Recent Price Movement and Market Context

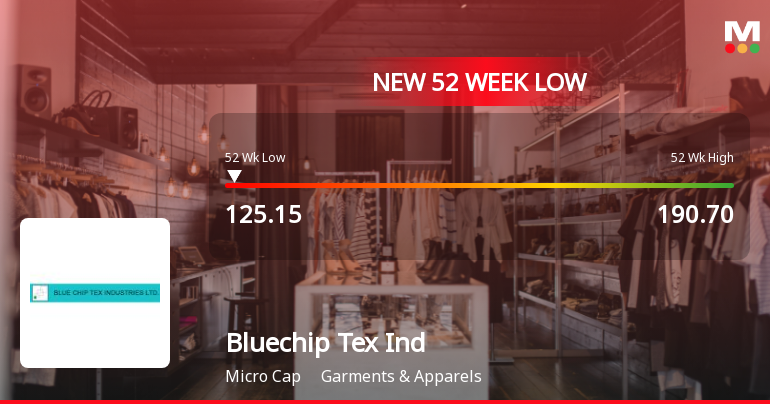

Bluechip Tex Industries Ltd’s share price fell by Rs 10.1 on 24 December, marking a significant intraday decline. The stock touched an intraday low of Rs 125.1, representing an 8.69% drop from previous levels. This sharp fall occurred despite the broader market, represented by the Sensex, maintaining positive momentum with a 1.00% gain over the past week. The stock’s performance today notably underperformed its sector by 6.8%, indicating sector-specific pressures or company-related concerns weighing on investor sentiment.

The stock traded within a wide range of Rs 12.55 during the day, signalling heightened volatility. Moreover, the weighted average price was closer to the day’s low, suggesting that a larger volume of shares exc...

Read full news article