Is Conduent, Inc. overvalued or undervalued?

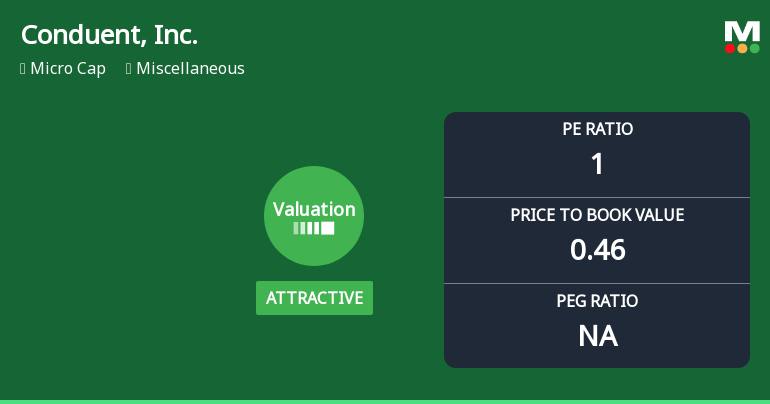

2025-11-11 11:34:00As of 7 November 2025, the valuation grade for Conduent, Inc. has moved from attractive to expensive, indicating a shift in perception regarding its market value. The company appears to be overvalued based on its current metrics, particularly with a P/E ratio of 1, a Price to Book Value of 0.46, and an EV to EBITDA of 7.70. In comparison, peers such as Thoughtworks Holding, Inc. and Chegg, Inc. exhibit significantly lower P/E ratios of -25.45 and -22.62, respectively, suggesting that Conduent's valuation is not justified relative to its competitors. Despite the lack of recent return data, the overall valuation metrics indicate that Conduent, Inc. is not positioned favorably in the current market landscape, reinforcing the conclusion that it is overvalued....

Read More

Conduent, Inc. Hits New 52-Week Low at $1.72 Amid Decline

2025-11-10 17:22:07Conduent, Inc. has hit a new 52-week low, reflecting a challenging year marked by a significant stock price decline. The company faces financial difficulties, including a drop in net sales and negative operating cash flow, alongside low profitability metrics and declining pre-tax and net profits.

Read More

Conduent, Inc. Experiences Revision in Stock Evaluation Amidst Financial Metric Shifts

2025-11-10 16:15:03Conduent, Inc. has recently adjusted its valuation, showcasing a P/E ratio of 4.72 and an enterprise value to EBITDA of 7.70. Despite a high return on equity of 37.50%, its return on capital employed is negative. The company has faced significant stock declines compared to the S&P 500.

Read MoreIs Conduent, Inc. overvalued or undervalued?

2025-11-09 11:09:08As of 7 November 2025, the valuation grade for Conduent, Inc. has moved from attractive to expensive, indicating a shift towards overvaluation. The company appears to be overvalued based on its P/E ratio of 1, a Price to Book Value of 0.46, and an EV to EBITDA of 7.70. In comparison, Medifast, Inc. has a significantly higher P/E ratio of 62.80, while Thoughtworks Holding, Inc. shows a negative P/E of -25.45, highlighting the disparity within the industry. Conduent's recent performance has been notably poor, with a year-to-date return of -55.94%, significantly underperforming the S&P 500's return of 14.40% over the same period. This stark contrast reinforces the conclusion that the stock is overvalued relative to its current financial metrics and market performance....

Read More

Conduent, Inc. Experiences Revision in Stock Evaluation Amidst Market Challenges

2025-11-03 16:08:39Conduent, Inc. has recently adjusted its valuation, showcasing a P/E ratio of 4.72 and an EV to EBITDA ratio of 7.90. Despite these metrics, the company has struggled with stock performance, significantly underperforming the S&P 500 over the past year, while its valuation remains more favorable compared to certain peers.

Read MoreIs Conduent, Inc. overvalued or undervalued?

