Is Bright Horizons Family Solutions, Inc. technically bullish or bearish?

2025-11-05 11:20:00As of 31 October 2025, the technical trend for Bright Horizons Family Solutions, Inc. has changed from bearish to mildly bearish. The current stance is mildly bearish, with key indicators such as the MACD showing bearish signals on the weekly and mildly bearish on the monthly. The Bollinger Bands and moving averages are also bearish on the weekly and daily time frames. The KST is bearish weekly and mildly bearish monthly, while the Dow Theory indicates no trend in both weekly and monthly assessments. In terms of performance, the stock has underperformed against the S&P 500 across multiple periods, with a year-to-date return of -7.43% compared to the S&P 500's 16.30%, and a one-year return of -23.16% versus 19.89% for the index....

Read full news articleIs Bright Horizons Family Solutions, Inc. overvalued or undervalued?

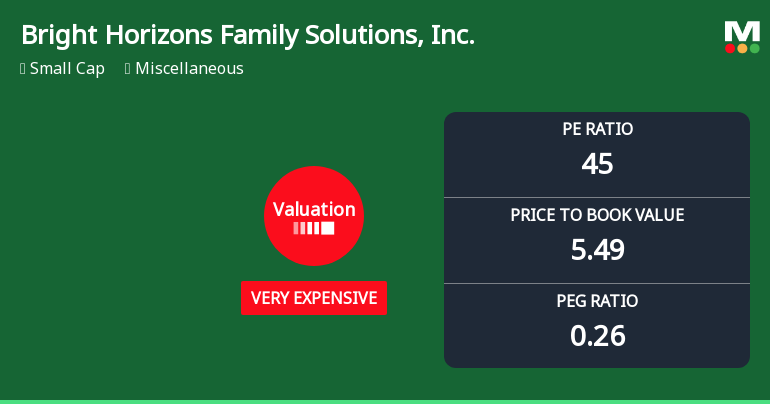

2025-11-05 11:09:56As of 31 October 2025, the valuation grade for Bright Horizons Family Solutions, Inc. moved from expensive to very expensive. The company appears to be overvalued based on its current metrics. Key ratios include a P/E ratio of 45, a Price to Book Value of 5.49, and an EV to EBITDA of 21.97, all of which are significantly higher than its peers. For instance, Booz Allen Hamilton Holding Corp. has a P/E of 15.81 and an EV to EBITDA of 12.90, indicating a more favorable valuation. In terms of recent performance, Bright Horizons has underperformed compared to the S&P 500, with a year-to-date return of -7.43% versus the S&P 500's 16.30%. This trend continues over longer periods, with a one-year return of -23.16% compared to the S&P 500's 19.89%. Overall, the high valuation ratios and poor stock performance suggest that Bright Horizons Family Solutions, Inc. is overvalued in the current market environment....

Read full news articleIs Bright Horizons Family Solutions, Inc. technically bullish or bearish?

2025-11-04 11:31:27As of 31 October 2025, the technical trend for Bright Horizons Family Solutions, Inc. has changed from bearish to mildly bearish. The weekly MACD is bearish, while the monthly MACD is mildly bearish, indicating a lack of strong upward momentum. The Bollinger Bands and KST also reflect a mildly bearish stance on both weekly and monthly time frames. Moving averages are mildly bearish on a daily basis, and the On-Balance Volume shows a similar mildly bearish trend. The Dow Theory indicates no trend on a weekly basis but is mildly bearish monthly. Overall, the indicators suggest a mildly bearish technical stance, with no multi-period return data available for comparison to the S&P 500....

Read full news articleIs Bright Horizons Family Solutions, Inc. overvalued or undervalued?

