Blue Cloud Softech Solutions Ltd is Rated Sell

2026-02-03 10:12:09Blue Cloud Softech Solutions Ltd is rated Sell by MarketsMOJO, with this rating last updated on 17 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 03 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

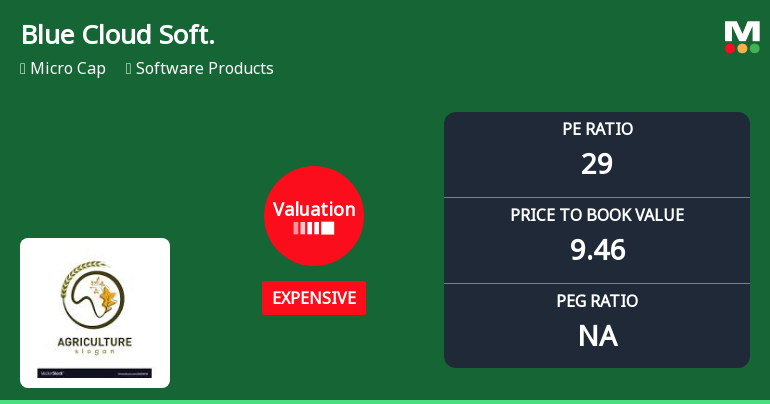

Blue Cloud Softech Solutions Ltd: Valuation Shift Signals Caution for Investors

2026-02-02 08:03:21Blue Cloud Softech Solutions Ltd has seen a notable shift in its valuation parameters, moving from fair to expensive territory. This change, reflected in its price-to-earnings (P/E) and price-to-book value (P/BV) ratios, raises questions about the stock’s price attractiveness amid a challenging market backdrop and peer comparisons.

Read full news article

Blue Cloud Softech Solutions Ltd is Rated Sell

2026-01-23 10:10:54Blue Cloud Softech Solutions Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 17 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 23 January 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

Blue Cloud Softech Solutions Ltd is Rated Sell

2026-01-12 10:10:38Blue Cloud Softech Solutions Ltd is rated 'Sell' by MarketsMOJO. This rating was last updated on 17 Nov 2025, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed below are current as of 12 January 2026, providing investors with the latest perspective on the company’s position.

Read full news article

Blue Cloud Softech Solutions Ltd is Rated Sell

2026-01-01 10:10:03Blue Cloud Softech Solutions Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 17 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 01 January 2026, providing investors with the most up-to-date perspective on the company’s performance and outlook.

Read full news article

Blue Cloud Softech Solutions Faces Bearish Momentum Amid Technical Shifts

2025-12-29 08:05:04Blue Cloud Softech Solutions, a player in the Software Products sector, is currently navigating a challenging technical landscape as recent evaluation adjustments indicate a shift towards bearish momentum. The stock’s price action and key technical indicators reveal a complex interplay of signals that investors and market watchers should carefully analyse.

Read full news article

Blue Cloud Softech Solutions: Technical Momentum Shift Signals Mixed Outlook

2025-12-26 08:09:29Blue Cloud Softech Solutions has exhibited a notable shift in its technical momentum, reflecting a nuanced market assessment amid fluctuating price dynamics. Recent evaluation adjustments highlight a transition from a predominantly bearish stance to a more mildly bearish technical trend, underscoring a complex interplay of momentum indicators and moving averages that investors should carefully consider.

Read full news article

Blue Cloud Soft. Sees Revision in Market Evaluation Amidst Challenging Returns

2025-12-21 10:10:24Blue Cloud Soft., a microcap player in the Software Products sector, has experienced a revision in its market evaluation reflecting shifts in its fundamental and technical outlook. This adjustment comes amid a backdrop of significant underperformance relative to broader market indices over the past year.

Read full news article

Blue Cloud Softech Solutions Faces Technical Momentum Shift Amid Market Challenges

2025-12-08 08:06:02Blue Cloud Softech Solutions, a player in the software products sector, has experienced a notable shift in its technical momentum, reflecting evolving market dynamics and investor sentiment. Recent technical indicators reveal a complex picture of price movement and momentum, underscoring the challenges faced by the company amid broader market trends.

Read full news articleAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

30-Jan-2026 | Source : BSEBlue Cloud Softech solutions Ltd (BCS SL) Announces Successful Deplloyment of Access Genie AIoT Video Analytics Platform at Rajiv Aarogyasri Health Care Trust (RAHCT) Dialysis Centre in Hyderabad.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

13-Jan-2026 | Source : BSECompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

Closure of Trading Window

31-Dec-2025 | Source : BSEIntimation of Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Blue Cloud Softech Solutions Ltd has declared 1% dividend, ex-date: 11 Oct 24

Blue Cloud Softech Solutions Ltd has announced 1:2 stock split, ex-date: 20 Jan 25

No Bonus history available

No Rights history available