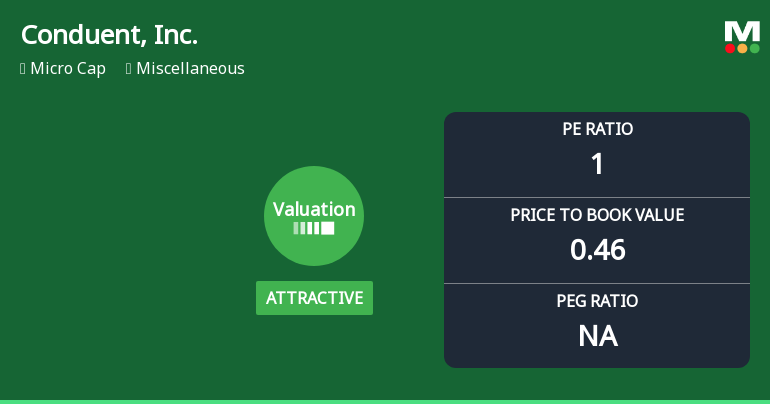

2025-10-28 11:12:35As of 24 October 2025, the valuation grade for Conduent, Inc. has moved from expensive to attractive, indicating a shift in perception towards the stock's value. The company appears undervalued, particularly when considering its P/E ratio of 1, a price-to-book value of 0.46, and an EV to EBITDA ratio of 7.70. In comparison, peers such as Thoughtworks Holding, Inc. have a significantly negative P/E ratio of -25.45, while Medifast, Inc. shows a much higher P/E of 62.80, highlighting Conduent's relative attractiveness in the market. Despite the recent valuation improvement, Conduent's stock has underperformed compared to the S&P 500, with a year-to-date return of -35.64% versus the S&P 500's 15.47%. This stark contrast in returns over multiple periods reinforces the notion that the stock may be undervalued, providing a potential opportunity for investors looking for value in the current market....

Read MoreIs Conduent, Inc. overvalued or undervalued?

2025-10-27 11:12:51As of 24 October 2025, the valuation grade for Conduent, Inc. has moved from expensive to attractive, indicating a shift towards being undervalued. The company is currently assessed as undervalued based on its metrics. Key ratios include a P/E ratio of 1, a Price to Book Value of 0.46, and an EV to EBITDA of 7.70, which suggest that the stock is trading at a significant discount compared to its peers. In comparison to its peers, Conduent, Inc. has a P/E ratio of 4.72, while Medifast, Inc. shows a much higher P/E of 62.80, highlighting the relative undervaluation of Conduent. Additionally, Thoughtworks Holding, Inc. and Chegg, Inc. are both categorized as risky with negative P/E ratios, further emphasizing Conduent's attractive valuation position. Although return data is not available for a direct comparison with the S&P 500, the overall valuation metrics suggest that Conduent, Inc. presents a compelling in...

Read MoreIs Conduent, Inc. overvalued or undervalued?

2025-10-26 11:09:18As of 24 October 2025, the valuation grade for Conduent, Inc. has moved from expensive to attractive, indicating a shift towards a more favorable assessment. The company appears undervalued based on its current metrics, with a P/E ratio of 1, a Price to Book Value of 0.46, and an EV to EBITDA ratio of 7.70. In comparison, peers such as Thoughtworks Holding, Inc. have a P/E ratio of -25.45, while Medifast, Inc. shows a significantly higher P/E of 62.80, highlighting Conduent's relative attractiveness in its industry. Despite the positive valuation indicators, Conduent has faced significant stock price declines, with a year-to-date return of -35.64% compared to the S&P 500's 15.47%. This stark contrast in returns reinforces the notion that the stock may be undervalued, as the market has not fully recognized its potential despite the attractive valuation ratios....

Read More

Conduent, Inc. Experiences Revision in Its Stock Evaluation Amid Mixed Financial Metrics

2025-10-20 17:26:15Conduent, Inc. has recently adjusted its valuation, revealing a P/E ratio of 1 and a price-to-book value of 0.46. Its financial metrics show a mixed performance compared to peers, with notable contrasts in valuation among companies in the same industry. The stock price is currently $2.43.

Read More