2025-11-04 11:15:55As of 31 October 2025, the valuation grade for Bright Horizons Family Solutions, Inc. moved from expensive to very expensive. The company is overvalued based on its current financial metrics. The P/E ratio stands at 45, significantly higher than the peer average of 36.94 for companies like Medpace Holdings, Inc. and Booz Allen Hamilton Holding Corp., which have P/E ratios of 33.13 and 15.81, respectively. Additionally, the EV to EBITDA ratio of 21.97 also exceeds the peer average of 19.44, indicating a premium valuation compared to its competitors. In terms of performance, Bright Horizons has underperformed relative to the S&P 500 over multiple periods, with a year-to-date return of -6.51% compared to the S&P 500's 16.30%. This trend continues with a one-year return of -22.40% against the S&P 500's 19.89%, further supporting the conclusion that the stock is overvalued given its lack of performance relative...

Read full news article

Bright Horizons Stock Soars 18.37% to Day High of $109.80

2025-11-03 17:41:50Bright Horizons Family Solutions, Inc. saw a notable increase in stock performance on October 31, 2025, reaching an intraday high. The company has reported positive results over the last five quarters, with significant growth in operating cash flow and net profit, while facing longer-term challenges.

Read full news article

Bright Horizons Family Solutions, Inc. Experiences Revision in Stock Evaluation Amid Market Dynamics

2025-11-03 15:30:56Bright Horizons Family Solutions, Inc. has adjusted its valuation, showcasing a P/E ratio of 45 and a price-to-book value of 5.49. The company has outperformed the S&P 500 recently but has underperformed year-to-date and over the past year, indicating a mixed performance relative to its peers.

Read full news articleIs Bright Horizons Family Solutions, Inc. technically bullish or bearish?

2025-11-03 11:30:35As of 31 October 2025, the technical trend for Bright Horizons Family Solutions, Inc. has changed from bearish to mildly bearish. The current stance is mildly bearish, supported by a bearish MACD on the weekly timeframe and a mildly bearish signal on the monthly timeframe. The Bollinger Bands and KST also indicate a mildly bearish trend across both weekly and monthly periods. The moving averages on the daily timeframe further confirm this mildly bearish outlook. In terms of performance, the stock has returned 8.27% over the past week, significantly outperforming the S&P 500's 0.71%, but it has underperformed over longer periods, with a year-to-date return of -1.46% compared to the S&P 500's 16.30% and a one-year return of -18.16% versus 19.89% for the index....

Read full news articleIs Bright Horizons Family Solutions, Inc. technically bullish or bearish?

2025-11-02 11:16:27As of 31 October 2025, the technical trend for Bright Horizons Family Solutions, Inc. has changed from bearish to mildly bearish. The weekly MACD is bearish, while the monthly MACD is mildly bearish. The moving averages indicate a mildly bearish stance on the daily timeframe. Additionally, both the Bollinger Bands and KST are mildly bearish on a monthly basis. The overall Dow Theory shows a mildly bearish trend for the monthly period. In terms of performance, the stock has underperformed against the S&P 500 over the year, with a return of -18.16% compared to the S&P 500's 19.89%. However, it has shown a strong return of 67.22% over the last three years, although it lags behind the S&P 500's 76.66% return in the same period. Overall, the current technical stance is mildly bearish....

Read full news articleIs Bright Horizons Family Solutions, Inc. overvalued or undervalued?

2025-11-02 11:08:32As of 31 October 2025, the valuation grade for Bright Horizons Family Solutions, Inc. has moved from expensive to very expensive, indicating a significant increase in perceived overvaluation. The company is currently considered overvalued based on its high P/E ratio of 45, a price-to-book value of 5.49, and an EV to EBITDA ratio of 21.97, all of which are substantially above industry norms. In comparison to peers, Booz Allen Hamilton Holding Corp. has a P/E of 15.81 and an EV to EBITDA of 12.90, while Genpact Ltd. shows a P/E of 14.38 and an EV to EBITDA of 10.34, highlighting the relative overvaluation of Bright Horizons. Furthermore, the company's stock has underperformed against the S&P 500 over the last year, with a return of -18.16% compared to the index's 19.89%, reinforcing the notion of its overvaluation....

Read full news article