Recent Price Movement and Market Context

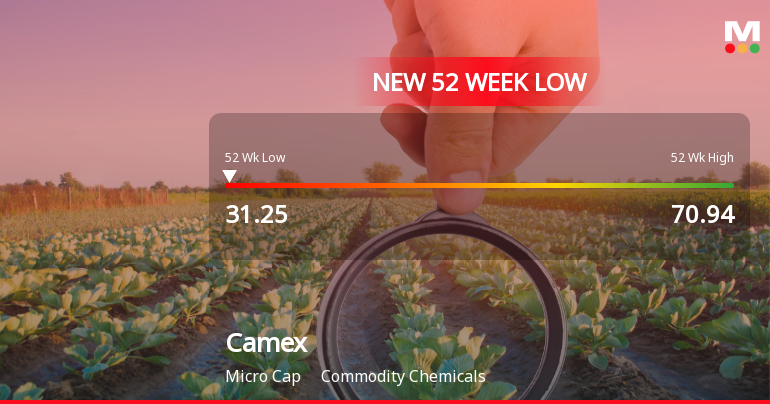

Camex Ltd’s price increase on 24 Dec is significant given the broader market environment. The stock opened with a gap up of 3.99%, signalling strong buying interest from the outset of trading. It also touched an intraday high of ₹33.90, maintaining the positive momentum throughout the session. This performance outpaced the sector by 2.22%, highlighting Camex’s relative strength amid its peers.

Despite this short-term rally, it is important to contextualise the stock’s longer-term performance. Year-to-date, Camex Ltd has declined by 44.54%, a stark contrast to the Sensex’s 9.30% gain over the same period. Similarly, over the past year, the stock has fallen 42.55%, while the benchmark index rose by 8.84%. These figures indicate th...

Read full news article