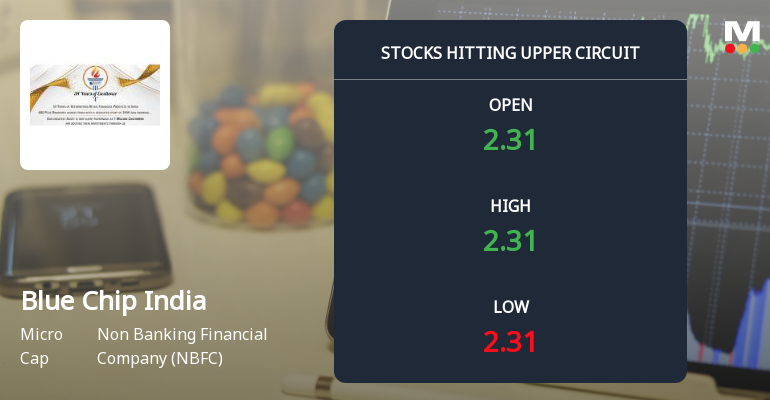

Blue Chip India Ltd Hits Upper Circuit Amid Strong Buying Pressure

2026-02-06 10:00:25Blue Chip India Ltd, a micro-cap player in the Non Banking Financial Company (NBFC) sector, surged to hit its upper circuit price limit on 6 Feb 2026, reflecting robust investor demand and intense buying momentum despite broader market headwinds.

Read full news articleWhen is the next results date for Blue Chip India Ltd?

2026-02-05 23:18:03The next results date for Blue Chip India Ltd is scheduled for 12 February 2026....

Read full news article

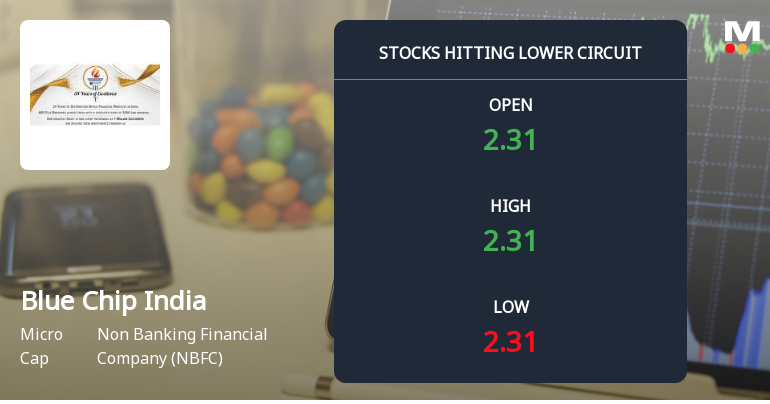

Blue Chip India Ltd Hits Lower Circuit Amid Heavy Selling Pressure

2026-02-05 10:00:17Blue Chip India Ltd, a micro-cap player in the Non Banking Financial Company (NBFC) sector, witnessed intense selling pressure on 5 Feb 2026, hitting its lower circuit price limit and marking a fresh 52-week low at ₹2.19. The stock’s persistent decline, coupled with unfilled supply and panic selling, underscores growing investor concerns amid deteriorating fundamentals and weak market sentiment.

