Constronics Infra: Analytical Perspective Shifts Amid Mixed Market Signals

2025-12-18 08:21:45Constronics Infra, a player in the Trading & Distributors sector, has experienced a revision in its evaluation metrics following a detailed reassessment of its quality, valuation, financial trends, and technical indicators. This article explores the factors influencing the recent shift in market assessment and what it means for investors navigating the stock’s complex performance landscape.

Read More

Constronics Sees Revision in Market Evaluation Amid Mixed Financial Signals

2025-12-06 10:10:23Constronics, a microcap player in the Trading & Distributors sector, has experienced a revision in its market evaluation reflecting nuanced shifts across key analytical parameters. This adjustment highlights evolving perspectives on the company’s financial health, valuation appeal, technical positioning, and overall quality within a challenging market environment.

Read MoreIs Constronics overvalued or undervalued?

2025-11-14 08:11:31As of 13 November 2025, the valuation grade for Constronics has moved from very attractive to attractive. The company is currently considered overvalued based on its financial ratios and peer comparison. Key ratios include a PE Ratio of 18.08, an EV to EBITDA of 16.17, and a PEG Ratio of 0.13, which suggests a relatively high valuation compared to its growth prospects. In comparison to its peers, Constronics' valuation appears less favorable. For instance, Elitecon International is deemed very expensive with a PE of 320.89, while PTC India, rated very attractive, has a significantly lower PE of 7.67. The current price of Constronics at 63.50 reflects a substantial decline in stock performance, with a year-to-date return of -43.56%, contrasting sharply with the Sensex's positive return of 8.11% over the same period. This further reinforces the view that Constronics is overvalued in its current market positi...

Read More

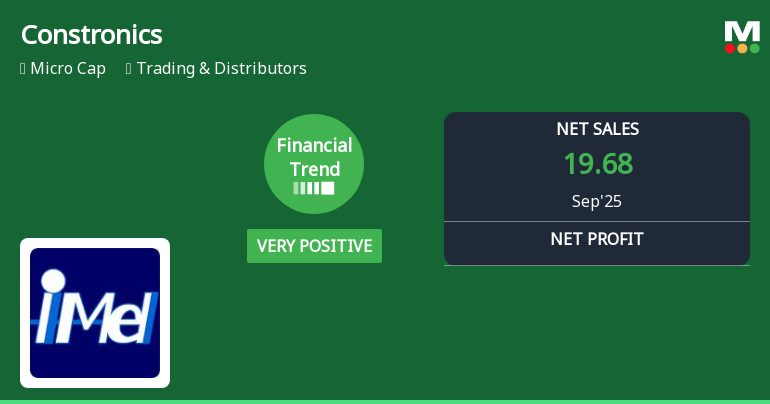

Constronics Infra Shows Strong Financial Performance Amid Mixed Stock Trends

2025-11-13 11:04:00Constronics Infra, a microcap in the Trading & Distributors sector, reported record net sales of Rs 19.68 crore for the quarter ending September 2025, alongside peak PBDIT, PBT, and PAT figures. Despite a recent decline in stock performance, the company has demonstrated significant long-term growth over the past decade.

Read MoreHow has been the historical performance of Constronics?

2025-11-13 00:32:55Answer: The historical performance of Constronics shows significant growth in net sales and profitability over the years, particularly in the most recent fiscal year ending March 2025. Breakdown: In the fiscal year ending March 2025, Constronics reported net sales of 50.97 Cr, a substantial increase from 0.77 Cr in March 2024 and 0.82 Cr in March 2023. Total operating income mirrored this trend, reaching 50.97 Cr in March 2025 compared to 0.77 Cr the previous year. The company's total expenditure also rose to 47.81 Cr in March 2025, up from 0.45 Cr in March 2024, leading to an operating profit (PBDIT) of 4.70 Cr, a notable improvement from 0.81 Cr in the prior year. Profit before tax surged to 4.37 Cr in March 2025, with profit after tax reaching 3.13 Cr, up from 0.72 Cr in March 2024. The earnings per share (EPS) increased to 2.5 in March 2025, compared to 1.0 in March 2024. On the balance sheet, total as...

