Is Block, Inc. overvalued or undervalued?

2025-12-01 11:06:00As of 28 November 2025, the valuation grade for Block, Inc. has moved from very attractive to attractive, indicating a shift in its perceived value. The company appears to be overvalued based on its current metrics, particularly with a P/E ratio of 12, which is lower than the industry average of 13.98, and an EV to EBITDA of 15.84 compared to peers like Cognizant Technology Solutions Corp. at 9.06. Additionally, the PEG ratio stands at a notably low 0.10, suggesting that growth expectations may not justify the current valuation. In terms of peer comparison, Block, Inc. has a P/E ratio of 12.43, which is lower than that of Cognizant Technology Solutions Corp. at 13.98 and significantly lower than Broadridge Financial Solutions, Inc. at 46.07. The recent stock performance shows that while Block, Inc. outperformed the S&P 500 in the past week with a return of 7.83% compared to 3.73%, it has significantly unde...

Read full news articleIs Block, Inc. overvalued or undervalued?

2025-11-30 11:06:20As of 28 November 2025, the valuation grade for Block, Inc. has moved from very attractive to attractive. The company appears to be overvalued based on its current metrics. Key ratios include a P/E ratio of 12, an EV to EBITDA of 15.84, and a PEG ratio of 0.10, which suggests that while the company may have growth potential, its current valuation does not adequately reflect that potential compared to its peers. In comparison to its peers, Block, Inc. has a lower P/E ratio than Cognizant Technology Solutions Corp., which stands at 13.98, and significantly lower than Broadridge Financial Solutions, Inc. at 46.07. Furthermore, Block's EV to EBITDA is higher than that of Cognizant, which is 9.06, indicating that it may be overvalued relative to its earnings potential. Notably, Block, Inc. has underperformed against the S&P 500 over the past year, with a return of -24.76% compared to the S&P 500's 14.18%, reinf...

Read full news articleIs Block, Inc. overvalued or undervalued?

2025-11-11 11:34:02As of 7 November 2025, the valuation grade for Block, Inc. has moved from attractive to very attractive, indicating a strong improvement in its valuation outlook. The company is currently considered undervalued, supported by a P/E ratio of 12, a PEG ratio of 0.10, and an EV to EBITDA ratio of 15.84, all of which suggest that the stock is trading at a discount relative to its earnings growth potential. In comparison to its peers, Block, Inc. has a lower P/E ratio than Cognizant Technology Solutions Corp. at 13.98 and significantly lower than Broadridge Financial Solutions, Inc. at 46.07, highlighting its relative attractiveness. Additionally, its PEG ratio of 0.10 is notably lower than the industry average, reinforcing the undervaluation narrative. However, the stock has underperformed against the S&P 500, with a year-to-date return of -21.40% compared to the index's 14.40%, suggesting that while the stock ...

Read full news article

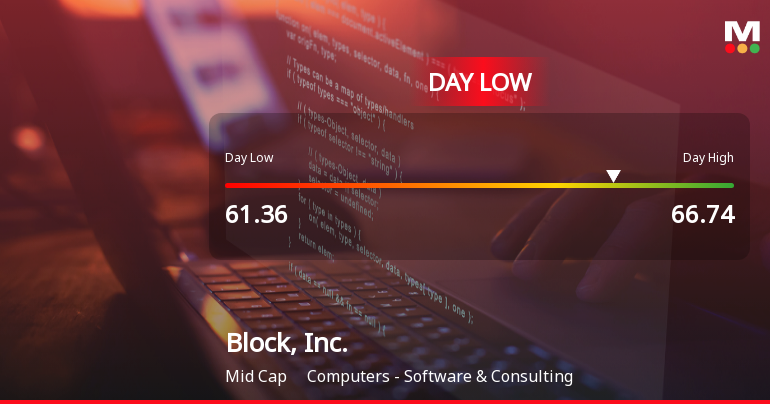

Block, Inc. Hits Day Low of $61.36 Amid Price Pressure

2025-11-10 17:51:36Block, Inc. faced a notable decline in its stock price, reaching an intraday low amid a challenging trading session. Despite recent short-term losses, the company has shown strong long-term growth in net sales and operating profit, with increasing promoter confidence and a solid return on equity.

Read full news article

Block, Inc. Experiences Valuation Adjustment Amidst Competitive Market Landscape

2025-11-10 15:58:53Block, Inc. has recently adjusted its valuation metrics, reporting a P/E ratio of 12 and a price-to-book value of 1.86. The company demonstrates strong financial indicators, including a low PEG ratio of 0.10 and favorable return metrics compared to its peers, despite recent stock performance challenges.

Read full news article

Block, Inc. Experiences Revision in Stock Evaluation Amid Market Volatility

2025-11-10 15:25:17Block, Inc. has experienced notable stock fluctuations, with a recent closing price of 65.45. The company faces mixed technical indicators, reflecting ongoing volatility. Performance metrics show a significant underperformance compared to the S&P 500, with year-to-date returns highlighting challenges in a competitive market landscape.

Read full news articleIs Block, Inc. overvalued or undervalued?

2025-11-09 11:09:11As of 7 November 2025, the valuation grade for Block, Inc. has moved from attractive to very attractive, indicating a positive shift in its valuation outlook. The company is currently considered undervalued, supported by a P/E ratio of 12, a PEG ratio of 0.10, and an EV to EBITDA ratio of 15.84, all of which suggest that the stock is trading at a lower valuation compared to its peers. In comparison, Cognizant Technology Solutions Corp. has a P/E of 13.98, while Broadridge Financial Solutions, Inc. has a significantly higher P/E of 46.07, reinforcing Block's relative attractiveness. Despite the favorable valuation metrics, Block, Inc. has underperformed against the S&P 500 in recent periods, with a year-to-date return of -22.99% compared to the S&P 500's 14.40%. This stark contrast highlights the potential for recovery in Block's stock price, given its attractive valuation ratios....

Read full news article