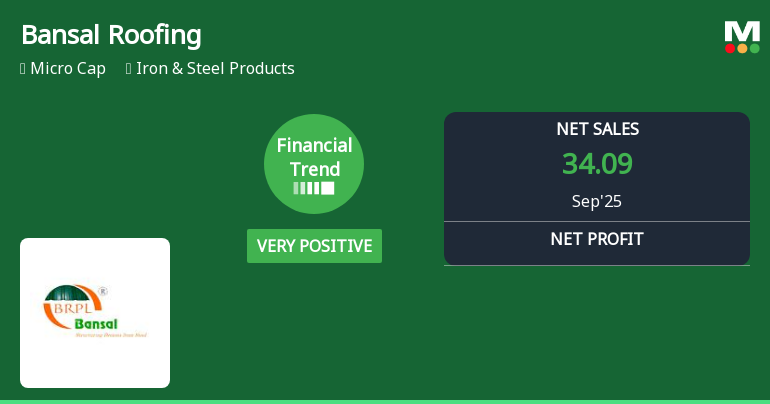

Examining the standalone annual results from March 2019 through March 2025, Bansal Roofing’s net sales have shown a significant upward trend. Starting from ₹44.13 crores in March 2019, sales dipped slightly in the following year but then surged to ₹96.63 crores by March 2025. The peak sales figure was recorded in March 2024 at ₹105.58 crores, indicating strong market demand and operational expansion during that period.

Operating profit (PBDIT) excluding other income also improved notably, rising from ₹3.08 crores in March 2019 to ₹9.19 crores in March 2025. This growth in operating profit was accompanied by an increase in operating profit margin from 6.98% to 9.51%, reflecting enhanced cost management and operational efficiency. Profit after t...

Read More