Read full news article

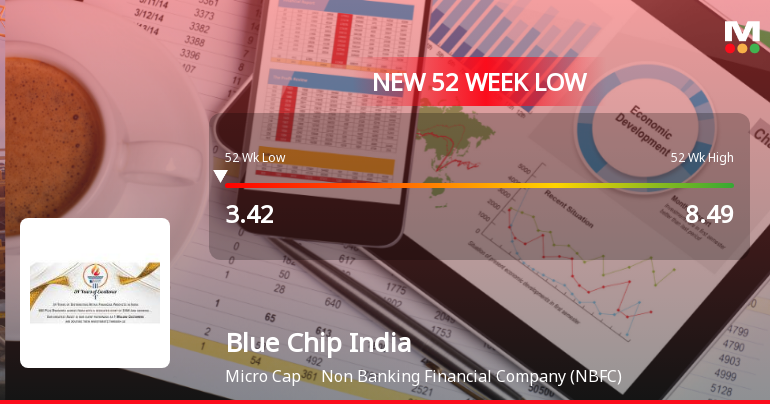

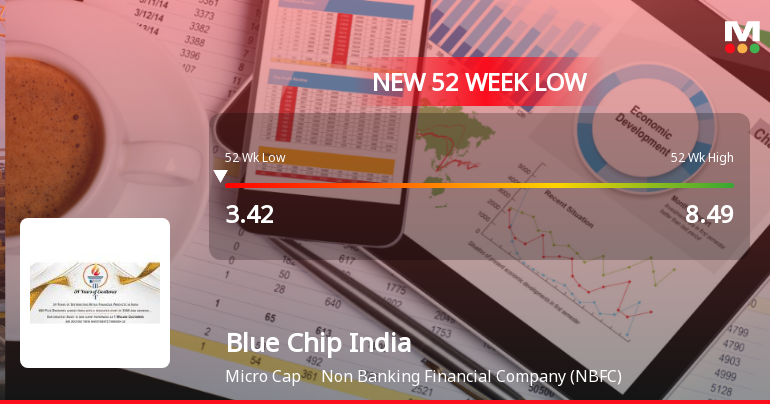

Blue Chip India Ltd Falls to 52-Week Low Amidst Weak Financial Metrics

2026-02-05 09:44:07Blue Chip India Ltd, a Non Banking Financial Company (NBFC), has declined to its 52-week low, reflecting a challenging year marked by subdued financial performance and market underperformance. The stock’s latest low price underscores ongoing concerns about the company’s fundamentals and valuation metrics.

Read full news article

Blue Chip India Ltd Hits Lower Circuit Amid Heavy Selling Pressure

2026-02-04 10:00:21Blue Chip India Ltd, a micro-cap player in the Non Banking Financial Company (NBFC) sector, witnessed intense selling pressure on 4 February 2026, hitting its lower circuit price limit of ₹2.23. The stock’s maximum daily loss of 1.76% starkly contrasts with the broader sector’s modest gain, signalling panic selling and unfilled supply weighing heavily on investor sentiment.

Read full news article

Blue Chip India Ltd Falls to 52-Week Low Amidst Weak Financial Metrics

2026-02-03 10:41:41Blue Chip India Ltd, a Non Banking Financial Company (NBFC), has declined to its 52-week low, reflecting ongoing financial pressures and subdued market performance. The stock’s latest low price marks a significant downturn amid broader market movements.

Read full news article

Blue Chip India Ltd Falls to 52-Week Low Amidst Weak Financial Metrics

2026-02-03 10:39:50Blue Chip India Ltd, a Non Banking Financial Company (NBFC), has reached a new 52-week low, reflecting ongoing pressures on its stock price. The share closed at its lowest level in a year, continuing a significant downward trajectory amid broader market fluctuations.

Read full news article

Blue Chip India Ltd Hits Lower Circuit Amid Heavy Selling Pressure

2026-02-03 10:00:29Blue Chip India Ltd, a micro-cap player in the Non Banking Financial Company (NBFC) sector, plunged to its lower circuit price limit on 3 February 2026, reflecting intense selling pressure and a sustained downtrend. The stock closed at ₹2.27, marking a fresh 52-week low and extending its losing streak to 21 consecutive sessions with a cumulative decline exceeding 32%.

Read full news article

Blue Chip India Ltd Hits Lower Circuit Amid Heavy Selling Pressure

2026-02-02 10:00:15Blue Chip India Ltd, a micro-cap player in the Non Banking Financial Company (NBFC) sector, witnessed intense selling pressure on 2 Feb 2026, hitting its lower circuit price limit of ₹2.31. The stock recorded its new 52-week low as panic selling gripped investors, resulting in a maximum daily loss of 1.7%, significantly underperforming its sector and broader market benchmarks.

Read full news articleBoard Meeting Intimation for Notice Of Board Meeting

04-Feb-2026 | Source : BSEBlue Chip India Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 12/02/2026 inter alia to consider and approve We hereby inform that pursuant to Regulation 29 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 the meeting of Board of Directors of the Company will be held on Thursday the 12th day of February 2026 at 3.00 P.M. inter-alia to consider approve and take on record the Unaudited Financial Results of the company for the quarter ended 31st December 2025 pursuant to Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015. Further in accordance with the Code of Conduct for Prohibition of Insider Trading. The trading window had been closed with effect from 1st January 2026 and will remain closed till 48 hours after the conclusion of Board Meeting.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

29-Jan-2026 | Source : BSEEnclosed Certificate under Reg 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31.12.2025

01ST EXTRA- ORDINARY GENERAL MEETING (EGM) FOR THE FINANCIAL YEAR 2025-2026

14-Jan-2026 | Source : BSE01st Extra-Ordinary General Meeting for the Financial Year 2025-2026

Corporate Actions

12 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available