Key Events This Week

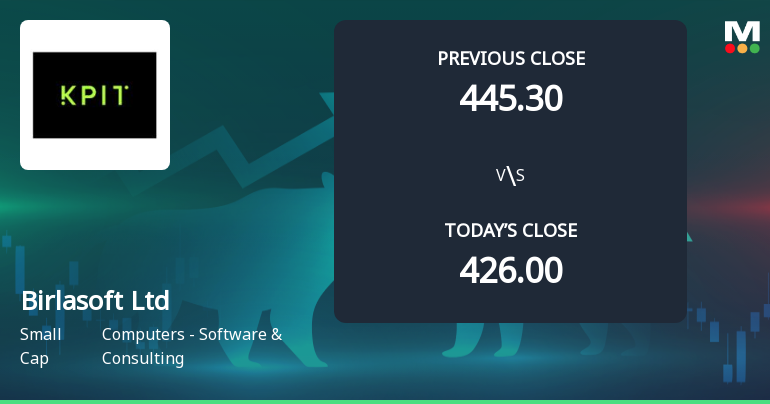

2 Feb: Stock opens at Rs.426.00, up 1.84% despite Sensex decline

3 Feb: Significant gap up with opening price surge and intraday high of Rs.451.15

5 Feb: Strong 4.63% gain aligned with technical momentum upgrade

6 Feb: Technical momentum shifts to bullish amid mixed market signals

Birlasoft Ltd Technical Momentum Shifts Signal Bullish Outlook Amid Market Volatility

2026-02-06 08:02:34Birlasoft Ltd has demonstrated a notable shift in technical momentum, upgrading its outlook from mildly bullish to bullish as of early February 2026. This change is underpinned by a confluence of positive signals from key technical indicators including MACD, moving averages, and on-balance volume, suggesting renewed investor confidence despite mixed signals from some monthly metrics. The stock’s recent price action and relative performance against the Sensex highlight a compelling narrative for investors analysing the Computers - Software & Consulting sector.

Read full news articleWhy is Birlasoft Ltd falling/rising?

2026-02-04 01:15:57

Recent Price Momentum and Market Outperformance

Birlasoft’s stock has demonstrated impressive momentum over the past week, delivering a 12.31% return compared to the Sensex’s modest 2.30% gain. This outperformance extends over the month and year-to-date periods as well, with the stock up 3.53% and 3.18% respectively, while the Sensex has declined by 2.36% and 1.74% over the same intervals. Such relative strength highlights investor confidence in Birlasoft amid broader market volatility.

On the day in question, the stock opened with a gap up of 5.9%, signalling strong buying interest from the outset. It also touched an intraday high of ₹451.15, maintaining gains throughout the session. This price action is supported by the stock trading above all major moving averages—5...

Read full news article

Birlasoft Ltd Opens Strong with Significant Gap Up Reflecting Positive Market Sentiment

2026-02-03 09:51:05Birlasoft Ltd commenced trading on 3 Feb 2026 with a significant gap up, opening 5.9% higher than its previous close, signalling robust positive sentiment in the Computers - Software & Consulting sector. This strong start was accompanied by sustained momentum throughout the day, with the stock outperforming both its sector and the broader market indices.

Read full news article

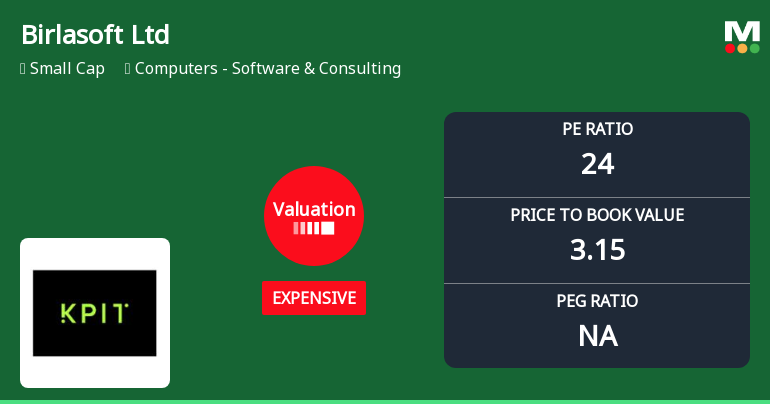

Birlasoft Ltd Valuation Shifts Signal Changing Market Perception

2026-02-01 08:05:00Birlasoft Ltd has experienced a notable shift in its valuation parameters, moving from a fair to an expensive rating, reflecting evolving market perceptions and sector trends. This article analyses the recent changes in key valuation metrics such as price-to-earnings (P/E) and price-to-book value (P/BV) ratios, comparing them with historical averages and peer benchmarks to assess the stock’s current price attractiveness.

Read full news article

Birlasoft Ltd is Rated Hold by MarketsMOJO

2026-01-31 10:10:20Birlasoft Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 19 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 31 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

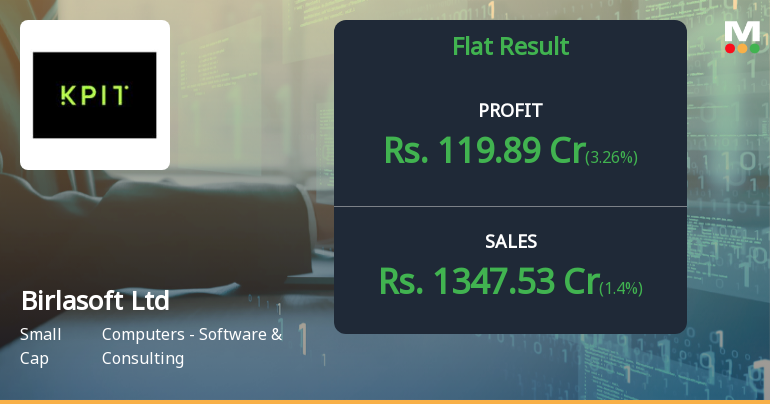

Read full news articleAre Birlasoft Ltd latest results good or bad?

2026-01-29 19:21:52Birlasoft Ltd's latest financial results for Q3 FY26 present a mixed picture, highlighting both operational challenges and some areas of improvement. The company reported a net profit of ₹116.10 crores, reflecting a sequential gain of 9.09% compared to the previous quarter, yet it shows an 8.95% decline year-on-year. Revenue for the quarter was ₹1,328.90 crores, marking a modest sequential increase of 3.42%, but a concerning year-on-year decrease of 2.87%. This marks the third consecutive quarter of year-on-year revenue contraction, indicating ongoing challenges in the demand environment, particularly in discretionary spending within the mid-tier IT services sector. On a more positive note, Birlasoft experienced significant margin expansion, with operating margins rising to 16.12%, a notable improvement from 12.36% in the prior quarter. This suggests enhanced operational efficiency and a better project mix...

Read full news article

Birlasoft Q3 FY26: Margin Recovery Masks Persistent Revenue Weakness

2026-01-28 19:17:05Birlasoft Limited, a mid-tier IT services provider with a market capitalisation of ₹11,325 crores, delivered a mixed performance in Q3 FY26, with net profit rising 9.09% quarter-on-quarter to ₹116.10 crores but declining 8.95% year-on-year. The stock has struggled significantly over the past year, down 22.78% compared to the Sensex's 8.49% gain, reflecting investor concerns about the company's ability to sustain growth in a challenging demand environment.

Read full news article