Key Events This Week

19 Jan: Stock opens at ₹2,252.25, down 2.12% amid weak market sentiment

20 Jan: Downgrade to Sell rating announced; technical momentum shifts sideways

21 Jan: Death Cross formation signals potential bearish trend

22 Jan: Technical momentum shifts from mildly bullish to mildly bearish

23 Jan: Week closes at ₹2,187.75, down 2.49% on the day

Centum Electronics Ltd Faces Technical Momentum Shift Amid Mixed Market Signals

2026-01-22 08:00:23Centum Electronics Ltd, a key player in the industrial manufacturing sector, has experienced a notable shift in its technical momentum, moving from a mildly bullish to a mildly bearish stance. This transition is underscored by a complex interplay of technical indicators including MACD, RSI, moving averages, and volume-based metrics, signalling a cautious outlook for investors amid recent price declines and mixed market signals.

Read full news article

Centum Electronics Ltd Sees Mixed Technical Signals Amid Mild Bullish Momentum

2026-01-21 08:00:50Centum Electronics Ltd, a key player in the industrial manufacturing sector, has experienced a subtle shift in its technical momentum, moving from a sideways trend to a mildly bullish stance. Despite this, the stock faces a complex technical landscape with conflicting signals from major indicators such as MACD, RSI, and moving averages, reflecting cautious investor sentiment amid recent price fluctuations.

Read full news article

Centum Electronics Downgraded to Sell Amidst Weak Financials and Technical Setbacks

2026-01-20 08:13:04Centum Electronics Ltd has seen its investment rating downgraded from Hold to Sell, reflecting a combination of deteriorating technical indicators, subdued financial trends, and valuation concerns. Despite a strong long-term return track record, recent quarterly results and technical signals have prompted a reassessment of the stock’s outlook.

Read full news article

Centum Electronics Ltd Faces Technical Momentum Shift Amid Mixed Indicator Signals

2026-01-20 08:01:16Centum Electronics Ltd, a key player in the industrial manufacturing sector, has experienced a notable shift in its technical momentum, reflected by a downgrade in its Mojo Grade from Hold to Sell as of 19 Jan 2026. The stock’s recent price action and technical indicators suggest a transition from a mildly bullish trend to a sideways or cautious stance, signalling increased uncertainty for investors amid mixed signals from momentum oscillators and moving averages.

Read full news article

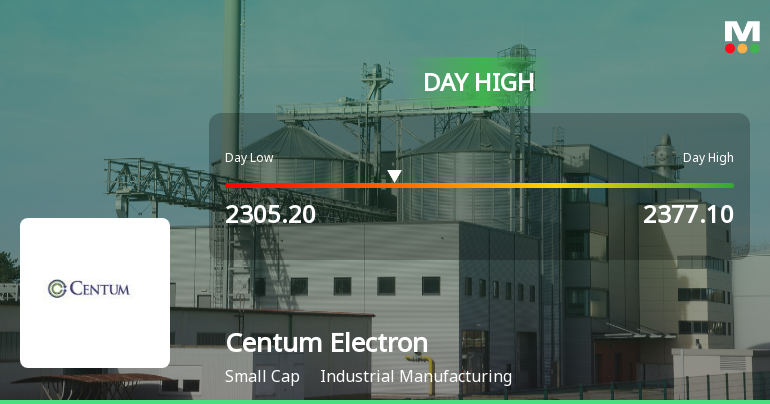

Centum Electronics Ltd Hits Intraday High with 16.52% Surge on 12 Jan 2026

2026-01-12 13:43:33Centum Electronics Ltd demonstrated a strong intraday performance on 12 Jan 2026, surging to an intraday high of Rs 2,486.3, marking a significant 16.52% increase. This surge outpaced the broader industrial manufacturing sector and the Sensex, reflecting notable trading momentum and volatility.

Read full news article

Centum Electronics Ltd Sees Mixed Technical Signals Amid Mildly Bullish Momentum Shift

2026-01-05 08:01:27Centum Electronics Ltd, a key player in the industrial manufacturing sector, has experienced a nuanced shift in its technical momentum, moving from a sideways trend to a mildly bullish stance. Despite this, several technical indicators present a mixed picture, reflecting both cautious optimism and underlying bearish pressures as the stock navigates current market conditions.

Read full news articleCentum Electronics Falls 7.63%: Downgrade and Technical Shift Mark a Challenging Week

2026-01-04 15:27:00

Key Events This Week

29 Dec 2025: Stock opens at Rs.2,344.65, down 4.38%

30 Dec 2025: Continued decline to Rs.2,337.40 (-0.31%)

31 Dec 2025: Slight recovery to Rs.2,343.00 (+0.24%)

1 Jan 2026: Sharp drop of 2.75% to Rs.2,278.55

2 Jan 2026: Close at Rs.2,265.00 (-0.59%) amid downgrade and technical concerns