Recent Price Movement and Market Context

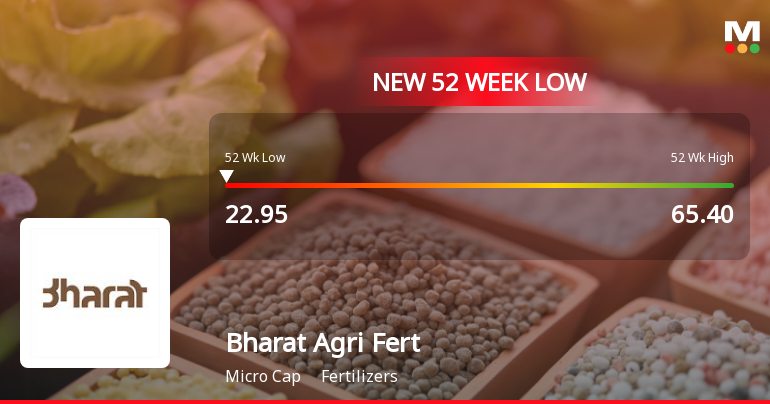

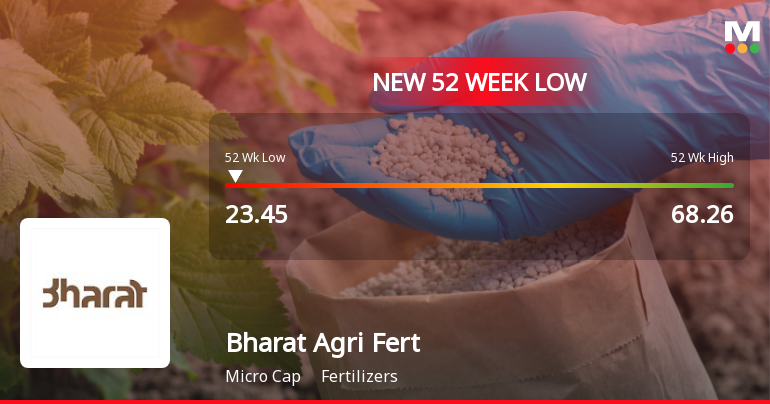

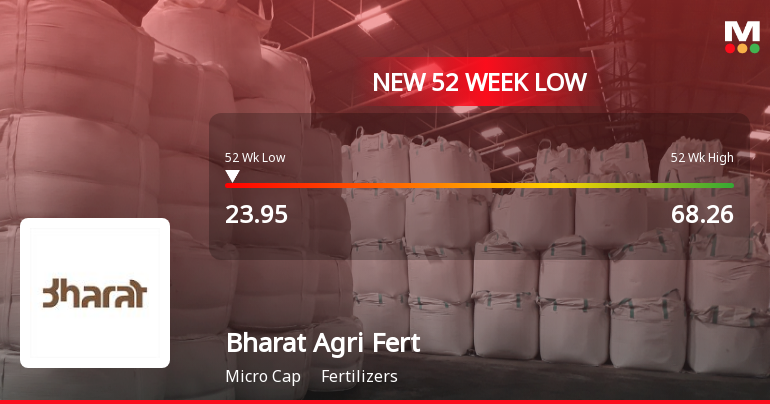

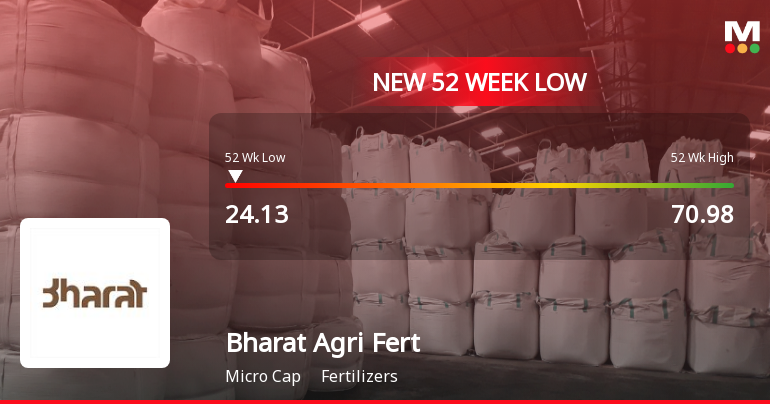

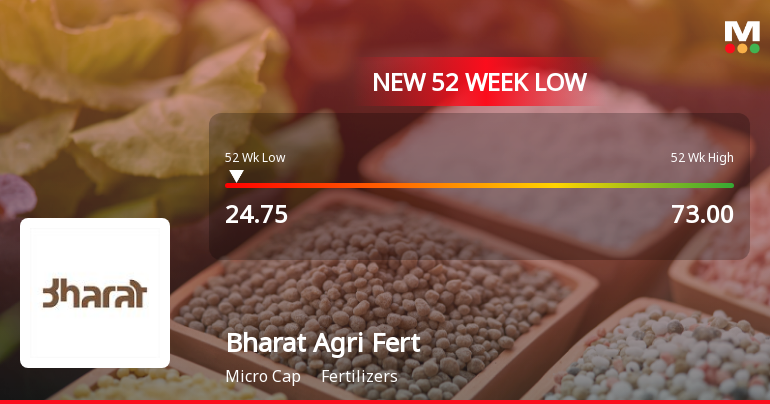

The stock hit a new 52-week low of ₹24.13 during intraday trading, marking a 6% drop from its previous levels. It underperformed its sector by 3.52% on the day, with the weighted average price indicating that a larger volume of shares traded closer to the day’s low. This suggests selling pressure dominated throughout the session. Furthermore, Bharat Agri Fert & Realty Ltd is trading below all major moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, signalling a bearish trend in both short and long-term technical indicators.

Investor participation has also waned considerably, with delivery volumes on 22 Jan falling by over 80% compared to the five-day average. This decline in active buying in...

Read full news article