Clipper Realty, Inc. Experiences Revision in Its Stock Evaluation Amid Market Challenges

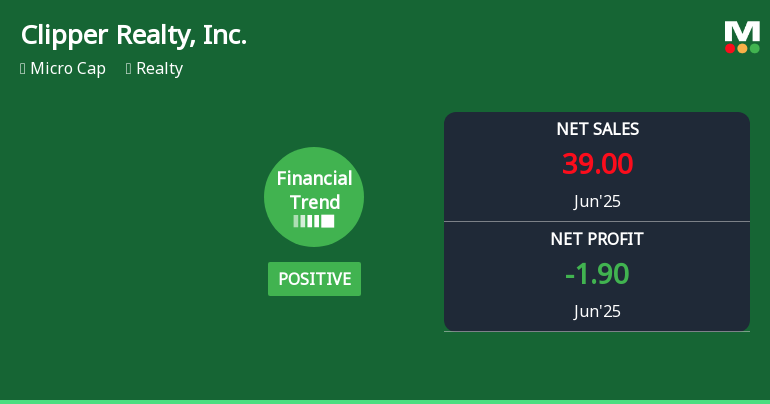

2025-11-20 15:38:09Clipper Realty, Inc. reported strong operating cash flow of USD 31.86 million for the quarter ending June 2025 and a net profit of USD 18.78 million for the half-year. However, challenges include a low debtors turnover ratio and a recent quarterly net loss, alongside significant stock declines compared to the S&P 500.

Read full news articleNo announcement available

Corporate Actions

No corporate action available