Construction Partners, Inc. Experiences Revision in Its Stock Evaluation Amid Market Fluctuations

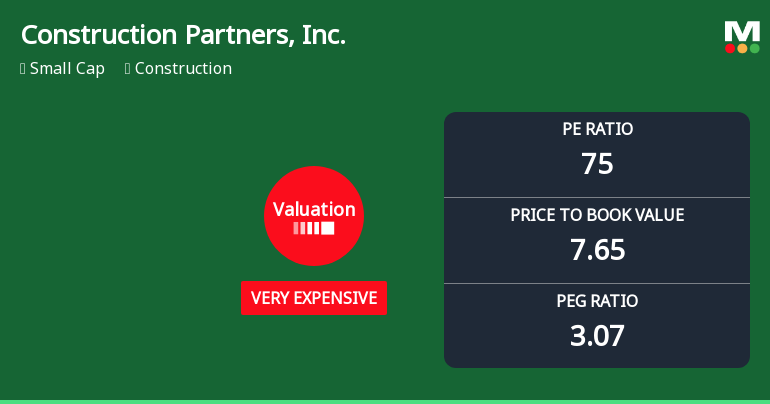

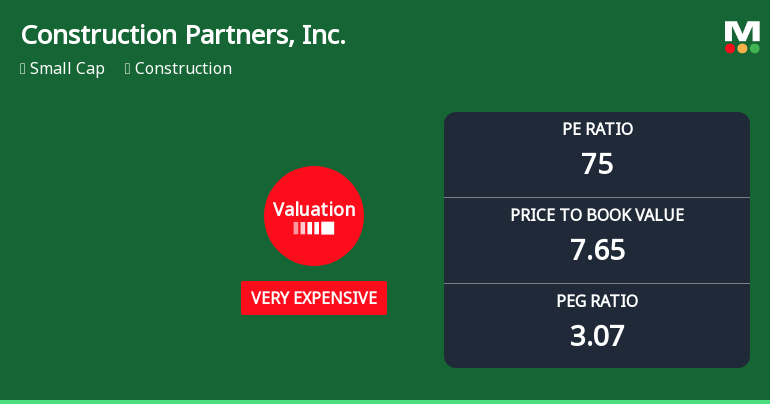

2025-11-24 15:34:55Construction Partners, Inc. has recently adjusted its valuation, showcasing a high P/E ratio of 75 and a price-to-book value of 7.65. Despite a recent decline in performance, the company has outperformed the S&P 500 over three years, indicating significant competitive dynamics in the construction sector.

Read full news article

Construction Partners, Inc. Experiences Revision in Stock Evaluation Amid Strong Market Position

2025-11-10 16:09:19Construction Partners, Inc. has recently adjusted its valuation, showcasing a high P/E ratio of 75 and notable financial metrics such as a return on equity of 10.16%. Compared to peers like MasTec and Dycom, the company maintains a strong market position within the construction industry.

Read full news articleNo announcement available

Corporate Actions

No corporate action available