Read MoreWhy is Constronics falling/rising?

2025-11-06 23:34:53As of 06-Nov, Constronics Infra Ltd is experiencing a price increase, with its current price at Rs 64.00, reflecting a change of 4.86 or 8.22% upward. The stock has shown a trend reversal, gaining after three consecutive days of decline. It outperformed its sector by 8.8% today and reached an intraday high of Rs 64. Additionally, there has been a significant rise in investor participation, with delivery volume increasing by 218.31% compared to the 5-day average. However, the stock's year-to-date performance remains concerning, with a decline of 43.11%, and it has underperformed against the benchmark Sensex over the past week and year. In the broader market context, the Sensex has also seen a decline of 1.30% over the past week, which is less severe than Constronics' 1.89% drop, indicating that while the stock is rising today, it has been more volatile compared to the benchmark. Over the past month, Constro...

Read MoreWhy is Constronics falling/rising?

2025-11-04 23:44:24As of 04-Nov, Constronics Infra Ltd is experiencing a decline in its stock price, currently at Rs 59.14, which reflects a decrease of Rs 4.62 or 7.25%. The stock has been underperforming, having fallen consecutively for the last three days with a total decline of 9.34% during this period. Additionally, the stock is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. The delivery volume has also significantly decreased, falling by 95.72% compared to the 5-day average, suggesting a lack of investor interest. In terms of performance, the stock has seen a substantial decline of 47.43% year-to-date and 56.13% over the past year, contrasting sharply with the Sensex, which has gained 6.81% and 5.94% respectively during the same periods. Broader market context shows that Constronics has underperformed relative to the Sensex, which has only declined by 1.38% ov...

Read MoreWhy is Constronics falling/rising?

2025-10-30 23:18:42As of 30-Oct, Constronics Infra Ltd is experiencing a decline in its stock price, currently at 64.20, which reflects a decrease of 0.8 or 1.23%. The stock has underperformed its sector today by 1.08%. In terms of returns, the stock has shown a negative performance over the past week, down 1.23%, while it has increased by 4.29% over the last month. However, year-to-date, the stock has significantly underperformed with a decline of 42.93%, contrasting sharply with the Sensex's gain of 8.02%. Despite these challenges, there has been a rise in investor participation, with a delivery volume increase of 19.29% compared to the 5-day average, indicating some interest in the stock. The stock is currently trading higher than its 5-day, 20-day, and 100-day moving averages, but lower than its 50-day and 200-day moving averages, suggesting mixed momentum. In the broader market context, the stock's short-term performanc...

Read MoreWhy is Constronics falling/rising?

2025-10-24 23:37:21As of 24-Oct, Constronics Infra Ltd is experiencing a decline in its stock price, currently at Rs 61.92, which reflects a decrease of Rs 3.08 or 4.74%. The stock has underperformed its sector by 4.6% today, reaching an intraday low of Rs 61.01, a drop of 6.14%. Over the past week, the stock has decreased by 4.71%, and it has shown significant underperformance over longer periods, with a year-to-date decline of 44.96% and a one-year drop of 52.77%. Despite a notable increase in investor participation, with delivery volume rising by 629.69% against the five-day average, the stock remains below its moving averages for shorter terms, indicating bearish sentiment. Broader Market Context: In contrast, the benchmark Sensex has shown a positive return of 0.31% over the past week and a 3.05% increase over the past month, highlighting the stock's struggle against broader market trends. While the stock's liquidity ap...

Read MoreAnnouncement under Regulation 30 (LODR)-Newspaper Publication

17-Nov-2025 | Source : BSENewspaper publication of the un-audited standalone and consolidated financial results for the quarter and half year ended 30th September 2025

Monthly Report On Special Window For Re-Lodgement Of Physical Share Transfer

15-Nov-2025 | Source : BSEMonthly report on special window for re-lodgement of physical share transfer

Board Meeting Outcome for Outcome Of Board Meeting Held On 12Th November 2025

12-Nov-2025 | Source : BSEOutcome of board meeting held on 12th November 2025 inter-alia to consider and approve the un-audited standalone and consolidated financial results for the quarter and half year ended 30th September 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available