Key Events This Week

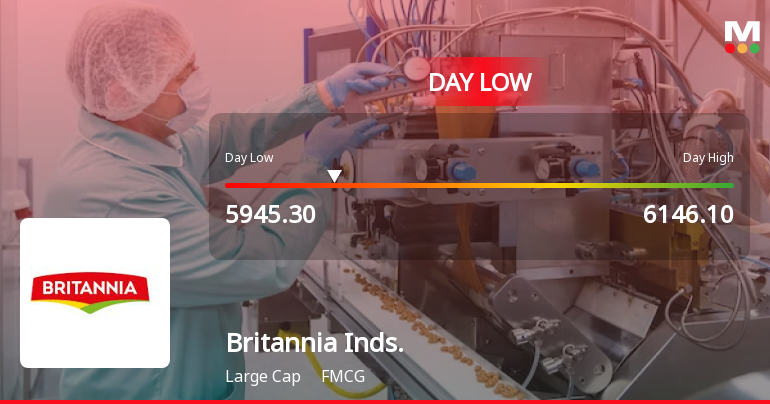

5 Jan: Stock opens at Rs.6,038.95, gains 0.81% despite Sensex decline

6 Jan: Continued rally with 1.45% gain, Sensex falls further

7 Jan: Moderate 0.94% rise, Sensex marginally up

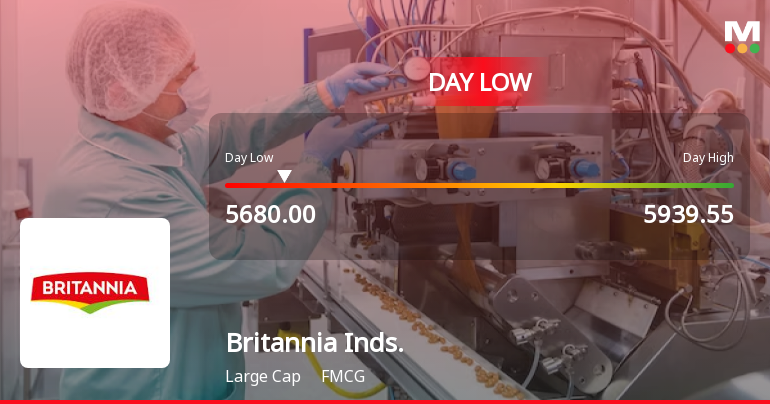

8 Jan: Intraday low hit amid price pressure, stock falls 2.45%

9 Jan: Week closes at Rs.5,977.65, down 0.91% on final session