Key Events This Week

Jan 27: Stock edged up 0.08% to Rs.254.95 as Sensex gained 0.50%

Jan 28: Capital Small Finance Bank advanced 0.67% to Rs.256.65 alongside a 1.12% Sensex rally

Jan 29: Quarterly results revealed flat performance; stock declined 0.92% to Rs.254.30 despite Sensex rising 0.22%

Jan 30: Stock rebounded 1.04% to Rs.256.95 amid margin pressure concerns; Sensex slipped 0.22%

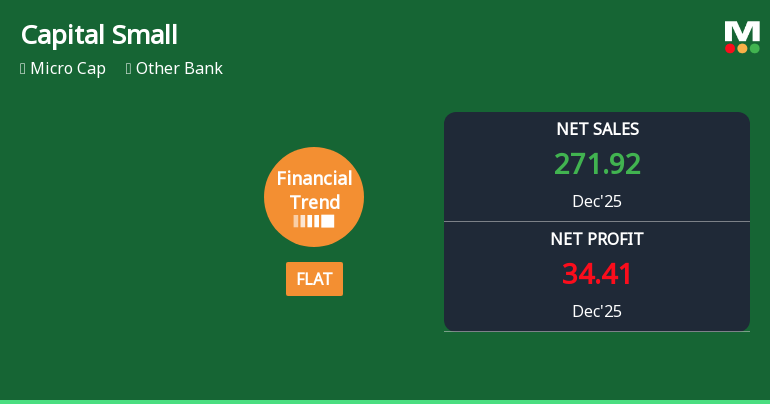

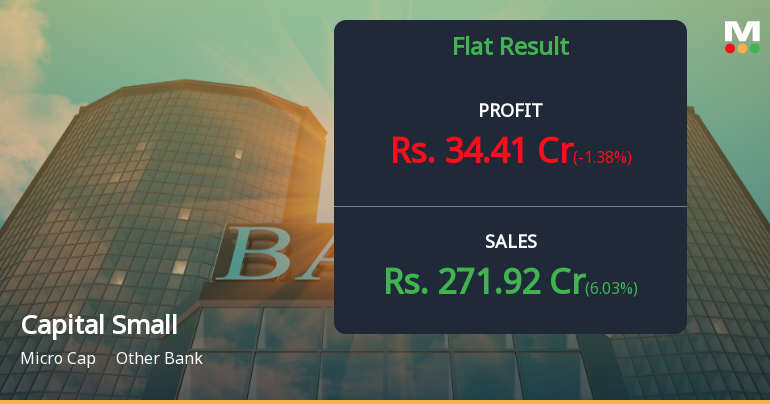

Capital Small Finance Bank Ltd Reports Flat Quarterly Performance Amid Margin Pressures

2026-01-30 08:00:35Capital Small Finance Bank Ltd has reported a flat financial performance for the quarter ended December 2025, marking a significant slowdown from its previously positive growth trajectory. Despite record highs in net interest income and interest earned, the bank’s profitability has been constrained by a sharp contraction in operating profit before tax and a heavy reliance on non-operating income, prompting a downgrade in its Mojo Grade from Hold to Sell.

Read full news articleAre Capital Small Finance Bank Ltd latest results good or bad?

2026-01-29 19:25:48Capital Small Finance Bank Ltd's latest financial results for Q2 FY26 reflect a mixed operational performance. The bank reported a net profit of ₹34.89 crores, which shows a recovery from the previous quarter's dip, although year-on-year growth was modest at 4.65%. The total income for the quarter reached ₹279.60 crores, marking a sequential growth of 3.57% and a year-on-year increase of 12.16%, primarily driven by interest earned on advances. Net interest income was reported at ₹111.64 crores, with a year-on-year growth of 10.62%, indicating some resilience in core lending operations. However, the bank's reliance on non-operating income, which constituted approximately 57.68% of profit before tax, raises concerns about the sustainability of its earnings. The asset quality metrics indicate stability, with a gross non-performing asset (NPA) ratio of 2.74%, which is slightly elevated compared to previous p...

Read full news article

Capital Small Finance Bank Q2 FY26: Modest Growth Amid Profitability Concerns

2026-01-29 16:05:55Capital Small Finance Bank Ltd. reported modest quarterly performance for Q2 FY26, with net profit reaching ₹34.89 crores, marking a sequential growth of 9.00% quarter-on-quarter but a muted 4.65% year-on-year increase. The Punjab-based micro-cap lender, with a market capitalisation of ₹1,163 crores, continues to demonstrate resilience in core banking operations, though concerns persist around elevated non-operating income contribution and a challenging valuation environment. The stock has declined 14.07% over the past year, significantly underperforming both the Sensex and its sector peers, trading at ₹256.55 as of January 29, 2026.

Read full news article

Capital Small Finance Bank Ltd is Rated Sell

2026-01-24 10:10:39Capital Small Finance Bank Ltd is rated 'Sell' by MarketsMOJO. This rating was last updated on 12 January 2026, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed here are current as of 24 January 2026, providing investors with the latest view of the company’s position in the market.

Read full news article