Valuation Metrics and Financial Health

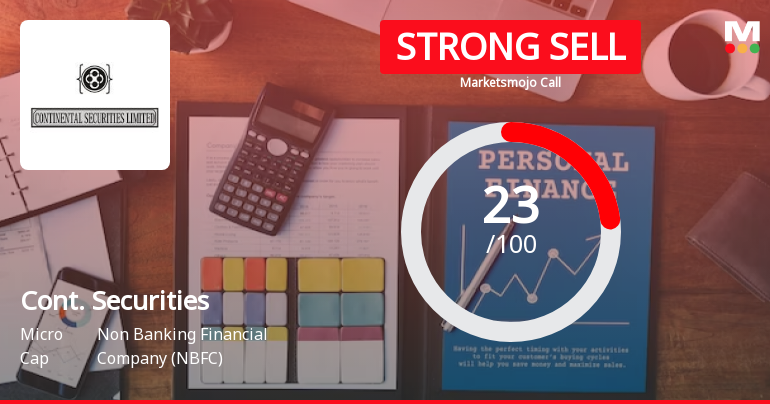

Cont. Securities trades at a price-to-earnings (PE) ratio of 23.32, which is moderate within the NBFC sector. Its price-to-book (P/B) value stands at 1.81, indicating the market values the company at nearly twice its book value. The enterprise value to EBITDA (EV/EBITDA) ratio is 16.45, reflecting the company’s operational profitability relative to its valuation. Notably, the PEG ratio is 0.56, well below 1, suggesting that the stock’s price growth is undervalued relative to its earnings growth potential.

Return on capital employed (ROCE) is 10.58%, and return on equity (ROE) is 7.77%, both of which are modest but positive indicators of efficient capital utilisation and shareholder returns. Dividend yield remains low at 0.28%, whi...

Read full news article